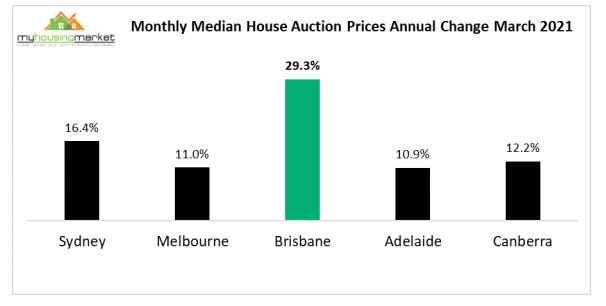

Property analytics group Archistar found all capital cities recorded sharp increases in the median price of houses sold at auction over the year ending March 2021.

Brisbane has the highest growth over the year, up by a whopping 29.3%, followed by Sydney (16.4%), Canberra (12.2%), Melbourne (11%), and Adelaide (10.9%).

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Dr Andrew Wilson, chief economist at Archistar, said it was unlikely we had yet reached the peak of auction prices.

"Weekend home auction markets as expected have continued to produce boom-time results over March with prices and clearance rates now clearly at record levels," Dr Wilson said.

"Although April is typically a quieter month for auction activity with buyers and sellers distracted by holidays, results will nonetheless likely continue to track at record levels with home prices set to go higher and higher."

Source: Archistar

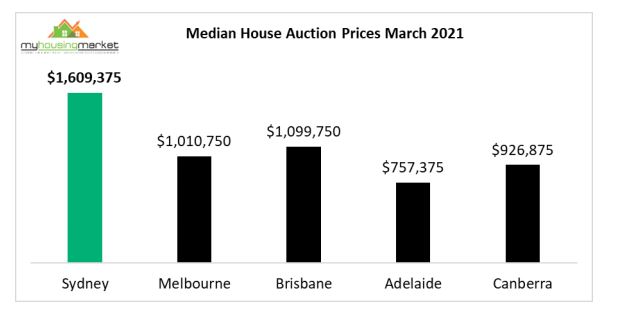

Sydney reported the highest median price for houses sold at weekend auctions over March at $1,609,375, followed by Brisbane ($1,099,750), and Melbourne ($1,010,750).

The figures are a stark contrast to median dwelling values, as according to CoreLogic, the median value of Brisbane homes is $535,618, less than half the median auction price.

In Sydney, the median dwelling value is $895,933, while Melbourne's is $717,767.

Source: Archistar

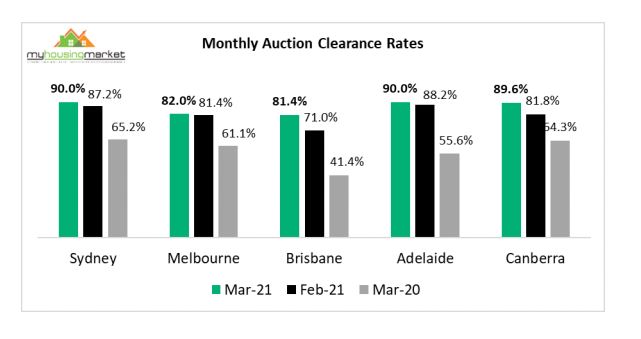

Dr Wilson said sky-high auction clearance rates off the back of massive buyer demand were also pushing values up.

"Already high auction clearance rates continued to climb over March with all markets remarkably reporting record-level results," he said.

"Sydney and Adelaide were the top performers at 90.0% followed closely by Canberra 89.6%, Melbourne 82.0% and Brisbane 81.4%.

"All capitals recorded clearance rates higher than reported over March last year with the growing impact of covid shutdowns influencing results at that time."

Source: Archistar

Busiest week for auctions in three years

According to CoreLogic, 3,791 homes were taken to auction across the combined capital cities last week, the busiest week for auctions since the end of March 2018.

In comparison, the week prior saw 2,710 auctions held across the capitals, while the same period last year saw 3,289.

The higher volumes saw the preliminary clearance rate strengthen, with 84.7% of auctions recording a successful result, up from the previous week's clearance rate of 82.0%.

Sydney's final auction clearance rate continued to maintain strength holding above 80% for the past seven weeks, which CoreLogic expected to be no different this week.

Meanwhile, Melbourne's dwelling values have reached a record high, surpassing their earlier April 2020 peak by 0.2%.

CoreLogic's executive research director Tim Lawless said it had been a matter of time before the housing market boom saw Melbourne hit a new peak.

“Reflecting what we saw in Sydney earlier this month, Melbourne dwelling values have now surpassed their previous peak to notch up a new record high," Mr Lawless said.

"Following a decline of -6.1% through COVID-19, values have since grown by 6.7%, and are now sitting 0.2% above their recent high recorded by CoreLogic’s hedonic daily home value index on 6 April 2020.”

Photo by Natalie Su on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

William Jolly

William Jolly