Figures from the latest Housing Industry Association (HIA) Affordability Index for the December 2020 quarter show a faster decline in regional housing affordability compared to the eight capital cities.

The regional affordability index fell by 3.7% to return to its December 2019 level, while the capital cities' affordability fell 2.5%.

This index is calculated quarterly, taking into account the latest dwelling prices, mortgage interest rates and wage developments.

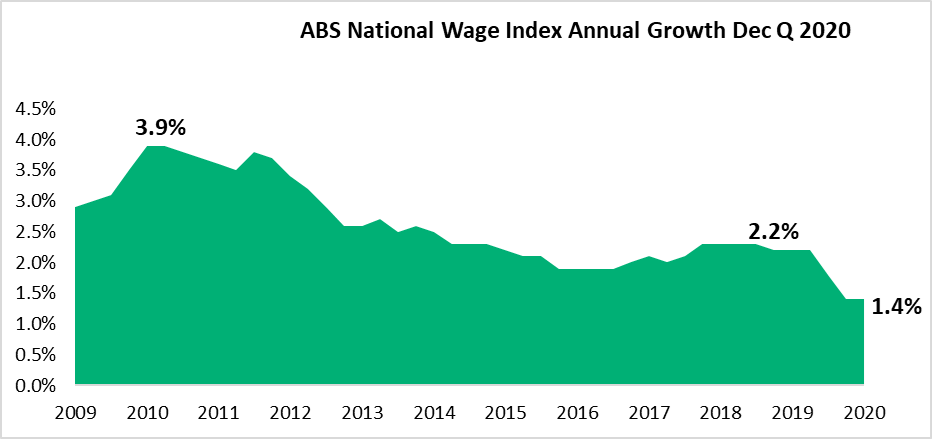

According to HIA Economist Angela Lillicrap, housing became less affordable overall in 2020 due to rising prices in addition to a slight fall in average incomes.

However, record-low interest rates have helped with affordability.

Source: Archistar

"Despite the decline, housing is considerably more affordable than the average over the past 20 years," Ms Lillicrap said.

“With the onset of COVID-19, consumer preferences have shifted towards detached housing and regional areas.

“Preliminary migration data shows more Australians left the capital cities in each of the first three quarters of 2020 than at any other time since records began in 2001. This involved an acceleration of retirement plans and fewer people moving to urban centres for work or education.

"As a consequence of this shift in population, house prices in regional areas outperformed the capital cities over the past year."

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

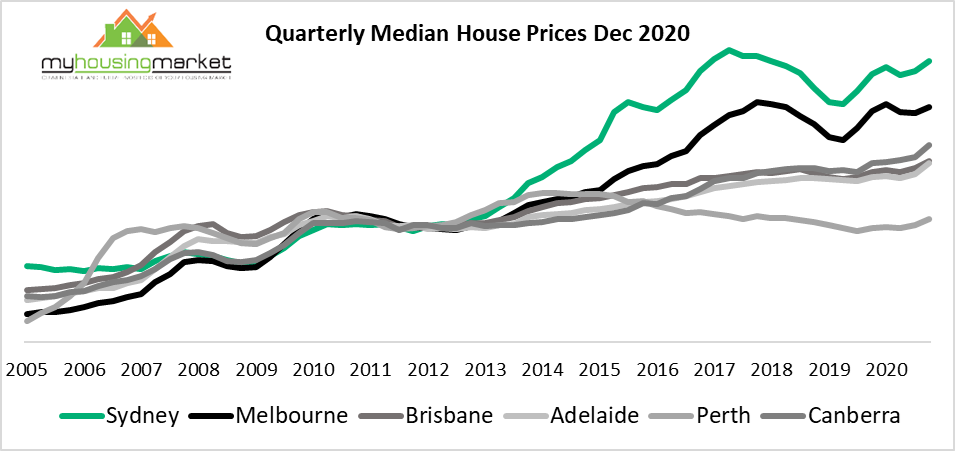

Prices have risen sharply over 2020 in spite of what most economists and banks initially predicted, with Sydney housing prices hitting a new record high of $895,933 (median) last month.

Nationally, dwelling values increased 2.1% in February, and CoreLogic expects these prices to continue to grow, which has caused more Australians to increase their concerns about housing affordability.

Figures from the Australian Bureau of Statistics (ABS) shows record numbers of people leaving capital cities, as more than 11,000 people left them in the three months to the end of September.

With more and more Australians turning to regional hotspots for work and affordability purposes, Ms Lillicrap says this trend will be permanent.

"When ‘normal’ does return, however, young students and workers will once again move to employment centres in capital cities."

Of the capital cities in HIA's index, Darwin saw the sharpest decline in affordability during the quarter, falling from an index reading of 134.6 to 128.0.

Brisbane and Adelaide followed with declines of 3.1% each, while Sydney and Melbourne remain the most unaffordable despite only falling 0.8% and 1.4% respectively.

See also: Should you make a regional move post-COVID?

'Boom' conditions now in every capital market

Data from property intelligence firm Archistar shows the housing market boom isn't just limited to Sydney and Melbourne, with every capital city now experiencing boom-time conditions.

While this is great for sellers and those who can afford to buy, it's less-great news for those struggling to buy or those on low incomes.

According to Archistar's National Housing Market report, housing prices are actually now reaching their "full potential", and the pandemic is only one factor.

"We've had roadblocks in the orderly conduct of our housing markets really going back over the last three or four years, perhaps longer," Chief Economist Dr Andrew Wilson told Australian Broker.

"Of course, the fluctuations in prices, demand and affordability are all about interest rates, but we've had other factors outside of them and the RBA's control of the macroeconomy."

The factors Dr Wilson cites include:

- APRA limiting interest-only loans to investors several years ago

- The credit squeeze from 2017 onwards around the time of the royal commission

- And the ultra-low interest rates following six different rate cuts since 2019

"Now that restrictions have been eased, we've seen markets heading back to where they should have been if it wasn't for these impediments," he said.

"The growth now is a lot about catch-up, particularly in Melbourne and Sydney, because those cities suffered the most from those roadblocks, in particular because of their higher levels of investors.

"This will run its course over the year. Once prices get to the point where the low rates and high incomes are soaked up, we'll see a flattening in growth."

Source: Archistar

Another factor that could be driving up prices is a "dire shortage of property listings", according Upside Realty Director of Sales James Kirkland.

Listings across capital cities are down 19.4% compared to this time last year, and Mr Kirkland says market uncertainty is causing many to buy before selling their current property.

“We usually see natural movement in the market, but this hasn’t occurred in the last 12 months due to so much uncertainty and people holding off selling. While many are desperate to buy, there’s still so many sellers choosing to wait it out and not put their home on the market,” he said.

“We saw an 86% increase in the average number of groups attending our opens in January 2021 compared to January last year.

"This shortage of stock is driving up prices.

“With JobKeeper about to be phased out and banks calling in their loans, people are desperate to secure a property. So, if you’re thinking of selling, now is a good time to do it.”

Related: JobKeeper extension would see house prices spike higher in 2021

Photo via Joan You on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Emma Duffy

Emma Duffy

Jacob Cocciolone

Jacob Cocciolone