This result sees the monthly inflation rate for April return to replicate February’s result of 6.8%, marking the first monthly increase in inflation figures in 2023.

ABS Head of Prices Statistics Michelle Marquardt noted the significant contributor to the increase in annual inflation movement in April was automotive fuel.

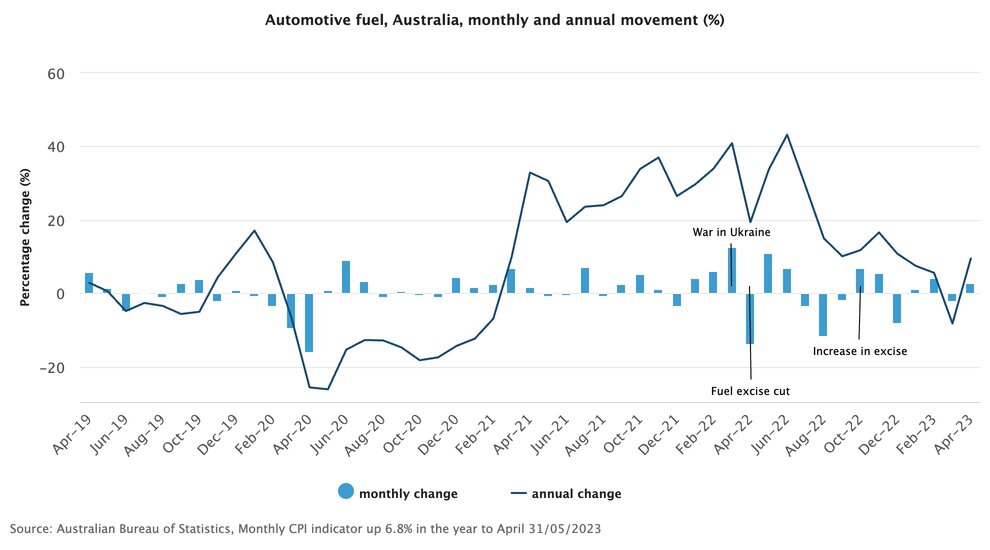

“The halving of the fuel excise tax in April 2022, which was fully unwound in October 2022, is impacting the annual movement for April 2023,” Ms Marquardt said.

“Automotive fuel prices were 9.5% higher this month than they were in April 2022 when prices fell following the 22 cents per litre cut in the fuel excise introduced on 30 March 2022.

“This contrasts to March 2023, which saw an annual fall in fuel prices of 8.2%, compared to the high prices recorded in March 2022 related to the war in Ukraine.

CommBank Economist Stephen Wu echoed this sentiment prior to the release of ABS figures, noting an uptick in the annual inflation rate was expected to be driven by petrol prices.

Economists across the major banks anticipated a much smaller rebound than the 0.5% increase April provided, with CommBank and ANZ anticipating the annualised monthly inflation rate to lift a minor 0.1%, while NAB was more bullish forecasting a rate of 6.6%.

Despite April’s result of 6.8%, Ms Marquardt said it can be helpful to exclude items with volatile price changes from the headline CPI to provide a view of underlying inflation.

“When excluding volatile items (automotive fuel, fruit and vegetables and holiday travel), the annual movement of the monthly CPI indicator was 6.5% in April, lower than 6.9% recorded in March,” she said.

Outside of fuel, the ABS detailed price rises for food and non-alcoholic beverages remain high but have eased slightly from an annual increase of 8.1% in March to 7.9% in April.

Further, new dwelling prices rose 9.2% to mark the lowest rate of annual growth since February 2022, while rent prices lifted from 5.3% in March to 6.1% in April.

Speaking before a Senate Committee on Wednesday, RBA Governor Dr Phillip Lowe said he expects rent inflation to continue to rise closer to 10% in 2023, which would see rent inflation reach a level not seen since June 1989.

“It is really hurting some people,” Dr Lowe said.

“The underlying issue here is supply and demand in the rental market. The vacancy rates in many cities are very low.

“There are a few things that have contributed to that - during the pandemic, the average number of people living in each household declined and people wanted more space and the other thing that’s now happening is a big increase in population.”

Image by Nick Fewings via Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury