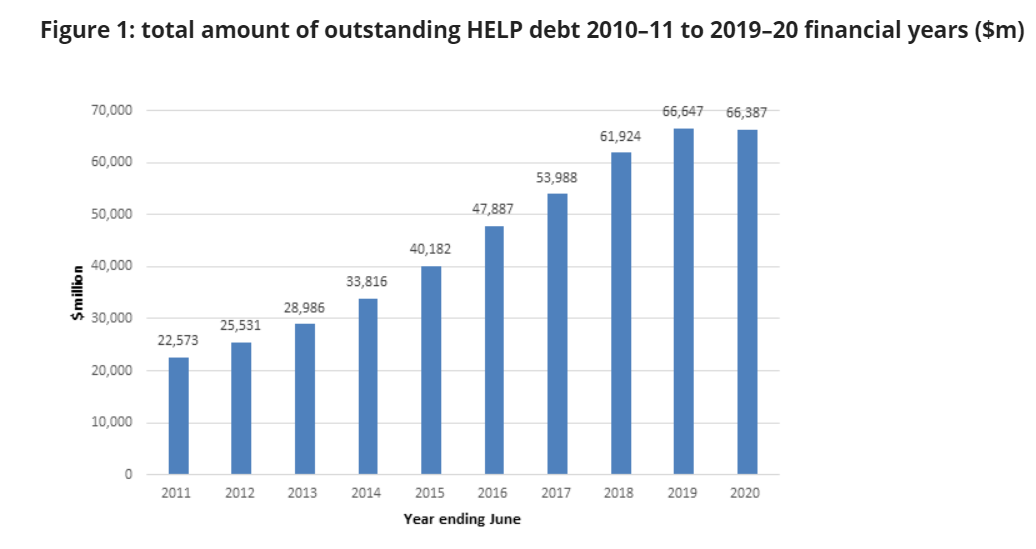

There are a lot of people with a lot of Higher Education Loan Program (HELP) and Higher Education Contribution Scheme (HECS) debt in Australia. According to the Australian Tax Office (ATO), there were 2.9 million people with outstanding HELP debts in the 2019/20 financial year - totalling nearly $66.4 billion. The average debt was $23,280, with 24,544 people having debt in excess of $100,001.

Source: ATO

If you want to buy a property, a HELP debt could minimise your borrowing power. Find out why, by how much, and what steps to take moving forward.

What is HELP debt?

HELP is a government subsidised loan program, encompassing HECS and other costs incurred from attending university and higher education institutions. To take advantage of the program you need to be either an Australian citizen, a New Zealand Special Category Visa (SCV) holder, or a permanent humanitarian visa holder. You also need to have a Tax File Number (TFN) and be enrolled in your courses by your institutes' census debt.

You don’t have to pay off your HELP debt until you hit a certain threshold, $47,014 at the time of writing, and the percentage you have to pay off increases as you move up the income brackets. You can see the brackets in the table below.

HELP repayment rates and thresholds from 1 July 2021 for 2021/20

|

Repayment income |

Repayment rate |

|---|---|

|

Below $47,014 |

Nil |

|

$47,014 to $54,281 |

1.00% |

|

$54,282 to $57,538 |

2.00% |

|

$57,538 to $60,991 |

2.50% |

|

$60,992 to $64,650 |

3.00% |

|

$64,650 to $68,529 |

3.50% |

|

$68,529 to $72,641 |

4.00% |

|

$72,641 to $77,000 |

4.50% |

|

$77,000 to $81,620 |

5.00% |

|

$81,620 to $86,518 |

5.50% |

|

$86,518 to $91,709 |

6.00% |

|

$91,709 to $97,212 |

6.50% |

|

$97,212 to $103,044 |

7.00% |

|

$103,044 to $109,226 |

7.50% |

|

$109,226 to $115,678 |

8.00% |

|

$115,678 to $122,728 |

8.50% |

|

$122,728 to $130,091 |

9.00% |

|

$130,091 to $137,897 |

9.50% |

|

$137,897 and above |

10.00% |

Source: ATO

You’ll need to let your employer know you have a HELP debt, and they’ll set aside additional tax from your pay to cover the estimated repayment.

