This decision was widely expected by markets and economists alike, with Bloomberg assigning only a 6% chance of a rate cut occurring prior to today’s meeting.

In the statement accompanying the decision, Reserve Bank of Australia (RBA) Governor Philip Lowe said the easing of monetary policy since June is supporting employment and income growth in Australia.

“Given global developments and the evidence of the spare capacity in the Australian economy, it is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target,” Dr Lowe said.

“The Board will continue to monitor developments, including in the labour market, and is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.”

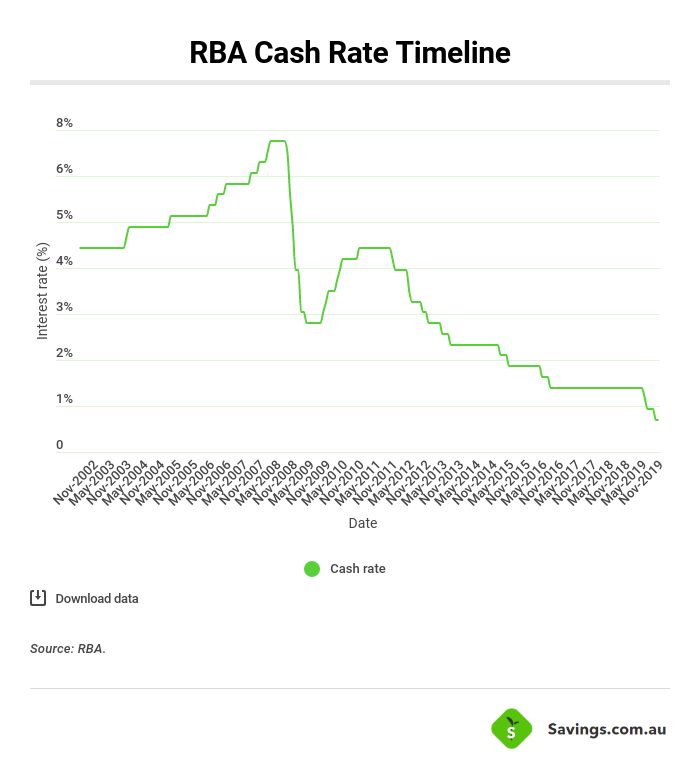

The cash rate has been cut three times in 2019 – in June, July and October – each by 25 basis points.

Based on Dr Lowe’s comments it seems to be a matter of when, not if, another rate cut occurs, and the general consensus among many leading economists is that the cash rate will be cut to 0.50% by early 2020, with some predicting a change even sooner.

There was no cut today, but AMP Capital chief economist @ShaneOliverAMP expects by Christmas the @RBAInfo will have lowered the official #CashRate to 0.5% #RBA #InterestRates pic.twitter.com/YU9u6IsFBk

— AMP (@AMP_AU) November 5, 2019

This view is supported by Monday’s retail sales data from the Australian Bureau of Statistics (ABS).

Retail sales grew by 0.2% in September (seasonally adjusted terms), which was below the predicted 0.4% increase.

Quarterly data showed sales slipped 0.1% in inflation-adjusted terms in the three months to September, with analysts expecting a 0.2% rise.

The government’s tax cuts and the RBA’s three cash rate cuts have appeared to do little to boost retail spending, and these figures are at their weakest point since the early 1990’s recession.

While this data may not be overly positive, CoreLogic research director Tim Lawless said the decision to hold interest rates in November was due to the national unemployment rate nudging lower and annual inflation edging slightly higher to 1.7%.

“Additionally, a rebound in housing values and a rise in buyer activity will hopefully begin to flow through to a gradual improvement in household wealth and spending,” Mr Lawless said,

“While several of the key economic indicators have stabilised, no doubt the RBA will be carefully monitoring other indicators which have continued to lose momentum such as consumer confidence, residential construction activity and retail spending.”

Mr Lawless said a negative side effect of historically low interest rates is a loss of confidence in household finances, a view that’s supported by the above retail sales data.

“Although the cash rate has remained on hold, lenders are becoming increasingly competitive, particularly for high-quality borrowers – ie those with low debt relative to their incomes and a responsible track record of savings together with expenses that are in line with their incomes,” he said.

