Findings by Equity Economics, commissioned by welfare and housing advocate Everybody's Home, found a lack of investment in social housing and planned cuts to JobSeeker - which could push an extra 200,000 into poverty - would be the catalysts for this rise in homelessness.

An estimated 7,500 more people are projected to become homeless, up from 83,000 in 2020, the report found, while the 24% increase in housing stress would result in around 880,000 families struggling financially after paying their housing bills.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

According to the report, New South Wales would see the biggest increase in both homelessness (19.1%) and housing stress (41.9%).

The reason New South Wales' figures are so high is due to the higher portion of households relying on two incomes to pay the bills.

Tasmania would see the second biggest rise in homelessness at 14.1%, followed by Victoria at 13.1%: The Northern Territory and Western Australia would actually see decreases of 5.9% and 4.8% respectively.

Meanwhile, Victoria, the hardest hit state by lockdowns, would see the second biggest rise in housing stress by 32.4%, compared to Western Australia which would see just a 0.8% increase in stress.

According to the study, this will place even more pressure on homelessness services, and cost the government an extra $225 million in additional services each year, based on Australian Housing and Urban Research Institute (AHURI) modelling.

This is timely given research last week from the Australian Institute of Health and Welfare (AIHW) found some 260 people were turned away from homelessness services every day in 2019-20, usually because of a lack of room.

At the height of the Covid-19 crisis (March to June), about 6,000 people each month were forced to seek out homelessness services.

“There were 11,201 children under 10 who missed out on support this year," Homelessness Australia chair Jenny Smith said.

“The number of people that homelessness services have to turn away has continued to grow each year. It’s clear that there is a growing gap between the demand for support and the resources available to homelessness services.”

About $68.7 million in financial assistance was provided to clients in 2019–20, up from $61.1 million in 2018–19, according to AIHW.

"Government-funded Specialist Homelessness Services (SHS) assist Australians who are experiencing homelessness—or at risk of becoming homeless—with services such as advice, counselling, professional legal services, meals and accommodation," said AIHW spokesperson Dr. Gabrielle Phillips.

"People with current mental health issues is one of the fastest growing client groups, increasing by 22% since 2015–16," Dr. Phillips said.

Recent reports show that between 5% to 15% of all renters could face evictions over unpaid coronavirus rental debts next year, and nearly all rental properties available in Australia at the moment are "unaffordable" for those on unemployment benefits.

[See also: Mental health, homelessness made worse by JobSeeker cuts?]

Social housing investment could be the key

The report suggests an investment in the construction of social housing at the federal level, one of the most recommended stimulus options put forward by economists this year, could be the key to both reducing homelessness while also "turbocharging" Australia's economic recovery.

According to Everybody's Home, if the Federal Government invests $7 billion in social housing, it could make a serious dent in homelessness, boost the post-pandemic economy by $18.2 billion, and create 18,000 jobs per year over four years.

In the long term, Equity Economics estimates that an additional 30,000 social housing units would reduce the number of Australians experiencing homelessness by around 4,500 per year and save $135 million in direct support costs.

“A secure, stable home is among our basic needs. With decent housing, we can fulfil our dreams, raise a family, and connect with our community. Take it away and even the most resilient person’s world will shatter into a million pieces,” said Kate Colvin, spokesperson for Everybody’s Home.

“Homelessness and housing stress are a hothouse for anxiety, depression, and family breakdown. It’s in everyone’s interest to prevent this.

"Social housing investment simultaneously attacks homelessness from multiple angles, giving more people a secure home, creating thousands of jobs and boosting economic demand.

"Investing in social housing is a no-brainer that will boost prosperity and help tens of thousands of people whose lives have been destroyed by COVID.”

So far, only Victoria ($5.3 billion) and NSW ($813 million) have committed to social housing infrastructure in their state budgets.

But more investment is needed across the country, according to the modelling.

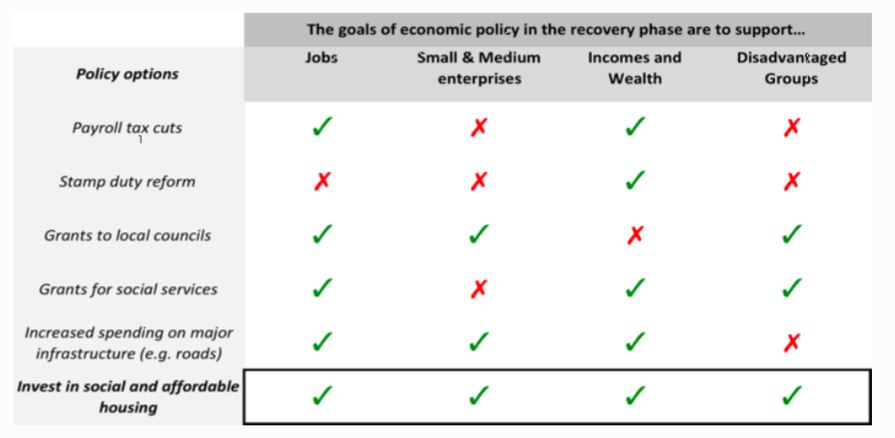

According to the modelling (Equity Economics), only social housing construction ticks all the policy goals for economic recovery.

Assistant Minister for Community Housing and Homelessness Luke Howarth said the Morrison Government had:

- Allocated about $1.6 billion to states to through the National Housing and Homelessness Agreement - including around $129 million in dedicated homelessness funding - and around $5.5 billion to 1.7 million individuals to help them pay for rent.

- Increased the National Housing Finance and Investment Corporation (NHFIC) low cost finance cap from $2 billion to $3 billion to support construction of new affordable houses.

If you need urgent help with money post-March, or even before then, head to ASIC’s MoneySmart for a list of free resources you can contact for urgent help with money.

Call Lifeline on 13 11 14 if you require mental help.

Photo by Jonathan Rados on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Rachel Horan

Rachel Horan