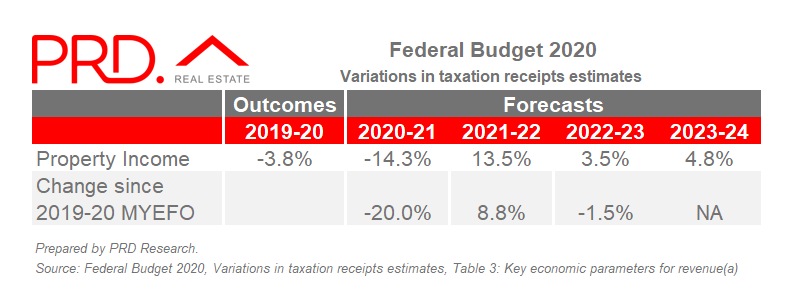

These figures also represent a 20% decline and an 8.8% rise, respectively, since the Government's Mid-Year Economic and Fiscal Outlook (MYEFO) gleaned from the 2019-2020 Budget.

Similarly, dwelling investment declined 8.8% last financial year and is forecast to decline 11% this year, before recovering 7% in 2021-2022.

Why the moderate 'V' shaped outlook? Coincidentally, the Government is also going to ramp up its Migration Program in the coming years.

This financial year it's costing $70 million; 2021-22, $85 million; 2022-23, $115 million; and in 2023-24, $117 million.

That's money spent on processing and promoting both skilled migration and family migration, of which the Government allocated 160,000 spots last financial year.

Property prices predictions have been up and down, however most recently, CoreLogic reported the fifth straight month of residential property price declines, dragged down by Sydney and Melbourne.

However, these Government tax receipts also take into account any rents, dividends, and interest the Government receives from property classes other than residential property.

It includes Government buildings, defence housing, affordable housing, and social housing, although there was little in the Budget in the way of social housing.

Immigration is still needed as it has a "multiplier effect" on the Federal Government's property income, according to PRD Real Estate chief economist Dr Diaswati Mardiasmo.

"Their projected property income at present is more based on national and local demand, and has been adjusted for and revised down substantially to reflect the impact of COVID-19 pandemic and health restrictions," she said.

The Government forecasts a loss of 72,000 people this financial year, with levels not returning positive until 2022-23.

In July, the Australian Bureau of Statistics reported short term visitor arrivals were down 99.6% compared to July 2019.

Dr Mardiasmo also pointed to the Government's simpler immigration process as potentially inducing housing demand.

"By streamlining the immigration progress those non-residents could potentially be residents, and thus have equivalent 'rights' to products as an Australian citizen - for example to purchase established dwellings to live," she said.

"This may 'tide us over' until borders are open again."

Prevailing headwinds

The Government and the Reserve Bank can also pull other levers to induce housing demand, according to Westpac's economics team, but that headwinds will prevail.

"It does appear that low interest rates and housing policies have pulled forward demand providing support into 2021 with dwelling investment forecast to rise 7% in 2021-22," Westpac economists said.

"Westpac gives greater prominence to potential headwinds: the fragilities pre-Covid (weak wages growth) and the legacies from the pandemic and the severe recession (high unemployment and fragile confidence)."

CommSec's chief economist Craig James also pointed to ongoing uncertainty.

"If foreign tourists, workers and students are blocked from entering Australia, recovery will be constrained for some sections of housing markets, airlines, overseas travel firms, casinos, education and labour-hire sectors," he said.

On Tuesday night, Treasurer Josh Frydenberg forecast a COVID-19 vaccine being available by the end of 2021, with the Government spending nearly $1.2 billion this financial year in gaining access to COVID-19 vaccine research and development.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Alex Brewster

Alex Brewster

Aaron Bell

Aaron Bell