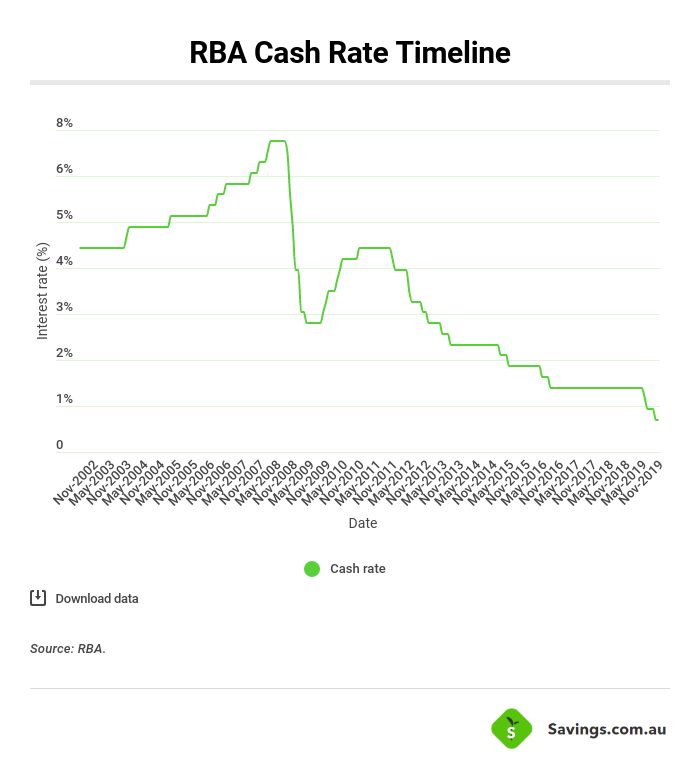

This is the third reduction in the cash rate in the last five months, with cuts occuring in June and July followed by consecutive rate holds in August and September.

The move was not unexpected, with markets pricing the chance of a cut at around 80%, while 74% of economists surveyed by Bloomberg correctly forecast a cut.

The cash rate of 0.75% is a new record low and marks the first time the Australian cash rate has ever been below 1%.

| Month | Change (bps) | Cash rate |

| May | 0 | 1.50% |

| June | -25 | 1.25% |

| July | -25 | 1.00% |

| August | 0 | 1.00% |

| September | 0 | 1.00% |

| October | -25 | 0.75% |

RBA Governor Philip Lowe said in his statememt that interest rates are very low around the world, and further monetary easing is expected as central banks respond to the persistent downside risks to the global economy.

“The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, signs of stabilisation in some established housing markets and a brighter outlook for the resources sector should all support growth,” Mr Lowe said.

“The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending.”

The #RBA cut interest rates 25bp to 0.75% at today’s meeting in line with expectations. Leading into the meeting consensus expectations are for the next cut to be in February, although this could be pulled forward as soon as November should Q3 inflation data disappoint #ausbiz pic.twitter.com/8X5wcITyrE

— Alex Joiner (@IFM_Economist) October 1, 2019

According to Mr Lowe, the board took the decision to cut today as new dwelling activity has weakened and growth in housing credit remains low.

“Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality,” he said.

“The economy still has spare capacity and lower interest rates will help make inroads into that.

“The Board also took account of the forces leading to the trend to lower interest rates globally and the effects this trend is having on the Australian economy and inflation outcomes.”

Mr Lowe also said it’s reasonable to expect an “extended period of low interest rates” if Australia is to meet its employment and inflation targets.

Stay up to date with the latest rate changes

SIGN UPIncreased risk of household indebtedness

CoreLogic head of research Tim Lawless said lower interest rates could lead to higher household debts.

“Although the housing recovery is likely to add to Australia’s economic momentum, it comes amidst record levels of household debt and ongoing affordability challenges,” Mr Lawless said.

“There is a risk that lower interest rates could fuel a further rise in household indebtedness as housing credit picks up and investors once again become more active, while higher housing prices are likely to curb participation from first home buyers despite the lower cost of debt.”

“The rebound in housing conditions should help to support an improvement in economic conditions as higher housing prices translate to a wealthier and more confident household sector who will hopefully be inclined to spend more.”

How low can it go?

Chief Executive Officer of Mortgage Choice Susan Mitchell says this historically low rate environment puts borrowers in a great bargaining position.

“If you asked me this time last year what a competitive interest rate was, I would have said that if your rate didn’t start with a 3, you were paying too much but today we have lenders on our panel offering loans starting with a 2,” she said.

“Today’s decision from the Reserve Bank comes as no surprise and it begs the question, how low can the cash rate go?”

Ms Mitchell encouraged borrowers and first home buyers to get into the market sooner rather than later.

“We will have to wait and see to what extent lenders pass the cut on to borrowers but the reality is, home loan interest rates have not been this low since the 1950s,” she said,

“And, with dwelling values in the major capitals starting to turnaround, now could be a great time for hopeful buyers to put their plans in action.”

There is renewed speculation another cash rate cut will occur sometime in the coming months, with calls for a cut as early as next month.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Dominic Beattie

Dominic Beattie