The map's data is fed from property analytics group CoreLogic, and Aussie CEO of Lending David Smith said Suburb Spotter helps potential home buyers navigate the property market.

“We wanted to create a thought starter for property buyers to help them understand not only median property prices but, even more importantly, the deposit required in their desired suburbs, along with the ability to expand their search to find surrounding suburbs which may meet their criteria and be that little bit more within reach," he said.

“The disparity in our research is striking. Australians are hearing about the low interest rates, the government incentives and grants, and they know there are opportunities in the property market, but they can’t seem to shake the emotion of feeling stuck and helpless.”

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

The interactive map is currently available for all eight capital cities, which, according to the Australian Bureau of Statistics (ABS) collectively have a median dwelling value of $728,500.

A survey of more than 2,000 people commissioned by Aussie shows more than half (54%) of Australians with a property goal are unsure about how to take their first or next step in achieving it.

A similar number (53%) also said market conditions are one factor holding them back from achieving their property goals, while more than two thirds were missed out on properties because the market was too competitive.

Mr Smith called this inertia a "paralysis".

“We understand finding the right home can take time, but there are also other larger issues at play when it comes to people feeling they can’t move forward," he said.

“In 2021, there are significant opportunities for first home buyers, movers, upgraders, downsizers and investors, but with this competitive market it’s important to do your homework and get organised in advance, so the next time your dream property comes along, you’ll be ready to make your move.”

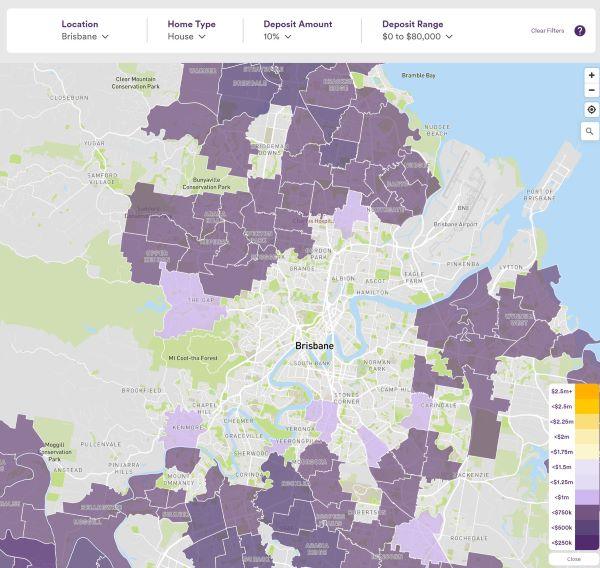

The map allows home buyers to input their capital city, their type of home, their loan-to-value ratio (LVR), and their deposit range.

In some cities, it may serve as a sobering reminder of what challenges first home buyers face.

For example, with a 10% deposit for a house in Brisbane (with a maximum deposit of $80,000), there is nothing available for the median price within six kilometres of the CBD, as seen below.

In Sydney, home buyers are effectively priced out unless they buy in Liverpool or Blacktown.

Aussie Suburb Spotter

Photo Supplied

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Aaron Bell

Aaron Bell