Does HELP debt affect home loan borrowing power?

HELP debt, just like any other debt, does affect your borrowing power. Borrowing power is the amount of money a lender will let you borrow from them to purchase a property.

Using Savings.com.au’s borrowing power calculator, you can get a rough idea of the effect a HELP debt could have on your borrowing power.

If you were on an income of $75,000 and wanted a home loan repaid over 30 years at a rate of 3.5%, you could borrow up to $554,890 (please note this is an estimation - your borrowing power will vary between lenders).

Now let’s add a HELP debt, using the average debt previously mentioned of $23,380. With an income of $75,000, you’d be required to pay 4.50% of the debt a year. That's $3,375, or a monthly commitment of $281.25. As a result, your borrowing power could fall to $503,900, taking $50,990 off what you could borrow if you didn’t have the HELP debt.

Let’s look at another example if you had a greater income.

If you were on an income of $100,000, again wanting a home loan at 3.50% over 30 years, you’d have a borrowing power of $740,560.

If you then had a HELP debt of $50,000, you’d be required to pay of 7.00% the balance a year. That’s $7,000 a year, or a monthly commitment of $583.33. As a result, your borrowing power would fall to $634,810, taking $105,750 off what you could borrow if you didn’t have the HELP debt.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

Lender Home Loan Interest Rate Comparison Rate* Monthly Repayment Repayment type Rate Type Offset Redraw Ongoing Fees Upfront Fees Max LVR Lump Sum Repayment Extra Repayments Split Loan Option Tags Features Link Compare Promoted Product Disclosure

Promoted

Disclosure

Promoted

Disclosure

Promoted

Disclosure

Should I pay off more of my HELP debt to improve my borrowing power?

HELP debt is often referred to as the cheapest debt you’ll ever have. This is because your balance is indexed with inflation, which has been at record-low levels for years and isn’t expected to rise for many more. For the 2020/21 financial year, the HELP indexation rate was 0.6%, one of its lowest ever points as Australia experienced deflation last year.

As a result of this cheap debt, it's often recommended you pay off any other debts you have before going near your HELP debt. These other debts are likely to have a far greater interest rate than what inflation sits at, so paying these off first can typically save you money on interest costs.

How to improve your borrowing power

If you have a HELP debt and want to improve your borrowing power, here are some of the ways to do so:

Set up a budget

Creating a budget can improve your borrowing power in a number of ways. A budget can give you a better idea of your finances, your incomings and outgoings, and help you to improve your financial behaviour. Lenders like to see a history of good financial behaviour, often trawling back six months and more to see how you manage your money. If the lender likes what it sees, your chances of approval should improve, while also improving your borrowing power.

Cut back expenses

Cutting back on expenses can be great way to save money and also improve your borrowing power. Non-discretionary expenses like insurance, car registration, and rent are typically hard to cut back on, but discretionary spend like going out for dinner and drinks, unused subscription services, and spending on clothes are all things that can easily be pulled back if you want to borrow more money.

Pay down debts

Having outstanding car loans, personal loans, credit card debt, and buy now, pay later debt can drastically reduce your borrowing power. Paying these down as much as possible, as well as making compulsory payments on time, in full, can all improve your image from a lenders' point of view.

Reduce credit limits and cancel cards

A large credit limit on an active credit card, even if you don’t have any debt on it, can be a red flag for a lender. Reducing your limit from $30,000 to $10,000 can be a great way to improve your borrowing power while cancelling the card all together is even better.

Avoid buy now, pay later and payday loans

Buy now, pay later and payday loans are both considered a form of credit and are viewed unfavourably by lenders. Payday loans are in many cases also fraught with danger, sporting extortionate fees and interest rates. Avoid these products where possible to avoid your borrowing power taking a hit.

Increase your income

Far easier said than done, increasing your income, in turn, increases your borrowing power. You could ask your current employer for a raise or look for alternative ways to increase your income through a side hustle.

Photo by Redd on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bernadette Lunas

Bernadette Lunas

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan