Despite apocalyptic predictions of 30% price falls in 2020, Australia’s property market fared reasonably well throughout the year.

Nationally, prices only fell 2.1% between April and September and rose for three straight months by 3.0% to finish the year, according to CoreLogic.

Economists are tipping values to surpass pre-COVID levels by February, with some capitals tipped for double-digit growth this year.

So, should you buy an investment property this year? We asked the experts what they thought, as well as what factors could affect the market throughout the year.

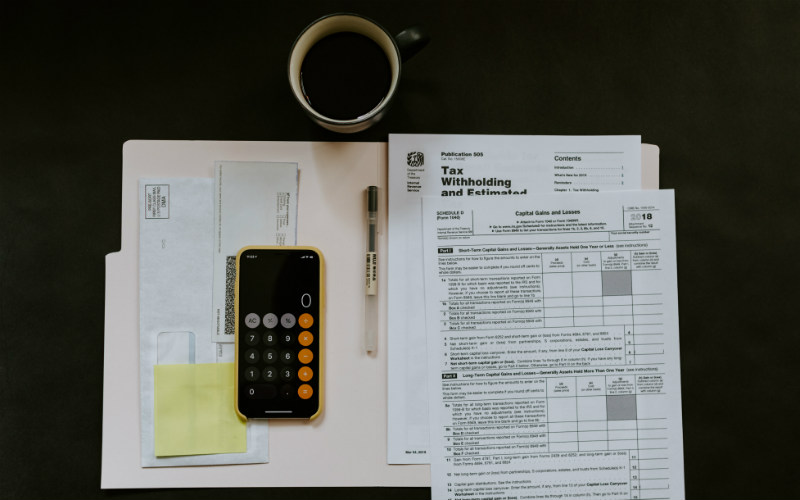

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

What to consider prior to investing

Gerry Incollingo, Managing Director of LCI Partners, told Savings.com.au there were several questions prospective investors should ask themselves prior to buying.

-

What type of property do I want to invest in? House, apartment, or commercial.

-

What is my budget?

-

What return on my investment can I expect?

-

What risks are involved?

-

What suburbs fit my investor profile?

“Your answers to these questions will narrow down your capabilities and bring forward information that you may not have been aware of before showing an interest in investing,” Mr Incollingo said.

What factors will affect the property market in 2021?

Investors should understand all investment comes with inherent risk. Of course, no year is the same, and this year is likely to be very different from the last (hopefully). Here are some of the factors likely to affect the Australian property market this year:

Relaxing of responsible lending laws

Treasurer Josh Frydenberg announced in September the government would relax lending laws, making borrowers more responsible for supplying accurate information on their loan applications and somewhat freeing lenders of their obligation to forensically verify it all. The decision was made in an effort to speed up the flow of credit and remove red tape. The move drew a great deal of criticism when announced, with 125 organisations writing an open letter opposing the decision, who said the laws were in place to prevent a repeat of the global financial crisis.

Dr Nicola Powell, Domain senior research analyst, said the changes, which come into effect March 1, would likely be positive for investors.

“The relaxing of lending will help the flow of housing credit. What it will mean is borrowers will ultimately be able to have loans approved faster because the responsibility of the suitability of a loan moves to the borrowers rather than the banks,” Dr Powell told Savings.com.au.

“That will drastically reduce the verification process, which obviously usually takes time.”

Record low-interest rates

The Reserve Bank of Australia (RBA) took Australia’s cash rate to a new record low in November, cutting by 15 basis points to 0.10%. Unfortunately, many lenders, including each of the big four, didn’t pass on this cut to variable rates on existing loans, instead offering record low fixed rates, some below 2% p.a. See if your lender passed on the cut here.

With RBA Governor Phillip Lowe suggesting the cash rate won’t be raised for at least three years, record low-interest rates are almost certainly locked in for 2021, with competition between lenders rife, fuelling speculation rates could dip lower.

Dr Powell said she expected this low rate environment to further spur the flow of credit this year.

