The report, released by the ARC Centre of Excellence in Population Ageing Research (CEPAR), investigated the links between homeownership and population ageing.

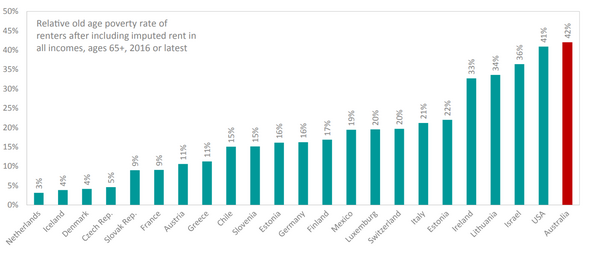

It concluded that those at greatest disadvantage in retirement are renters, with relative poverty in the group among the highest in the 36 countries in the Organisation for Economic and Co-operation and Development (OECD).

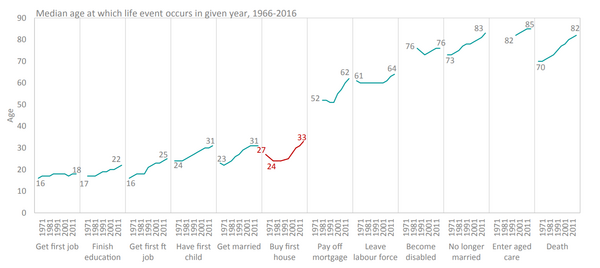

The report also found that while younger people are less likely to commit to buying a home than they were in the past, this makes sense given that people’s lives are longer and are settling down at older ages.

For example, over the past 50 years, the median age of home purchase has increased by six years, from age 27 to 33.

Over the same period the median age of:

- Getting a first job has increased by two years

- Finishing education has been delayed by five years

- Having a child has been delayed by seven years

- Getting married has been delayed eight years

- Death has been delayed 12 years

Source: CEPAR

Rafal Chomik, the report’s lead author and CEPAR senior research fellow at UNSW Sydney said despite the delays in home purchases, the home itself is vitally important for wealth.

“Homeownership serves multiple purposes and housing outcomes affect financial and personal health and wellbeing over the lifecycle, ” Mr Chomik said.

“It acts as a home – the nest – as well as a store of wealth – the nest egg – to guarantee financial security in retirement.

“As lifespans increase and Australia’s population ages, it is important to understand the interactions between demography and housing.”

Centre Director John Piggott, Scientia Professor of Economics at UNSW Business School, said the report confirmed the role of housing in Australian society.

“Housing has long been a critical pillar in wellbeing and social support through the life course,” Mr Piggot said.

“One way or another, it has always been a central piece of our social support system.

“It is at least arguable that our social protection system has relied on a high owner-occupier ratio in order to function sustainably and adequately.”

Home purchase delay can have serious consequences

The report found that with the Australian retirement system built on the premise of homeownership, excessive or indefinite deferral of home purchase can have negative repercussions.

Mr Chomik said lifetime homeownership rates will decline if some people postpone purchasing a home indefinitely.

“Banks may be reluctant to lend past a certain age given retirement ages are increasing more slowly,” Mr Chomik said.

“Greater shares may retire with debt. There is the potential that in the future more older people end up renting, and if so, we need a safety net to support them as the current retirement income system is failing renters.

“Currently, the Age Pension offers the same maximum benefit for owners as it does for renters.

“The Government’s retirement income system review, due to report next year, is an opportunity to take housing into account more fully with the aim of narrowing the financial gap between renters and owners in the future.”

Older renters prone to vulnerability

The report investigated the challenges associated with people postponing their home purchase indefinitely, and found doing so at older ages could lead to relative poverty, housing affordability stress and homelessness.

New estimates suggested that older Australian renters have among the highest relative poverty rates in the OECD.

This group also has greater rental affordability stress than any other age group.

Source: CEPAR

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan