What is :Different?

Founded in 2017 by husband and wife duo Mina Radhakrishnan (a former head of product at Uber) and Ruwin Perera, :Different describes itself as “smarter, faster and more reliable property management”.

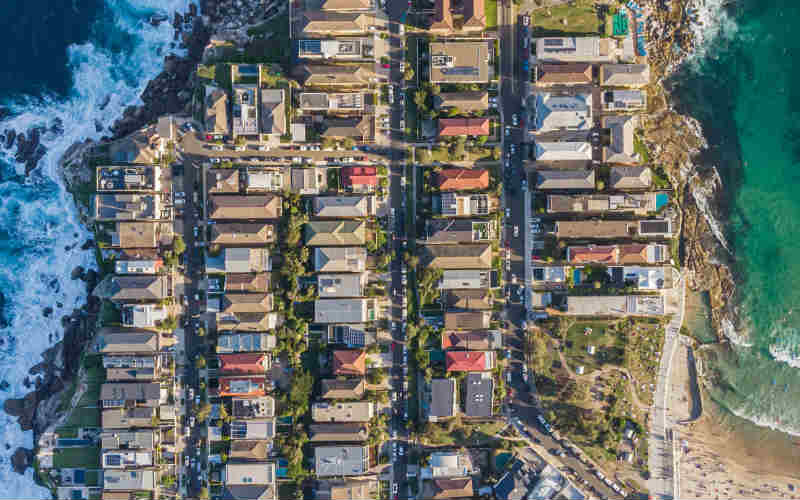

It’s essentially an app and online portal that combines a network of property managers and smart technology and has already accumulated more than $700 million worth of properties in Sydney, Brisbane and Melbourne.

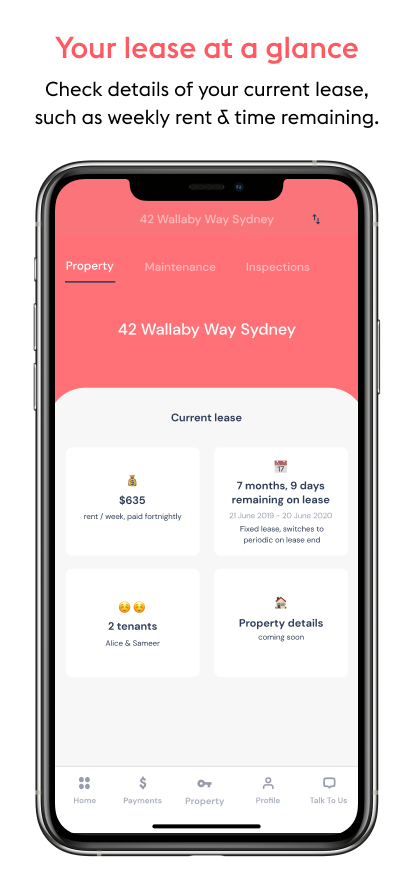

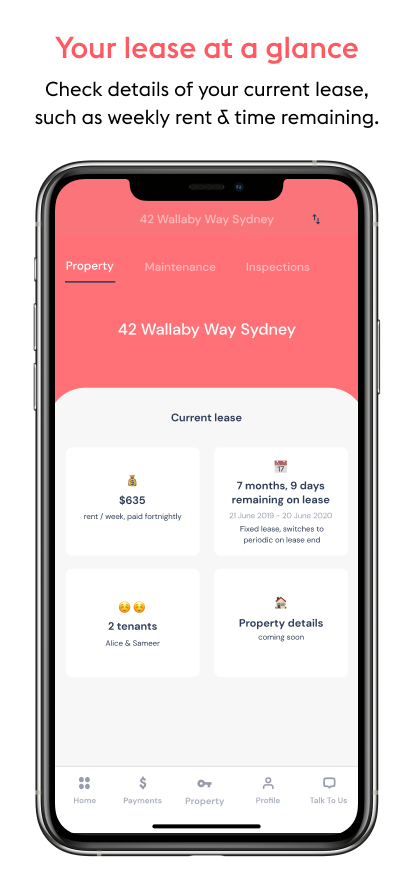

With 24/7 access to the portal, :Different promises customers:

- On-demand access to leases, statements and maintenance requests

- A tenant app for faster communication

- Automatic inspection schedules

- Reminders for bills and payments

- Free landlord insurance for the first year

- A rent guarantee if the tenants are more than five days late

All for a flat fee of $100 a month (plus up to $1,000 to for finding a new tenant).

Photo supplied.

:Different Qld Head of Operations, Kym Cheney told Savings.com.au the platform is better than traditional property management thanks to its use of technology.

“While we’ve seen a big shift in the way we find our next home (goodbye classified section in the paper, hello, online world) the way we buy, sell and in particular, manage properties has remained largely unchanged. Agents are still scanning copies of keys; statements are still being sent in the mail. It’s why we launched :Different in 2017,” Ms Cheney said.

“We see a huge opportunity for technology to transform the property management industry to provide a better experience for property owners and tenants alike. No longer do you need to call your agent to report a maintenance request. It can all be done through an app or online portal with just a few clicks, for example.

“Tech has the power to automate the mundane everyday tasks, so people (property managers) can focus on what they do best — connecting with people. Not only will this improve the experience by creating efficiencies and increasing communication channels, but it provides greater transparency for property owners and tenants.”

:Different’s Kym Cheney. Photo supplied.

Ms Cheney also says :Different’s automation means its pool of property managers is able to manage a person’s property portfolio better than an individual property manager can.

“We have a network of property operators across Sydney, Melbourne and Brisbane who are real people but are aided by technology. Technology automates everyday tasks so the operators can focus on what people do best,” she said.

“A network approach also ensures our customers have fast and always-on communication. Traditional property managers are typically juggling hundreds of properties, meaning responses can be slow. There is also typically high staff turnover.

“Having a team of property managers looking after your property ensures owners have round the clock service and a consistent experience every time.”

To learn more about how :Different works, check out its FAQ page which has more information on:

- The services it offers and how it all works

- Whether :Different fees are taxable

- How insurance works through its platform

- How the rent guarantee works

Different vs property managers: Which is cheaper?

As mentioned before, :Different has a flat fee pricing model of $100 per month, which, in the words of Ms Cheney, “means property owners know exactly how much they’ll be paying each month for their property management” in a fair and transparent way.

This is a bit different from traditional property management, which usually charges three different fees:

- Management fees, which are the fee associated with the day-to-day management of the property, such as rent collection.

- Letting fees, which are the fees charged for finding a new tenant.

- Other fees, the other costs which can vary from agency to agency, but covers things like lease renewal fees and tribunal representation fees.

All of this can be quite expensive, and the management fee is alone is usually around 5-12% of your weekly rental income, which is different from the flat fee model proposed. This means property management fees can vary significantly depending on rental income, which in itself is determined by lots of different factors.

Here’s a breakdown of the approximate average property manager charges across the country for management fees, according to Which Real Estate:

|

State |

Average cost (% of rental income) |

|---|---|

|

NSW |

5-8% |

|

QLD |

9% |

|

VIC |

6% |

|

SA |

9-11% |

|

WA |

8-11% |

|

ACT |

6-8% |

|

TAS |

7.5% |

According to Domain’s Rental Report for December 2019, the average weekly rent in Sydney for a house is $525, or $2,281 a month. Eight per cent of this is $182, while 5% is $114. Based on these figures, :Different’s pricing model of $100 per month could be significantly cheaper than the current method of property management, and that’s before factoring in the two other fees.