“Interest rates are always a big one because obviously, the lower the interest rates are, the more affordable mortgages are, and I think those low-interest rates are here to stay.”

COVID-19 containment and vaccine

You heard it 1,000 times in 2020 and you’ll no doubt hear it more in 2021. No, not the word ‘unprecedented’, COVID-19.

Australia will begin rolling out vaccines in February, following the lead of countries in dire straits, like the US and UK.

Dr Powell said the success of vaccines domestically and globally would influence the strength of the rebound in the property market this year.

“If we have a successful rollout of the vaccine, not just in Australia but internationally, and that leads to international borders being reopened, we may start to see foreign students return and overseas migration recommence.

“That will be a big change for the property market and I think the lure of Australia is stronger than ever, given our containment of the virus has been world-class.

“When you look at countries like America and the UK which are continuing to battle severe outbreaks, Australia is definitely an attractive destination for international migrants.

Government support ends

Last year, financial support systems were implemented on a scale never seen before in Australia. JobSeeker (formerly Newstart) was raised to $1,100 a fortnight, the $1,500 a fortnight JobKeeper scheme was created, and tax cuts were brought forward.

Even the banks came to the party, granting mortgage holidays to those who needed them, while many renters were afforded rent reductions, deferrals, and had a moratorium (a word I knew before 2020) on evictions.

All of these measures are set to end in March. JobKeeper is due to be scrapped, JobSeeker likely to return to the much-maligned $40 a day rate, and lenders will no longer grant deferrals. All of these schemes ending at the same time have sparked fears of a fiscal cliff, but a ten year high in consumer confidence, and mortgage deferrals dropping to just 2% of all loans have abated this somewhat.

National Director at JLL, Leigh Warner, said the ending of all of these measures coinciding with each other could hurt the market.

“While prices are recovering at present, risks still exist. Most notably, the containment of the virus itself, but also the removal of a significant amount of public sector support for households and business over coming months,” Mr Warner said.

“Both these factors, but particularly in combination, could test the housing market recovery.

“This is why I would suggest many smart investors will not make investment decisions about short-term capital growth prospects and instead focus more on rental yield and longer-term capital growth prospects in currently more affordable regions.”

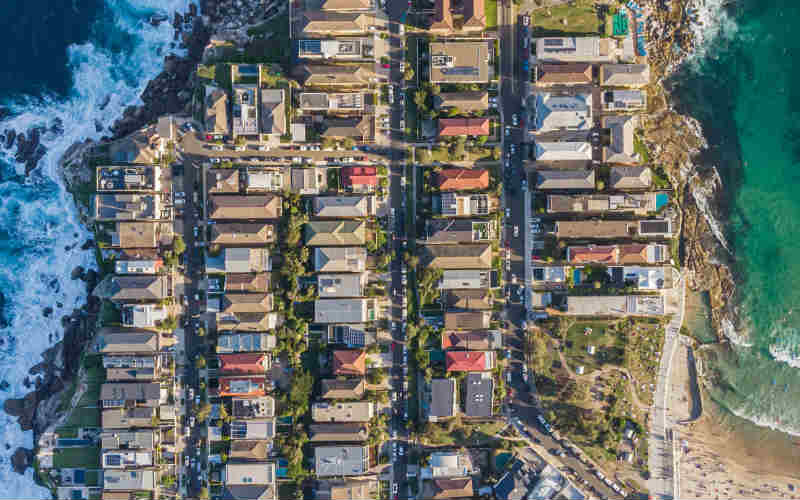

Regional areas to continue to grow in popularity

Regional suburbs were one of the few winners of 2020.

Regional house prices increased by 6.9% over the year, more than triple their capital city counterparts who saw an increase of just 2%. The increase in values was driven by the work-from-home phenomenon, as households who no longer had an obligation to the city looked to (quite literally) greener pastures.

Dr Powell said lifestyle locations were likely to perform well as a result of this shift.

