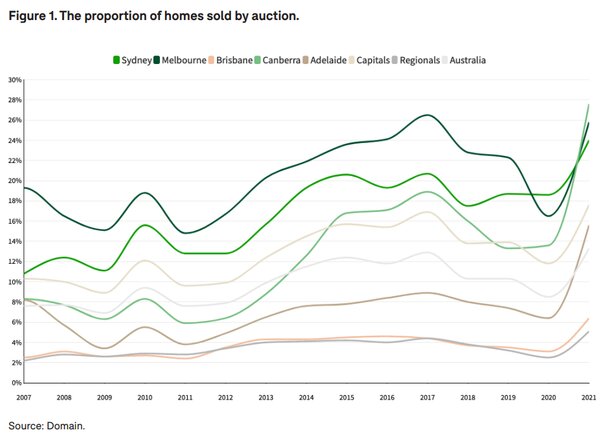

Auction sales have increased across Australia - particularly over the past year - with mostly higher priced homes being sold under the hammer according to Domain research.

Domain's latest In Focus: Auctions report revealed that Canberra is the most auction-centric city with the highest proportion of sales by auction - 27.6%.

Australia's capital has overtaken Melbourne where 25.8% of homes are sold by auction.

Overall, 13.3% of properties in Australia were sold by auction in 2021 - equating to a record-breaking 42,918 auctions.

This has been led by the capital cities with 17.6% of sales being by auction; only 5.1% of regional sales were by auction.

Domain's Chief of Research and Economics Dr Nicola Powell said we can expect to see a growing number of auctions in the years to come.

"This trend is not isolated to just one city, we're seeing it across Australia and spreading from the higher-priced suburbs into the middle and outer suburbs," Dr Powell said.

"Buyers and sellers are embracing the transparency and efficiency that auctions can often provide, and the fact that all cities have a higher median price at auction compared to private treaty."

Why the growing interest in auctions?

Every capital city has a higher median auction sale price compared to private treaty sales.

The biggest difference can be seen in Brisbane's house prices where the median auction price is $1.035 million compared to $622,000 for private treaty sales - a difference of 66%.

Coming in just after Brisbane is Sydney, where auction sales are 63% higher than private treaty sales.

The trend is also clear with unit prices; Sydney has the biggest price difference of 41% ($1.07 million median auction price, $760,000 median private treaty price).

Domain's Chief Revenue Officer John Foong said the popularity of auctions is an opportunity for agents to get the strongest results possible.

"Australians love auctions thanks to the transparency and efficiency they can often offer - now with a virtual option," Mr Foong said.

"Greater peace of mind for sellers can be achieved by having a reserve price, providing the opportunity for an early sale, and the safety of post-auction negations if a property passes in."

See Also: Why buy a home at auction?

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by RArchitecture on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Emma Duffy

Emma Duffy