The table below shows similar calculations for the other capital cities, based on Domain’s data.

|

Capital city |

Average monthly rent - Dec-19 |

Average monthly property management cost |

:Different’s difference |

|

Sydney |

$2,281 |

$182.48 |

- $82.48 |

|

Melbourne |

$1,868 |

$112.08 |

- $12.08 |

|

Brisbane |

$1,782 |

$160.38 |

- $60.38 |

|

Adelaide |

$1,695 |

$186.45 |

- $86.45 |

|

Perth |

$1,607 |

$176.77 |

- $76.77 |

|

Hobart |

$1,999 |

$159.92 |

- $59.92 |

|

Canberra |

$2,510 |

$200.80 |

- $100.08 |

|

Combined Capitals |

$1,938 |

$174.42 |

- $74.42 |

Based on these results, :Different would be cheaper in every capital city by $74 on average (assuming the higher property management fee). Although it is only available currently in Sydney, Melbourne and Brisbane, where it would be roughly $52 cheaper per month - that’s $624 per year saved on property management fees. Over the lifetime of owning a property, that could be thousands and thousands of dollars saved.

Of course, it won’t always be cheaper, and if you’re on the lower end of the scale in terms of rental income, you might actually save money by using a property manager. But based on these calculations, you’d have to be earning below the average rental income for that to happen.

How to maximise your property’s return with :Different

Investors always want to make as much as they reasonably can off their investment property, but there are a lot of things that can reduce how much you get back. Management costs, maintenance fees, taxes, insurance costs and other admin can all work together to put a dent in the return your investment property can return. Ideally, you want your rental income to outweigh your rental expenditure.

Photo supplied.

We asked Ms Cheney how you can maximise your return on investment, and unsurprisingly, she said property management fees are a big killer.

“All property managers charge a fee to manage your property, but not all are priced equally, so it's important you know exactly how much you will be paying every week/fortnight/month and what that fee includes,” she told Savings.com.au.

“The fee is typically a percentage based on your rental income, and a 0.5% difference every week, or unknown extra fees, could be the difference of thousands of dollars over the lifetime of your property.

“It's actually why we choose to offer a flat fee with no forgotten costs, so property owners know exactly how much they'll be paying every month, and it's fairer for all.”

It’s worth comparing your expected property management costs to what you’d have to pay with :Different in order to see which one is better for your situation.

Read: The costs of investing in property

Know what renters want

The ideal tenant-landlord relationship should be one where each party gets what they want:

- The landlord should receive rent on time and not expect too many dramas

- The tenant should receive an adequate place to live with minimal overreach into their lives

A good property manager can sustain positive relationships with tenants, which in turn makes them like you more and increases the chance they’ll stay in the property for longer. And a good property manager has experience with tenants, and knows what they want in the current market.

“Don’t underestimate the difference that value add-ons can make to your property and how much you rent it for,” Ms Cheney said.

“Whether it’s installing a dishwasher or an air conditioning unit, or perhaps giving the walls a fresh coat of paint or fixing the internal laundry facilities — understanding what your tenants value can go along away in keeping them happy in your rental property and maximising your return.”

Find the right tenants

Finding good tenants is important. Bad tenants can cost money in damages and repairs, while a tenant moving out could cost you both a break in rental income and advertising costs to find a new one.

Ms Cheney says investors need to take the time to invest in finding good tenants who will treat the property like it’s their own.

“To attract the right tenants, making sure your rental property is presentable and desirable in both real life and online is key,” she said.

“When it comes to advertising your property make sure you invest in capturing high-quality photographs and using a reputable website to reach your desired tenants. Don’t be tempted to skimp on these things.

“Finding the right tenants and keeping them in your priority as long as possible will save you so much time and money in the long run.”

Savings.com.au's two cents

If you’re one of the two million+ property investors in Australia, then you would surely know how much owning that property and renting it out can cost you not just in terms of money, but time as well. More than half (54%) of Australia’s property investors use the services of a property manager, according to the Real Estate Institute of Australia (REIA), which takes a lot of the strain off yourself, but as you can see from the calculations earlier, this method might not be the cheapest way to manage your investment property.

There are apps and platforms springing up every day across lots of different industries now, and property management is no exception. Although we’re not guaranteeing its success, the combination of :Different’s low costs and easy-to-use portal means you could consider giving it a go. It might make your life a lot simpler.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

Aaron Bell

Aaron Bell