“While the improved housing market conditions are positive for broader economic conditions, an increase in speculative activity from property investors or a slip in the quality of lending standards could be the trigger for a new round of macro-prudential policies aimed at maintaining prudent lending standards and keeping a lid on further accrual of housing-related debt.”

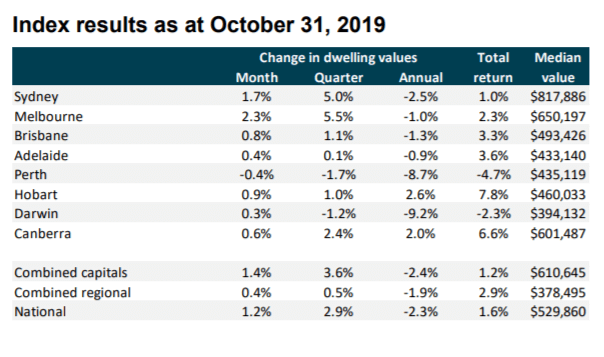

Philip Lowe meanwhile also said in his statement that there are signs of a turnaround in established housing markets, especially in Sydney and Melbourne.

This is supported by recent data from the likes of CoreLogic, which found the median house prices in these two cities rose by 1.7% and 2.3% over October respectively.

“In contrast, new dwelling activity is still declining and growth in housing credit remains low,” Dr Lowe said.

“Demand for credit by investors is subdued and credit conditions, especially for small and medium-sized businesses, remain tight.

“Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.”

Why the monetary policy statement won’t change

Federal Treasurer Josh Frydenberg wrote in an opinion piece via the AFR this morning that the existing statement regarding monetary policy will not change, citing the need for continuity and consistency in a time of global economic uncertainty.

“While recent years have seen inflation below the band, I have concluded after careful consideration, as well as consultation between Treasury and the RBA, that the existing statement is consistent with the government’s and the RBA’s shared understanding of the monetary policy framework,” Mr Frydenberg wrote.

“Australia is not alone in experiencing an extended period of low inflation, low unemployment and low interest rates.

“Indeed over the medium term, inflation is expected to return to the band consistent with the statement.”

Shadow Treasurer Jim Chalmers, however, was critical of the Government following the RBA’s announcement, saying the interest rate cuts seen since the election have not been enough to turn around a “floundering” economy.

“Interest rates are already just a quarter of what they were during the depths of the Global Financial Crisis and yet the Morrison Government continues to leave all the heavy lifting to the Reserve Bank,” Mr Chalmers said.

“In his statement today, the RBA Governor noted that “the main domestic uncertainty continues to be the outlook for consumption” and pointed to subdued wages growth which is likely to continue for some time.”

He also said that despite growing concern that interest rate cuts are losing their effectiveness, the Government have “refused to lift a finger” to support struggling pensioners and workers.

“Right when the Australian economy needs responsible, proportionate and measured stimulus, Scott Morrison and Josh Frydenberg have a political strategy but not an economic plan,” he said.

“It is time the Liberals brought forward a budget update to fix their forecasts and properly outline an economic plan that supports the floundering economy and better safeguards it from global risks.”

The Liberals have presided over the worst retail sales result since the 1990s, record household debt, and the slowest economic growth since the GFC but Scott Morrison and Josh Frydenberg are just sitting on their hands while workers and pensioners struggle. #auspol #ausecon pic.twitter.com/0I3SP9tmPI

— Jim Chalmers MP (@JEChalmers) November 5, 2019

13 economists back RBA Governor over Treasurer

Governor Lowe has repeatedly gone on record in the past saying “fiscal support” is needed to help boost the economy, with cash rate cuts alone not being enough.

The Treasury, however, has said that economic weakness was best responded to by monetary policy, ala cash rate cuts.

The Conversation asked 13 economists whose side they were on, and all 13 said they backed the RBA over the Treasury.

According to The Conversation, 11 of the 13 believe the government should abandon its determination to deliver a budget surplus next financial year.

In combining the 13 responses, the general consensus is that it’s the government’s responsibility to prevent the economy from weakening further, and it would be “unwise” to palm responsibility entirely off to the Reserve Bank.

Measures the government could adopt, according to The Conversation, include:

- Raising the rate of Newstart

- Boost funding to skills training

- Further tax cuts that double as tax reform

- Spending more on programs aimed at avoiding the worst of climate change, and

- Infrastructure projects with a social rate of return greater than the cost of borrowing

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan