An estimated $25 billion in residential property is exposed to a 'high coastal risk' - represented by a Coastal Risk Score - according to data and analytics company CoreLogic.

The risk score measures the potential impact of climate change over time; the methodology evaluates combined coastal risks based on a number of factors including storm surges and changes in coastlines.

According to CoreLogic, the risk score assigns a coastal risk rating for 98% of residential property in Australia.

Dr Pierre Wiart, CoreLogic's Head of Consulting and Risk Management, said the damages caused by the recent floods in Queensland and NSW were a tragic but timely reminder of the destruction extreme weather events can cause.

"In the next three decades, coastal risk will crystalise, with the tangible effects of climate change already being felt in most parts of Australia," Dr Wiart said.

"This is leading to direct physical and financial consequences. Coastal risk has far-reaching implications for the country’s property market and its supporting financial sector, including property valuations, home loan viability and insurance premiums."

This research comes off the back of an IPCC report which revealed that Australia's sea levels are increasing at a rate higher than the global average, which Dr Wiart called alarming and requiring urgent attention.

"Understanding the coastal risk associated with those properties is important to every owner, potential buyer and ultimately our property and financial sectors that are supporting the expansion of new coastal properties in number and in value," he said.

"Increasing coastal risk is also adding pressure on insurance. Property owners face ballooning insurance premiums and restricted insurance coverage, together diminishing their insurance affordability and protection of their significant assets."

Which suburbs are most at risk?

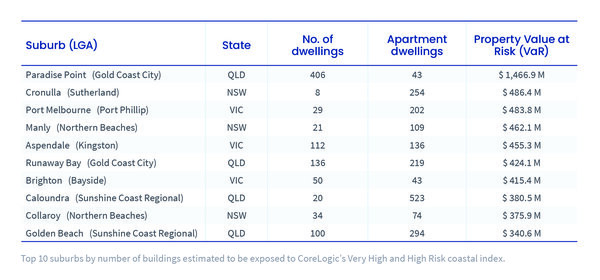

According to the research, Queensland has the highest concentration of properties - both units and individual houses - considered 'very high risk' due to the Sunshine and Gold Coast's densely populated coastlines.

There are still a large number of individual houses classified as 'very high risk' in NSW, Tasmania, and South Australia.

Notably, dwellings categorised as 'very high risk' may be impacted by coastal retreat within the next 30 years, and are at risk of 'significant' storm surge impact according to CoreLogic.

Paradise Point, located on Queensland's Gold Coast, has the highest volume of detached houses 'most vulnerable'.

About 20% of the suburb's housing stock - equivalent to 40% of the suburb's total residential value - is considered to be at a high coastal risk, representing an estimated $1.47 billion.

Also considered 'very high risk' were suburbs such as Cronulla, NSW and Port Melbourne, VIC due to the high density of apartments within close proximity to the coastline.

Source: CoreLogic

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Marc James on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Hanan Dervisevic

Hanan Dervisevic