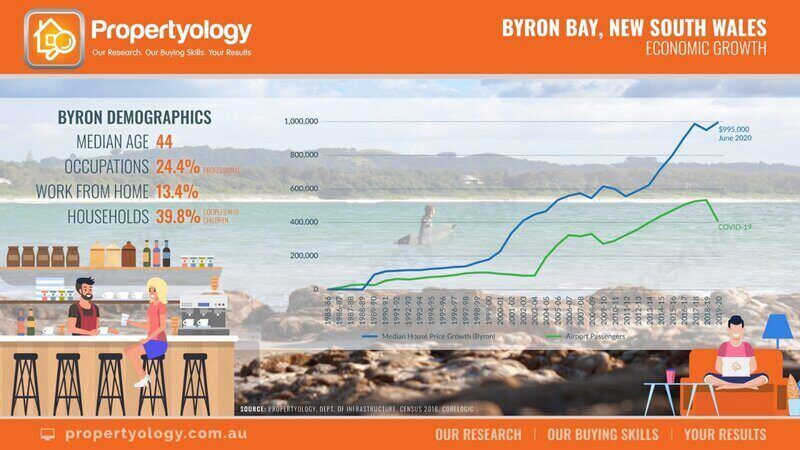

Buyer's agency Propertyology tipped Byron Bay as Australia's best community prototype to have already adopted the work from home (WFH) demographic.

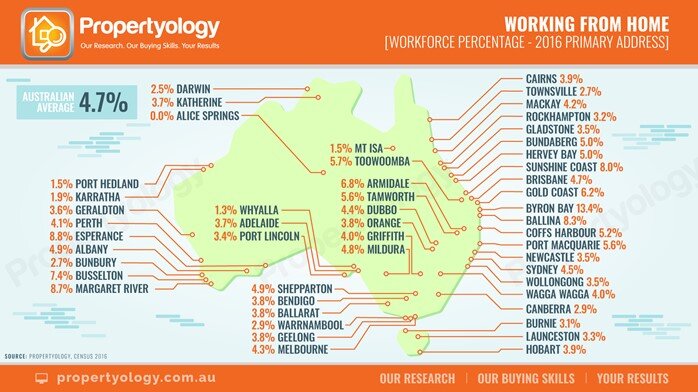

“A significant 13.4% of Byron’s workforce nominated ‘home’ as their primary work address at the 2016 Census. That is 3-times the national average of 4.7%,” Propertyology Head of Research Simon Pressley said.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Mr Pressley also pointed to the ease of access Byron Bay had to nearby cities like Brisbane and the Gold Coast, as well as the beach lifestyle it offered.

“It’s no coincidence that Byron’s airport passenger volumes have exploded over the last 20-years," he said.

"The airport ranking has significantly improved from being Australia’s 40th biggest carrier in 1993-94 to 17th in 2019-20.”

Byron has one of the largest WFH cohorts in the country, despite only having a population of 35,000, and also boasts the highest median house price in the country ($995,000 in June 2020).

“Over the last 20-years, no Australian location, capital city or region, had a higher average annual rate of capital growth than Byron," Mr Pressley said.

"One shouldn’t underestimate the role that work-from-home played in this outcome.”

Mr Pressley said the key location criteria for WFH was a relaxed lifestyle, coupled with two-hour access to capital cities by car, plane, or train.

Other locations with a high portion of WFH at the 2016 census were:

- Coastal locations: Surf Coast VIC (12.8%), Kiama NSW (11.4%), Noosa QLD (10.8%), Esperance WA (8.8%), Ballina NSW (8.3%), Bass Coast VIC (8%), Victor Harbour SA (6.9%)

- Winery and foodie cultures: Adelaide Hills SA (13.8%), Macedon Ranges VIC (11.1%), Margaret River WA (8.7%), Mornington Peninsula VIC (8%)

- Other inland wonders: Golden Plains VIC (16.9%), Scenic Rim QLD (12.3%), Maleny QLD (11.9%), Warragul VIC (9.2%), Armidale NSW (6.8%)

Propertyology found other locations with WFH appeal included Orange, Cessnock and Albury (in NSW), Cairns, Townsville, Hervey Bay and Yeppoon (in QLD), Kingscliff and Batemans Bay (in NSW), Bendigo and Warrnambool (in VIC), Hobart and Launceston (in Tasmania), and Geraldton (in Western Australia).

What's the scope of the WFH phenomenon?

With millions of Australians forced to WFH in the last six months, Mr Pressley said the scope of the shift was considerable.

“Imagine if Australia’s total WFH workforce increased to just 10%," he said.

"That would mean that, in a country with 10.5 million households, 1.3 million people would be earning their income with ‘home’ being their workplace.”

He conceded WFH wasn't for everyone, but predicted some people would adopt it as their new normal.

“Some will go one-step further and move town to do it from their dream location. Some have already done it!”

Propertyology pointed out 46% of the 13 million strong Australian workforce could WFH with little to no impact on their performance.

“Examples of roles that can comfortably service their customers no matter where they live include lawyers, accountants, journalists, mortgage brokers, call-centre operators, engineers, marketing consultants, web designers, analysts, and graphic designers," Mr Pressley said.

He added, unless you were living under a rock it was obvious there would be "a transference of housing demand away from congested and expensive capital cities and towards more relaxed parts of regional Australia".

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Brooke Cooper

Brooke Cooper