“There is a greater proportion of higher-wage workers that can actually work from home,” she said.

“What that means is in some of these lifestyle coastal locations and tree change areas, those higher-wage workers are likely to drive up prices in certain regional towns that are seeing increased demand.”

What areas should you invest in 2021?

Simon Pressley, Propertyology’s Head of Research, said prospective investors should review 100% of their options when looking where to buy.

“When it comes to Australian real estate, those options include around 200 individual towns and cities. When done well, property investors adopt a financial mindset that is very similar to share investors,” Mr Pressley told Savings.com.au.

“They understand that property is a financial instrument (not bricks and mortar). Each of the eight capital cities and the hundreds of non-capitals (big and small) is the equivalent of a company on the stock exchange.”

Mr Pressley warned investors away from Sydney and Melbourne and urged them towards regional locations.

“The obvious no-go-zones include apartments (new or established) in every location and always avoid locations with a one-industry economy.”

“We have medium-term concerns about Melbourne, while anyone who is honest must also agree that Sydney has vulnerabilities and is a long off having the best fundamentals.”

“The other six capital cities all have a healthy outlook. But, without a shadow of a doubt, the locations with the very best potential are beyond the capital cities.”

Mr Warner concurred with Mr Pressley, and said affordability and rental yields were much higher outside of Sydney and Melbourne.

“Sydney and Melbourne are also still absorbing the tail end of the last large construction cycle, which is made harder by much lower overseas migration, and this is still resulting in a softer rental market and pressure on rents.

“In contrast, demand and supply balance is much stronger in most other parts of the country and the rental market is tightening fast in most of the smaller capital cities.

“So I think investors will definitely be looking more towards Brisbane, Perth and Adelaide in 2021, as well as some regional locations that are benefiting from post-COVID domestic migration to lower density lifestyle locations.”

Should you buy an investment property in 2021?

So we come to it, the moment you’ve all been waiting for - is this the year to invest in property or should you hold off or look to other investments?

“It is always a good time to invest in your future. As soon as you can afford to, you should always invest. The key question is not ‘when’, it is always ‘where’,” Mr Pressley said.

He added this year presents a once in a generation opportunity for prospective investors.

“In addition to low supply and strong already putting upward pressure on asset values, property investors currently have this unique situation wherein many locations have record low vacancy rates and roaring rents. (is that a typo?)

“When investment incomes (+5% yields) are combined with interest expenses of sub 3%, this quite literally is the best set of conditions for property investors in all of our lives.”

Mr Warner said property investment was an excellent avenue to grow wealth this year, especially compared to other forms of investments.

“The combination of improving prices, record low-interest rates and incentives on offer are all making residential property investment much more attractive at the moment than over recent years.

“But it is also reflects the extreme uncertainty about other asset classes that still exists. Low interest rates mean property investments in many parts of country can be neutrally or positively geared, which is attractive in an environment when equity and bond markets still have questionable valuations.”

Dr Powell said whether you should invest came down to your personal circumstances, but there were several factors unique to 2021 that would interest investors.

“We've got historically low interest rates and it doesn't look like they're going to move anytime soon. The credit is cheap and I think we're likely to see some investors utilise those record-low rates.

“The focus for capital growth has moved away from Sydney and Melbourne and we’re starting to see a strong rebound in prices nationwide.

“2021 is definitely starting better than 2020 because we’ve got the vaccine and once we have that large scale rollout the outlook looks much better.”

Savings.com.au’s two cents

All investment comes with risk. If you’re considering investing in property in 2021, it may be worth putting out of your mind the insane times we're living in and get back to basics.

Put yourself in the mind of the tenant and ask if you would want to live in this home and area.

Does the suburb provide good capital growth?

What are the risks?

This will at least give you a strong foundation on which to base your decision. Then you can deal with individual factors 2021 will throw at you.

Photo by Nick Sarvari on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Arjun Paliwal

Arjun Paliwal

Harry O'Sullivan

Harry O'Sullivan