Typically the driving force behind purchasing an investment property is to make more money. If you’re a property investor, rental yield can give you an idea of how much money you’re earning each year on your property.

Find out what exactly rental yield is in this article, including how to calculate it and what a good rental yield might be.

What is rental yield?

Rental yield is essentially a measure of an investment property’s income generation over a year in relation to the price of the property. A high rental yield suggests the property earns high rent relative to the property’s price while a low yield suggests the opposite.

Think of rental yield as a bit like the interest rate on a savings account, or the dividend yield of a stock - these metrics all serve to indicate how much income an asset will generate for the holder of the asset over a year.

You’ll typically find that cheaper properties with lower prospects of capital growth (e.g. homes in some country towns) tend to have higher rates of rental yield, while more expensive properties in busy cities where values are expected to rise faster often have lower rental yield rates. If you look at a list of suburbs with the highest rental yields, you’ll notice regional areas dominate.

While rental yield is an important barometer of an investment property’s financial performance, remember that investing is a long-term game. Most property investors are more interested in capital gains rather than rental yield, but there are still some that prefer properties that produce a steady and reliable source of rental income.

When considering investing in a property, you generally shouldn’t let rental yield be your only deciding factor. Capital growth potential, vacancy rates and ongoing expenses are just some of the many other aspects you should take into account.

How to calculate rental yield

There are two types of rental yield, gross rental yield and net rental yield. You can find out how to calculate each below:

How to calculate gross rental yield

Gross rental yield measures your yearly rental income against your property value and shows it as a percentage. You can follow the steps below to calculate gross rental yield:

-

Add your weekly rental income up for the year to get your total annual rent.

-

Divide the total annual rent by your property value.

-

Multiply the figure by 100 to get your gross rental yield as a percentage.

How to calculate net rental yield

Net rental yield measures your yearly rental income minus rental expenses against your property value and displays it as a percentage. You can follow the steps below to calculate net rental yield:

-

Add up your rental expenses for the year.

-

Add your weekly rental income up for the year to get your total annual rent.

-

Subtract your annual expenses from your annual rent.

-

Divide this figure by your property value.

-

Multiply that figure to show your net rental yield as a percentage.

Net rental yield is often considered a more accurate measurement than gross rental yield as it gives a more complete picture by accounting for any expenses incurred in the year.

Rental yield case study

Isaac is the proud owner of an investment property and wants to find out how it's financially performing. The property is worth $600,000 and he charges $500 a week in rent. He decides he wants to find out the gross rental yield.

He multiplies his weekly rent ($500) by 52 to get the annual rental income ($26,000), divides this by the property value ($600,000), and multiples this figure by 100. His gross rental yield comes to 4.33%.

Isaac realises this isn’t a great indicator of how his property has performed as he’s forked out some serious cash on expenses over the year, so he decides to calculate the net rental yield.

Isaac spent $2,000 on repairs, $500 on property management fees, and $3,000 on insurance, taking his total expenses to $5,500 for the year.

He subtracts his annual expenses ($5,500) from his annual rental income ($26,000), divides this by the property value ($600,000), and multiplies this figure by 100. His net rental yield comes to 3.42%.

What is a good rental yield?

Property investment adviser Niro Thambipillay from investmentrise.com.au said a good rental yield was something that differs from suburb to suburb.

“For example, in Sydney, the average rental yield is sitting at about 3% or less. However, in Brisbane, the average rental yield is 4% or higher,” Mr Thambipillay told Savings.com.au.

“Then of course within each city, some areas will provide higher rental yield than others. It’s a case of doing your research and understanding what is right for you and your goals.”

Alison Rogers, partner at LJ Hooker Pinnacle Property, said there was a large range of good rental yields across the country.

“In today’s market, Tasmanian properties generate around 5% which potentially is covering the mortgage at least. This would in general be a higher return than other capital cities,” Ms Rogers told Savings.com.au.

“In regional Western Australia, it can be as high as 14%, regional Queensland 13%, and regional New South Wales 7-8%, based on figures from CoreLogic.”

How can I find a property with a good rental yield?

When looking for a property with good rental yield, Ms Rogers recommended talking to local experts and finding amenities that suited a range of potential tenants.

“Generally suburbs that are close to schools, shops and services and have easy access to transport make for the better returns. One needs to be mindful of socioeconomic factors,” she said.

“Property agents and managers are a good resource to access before your purchase as they have their ear to the ground in terms of local knowledge, vacancy rates and current possible rental income etc.”

Mr Thambipillay said it was important to hone in on a city or region, rather than a specific suburb.

“Start by identifying which city you want to invest in. Then start looking at suburbs that match your desired price point and analyse the average rent.

“You’ll be surprised how, even for the same price, different suburbs will give you different rental yields.”

What types of property have a good rental yield?

Ms Rogers said there had been a shift in recent years in properties with a good rental yield, but there was a solid national trend in properties performing well.

“Mid-range valued homes which in Hobart at present are priced between $400,000 and $600,000 and the most likely type is either two-bedroom units or three-bedroom homes,” she said.

“The type of home would be similar across the country and mid-range pricing will obviously vary. COVID has changed the landscape with inner-city apartments no longer in high demand and a shift towards regions for a lifestyle choice is popular.”

Mr Thambipillay recommended looking to properties that were or already or had the opportunity to become a duplex.

“At the moment, rental yields on houses are the strongest they have ever been. In some parts of the country, you can also look at a dual income property which can offer over 6% rental returns.”

How to improve rental yield

If you’re looking to try and improve the rental yield of your investment property, Mr Thambipillay offered this advice.

“If you’re buying an older property, you can renovate it and add value to then charge a higher rent and increase yield,” he said.

“However, regardless of whether you buy old or new, the key thing is to buy in areas with a tight vacancy factor where rental demand is greater than supply.

“If you can do that, the natural market forces will see your rents start to increase over time without you needing to do anything.”

Expert tips on rental yield

Mr Thambipillay warned investors to not chase high rental yields at the expense of everything else and employ good research and investment practices first.

“A few years ago, people were being encouraged to heavily invest in mining towns for their high rental yields. Unfortunately, today many of those properties are now worth about half of what investors paid for them – and the rents have fallen through the floor,” he said.

“So you need to be careful. Focus on areas where demand is greater than supply, where there is good infrastructure and where you believe prices are likely to grow over the long term.

“Once you have found the areas that meet these criteria, then look at rental yields.”

Ms Rogers said investing in a home that would likely have low expenses was a good way to increase your chances of a high rental yield.

“The home should be low maintenance potentially brick or a rendered exterior as opposed to weather board and is kept in good repair to avoid costly works down the track,” she said.

“Gardens are not always looked after by tenants so a highly landscaped garden that requires intensive maintenance should be avoided or factor a gardener at the investors cost into the calculations if you want the garden to continue to look the way it does at purchase.”

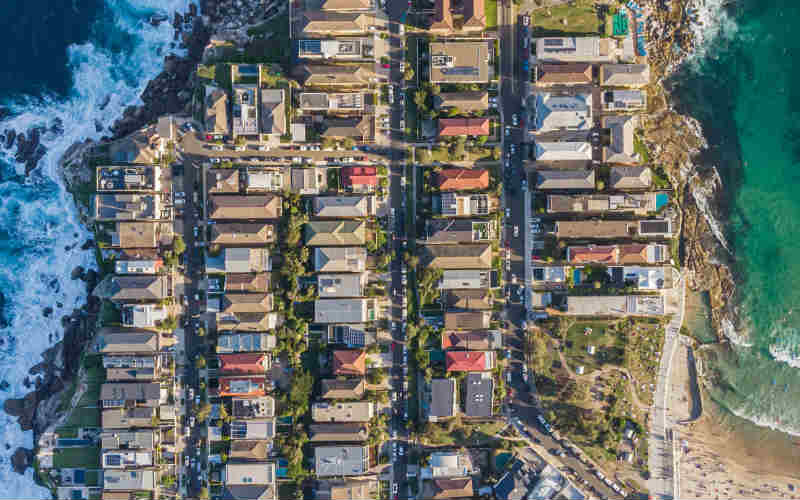

Photo by Dim Hou on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Aaron Bell

Aaron Bell

Alex Brewster

Alex Brewster