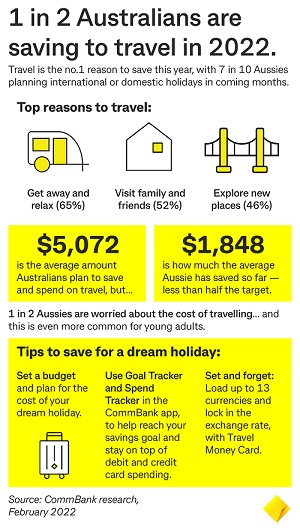

The CBA survey of more than 1,000 Australian adults found more than 70% are dreaming of the top travel destinations with many planning to travel either internationally or domestically this year.

CBA’s Executive General Manager, Everyday Banking, Kate Crous said it's great to see Aussies planning a much deserved break.

"Saving for a holiday was the third most popular type of goal that customers chose to create within the CommBank app Goal Tracker tool in both 2020 and 2021," she said.

Australians’ urge to get away has already been reflected in spending trends in January, with data from the most recent CommBank Household Spending Intentions (HSI) Index showing a 14.9% increase in travel spending intentions in January 2022 in comparison to January 2021.

Increases in spending were recorded in all travel categories, including travel agents, airlines, motor home & RV rentals, cruise ships, bus lines and airports.

Young adults (18 – 29 years) are more likely to be planning to travel internationally in the next year (2 in 5), compared to Australians over fifty years old (1 in 5).

Fewer than 20% who intend to travel have actually made plans and bookings, and more than 40% still have no plans for where and when they will go.

Of those who have planned, most are still planning domestic rather than international travel.

The real cost of a holiday

On average, Australians plan to save and spend $5,072 on travel in 2022.

Behaviours around savings are supported by the latest CBA and Melbourne Institute Australian Consumer Financial Wellbeing report which found elevated savings balances are helping to keep financial wellbeing levels higher than they were before the pandemic began.

However when it comes to saving for holidays, CBA research shows the majority have saved less than 50% of the desired amount so far, with an average of $1,848 saved for travel.

Payment trends

The CBA research shows one third of people say they’d be more likely to travel or travel more if they could spread out the payments over time, with this increasing to one-in-two for those under 30 years old.

68% of Australians plan to pay for their travel bookings upfront with physical cash or debit cards, compared to 46% of Australians who plan to pay for their travel through a buy now, pay later provider or with a credit card.

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

| Bank | Savings Account | Base Interest Rate | Max Interest Rate | Total Interest Earned | Introductory Term | Minimum Amount | Maximum Amount | Linked Account Required | Minimum Monthly Deposit | Minimum Opening Deposit | Account Keeping Fee | ATM Access | Joint Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

3.70% p.a. | 5.15% p.a. Intro rate for 4 months then 3.70% p.a. | $844 | 4 months | $0 | $249,999 | $0 | $1 | $0 |

| Promoted | Disclosure | ||||||||

4.50% p.a. | 4.85% p.a. Intro rate for 4 months then 4.50% p.a. | $933 | 4 months | $0 | $99,999,999 | $0 | $0 | $0 |

| Promoted | Disclosure | ||||||||

4.20% p.a. | 4.95% p.a. Intro rate for 4 months then 4.20% p.a. | $899 | 4 months | $250,000 | $99,999,999 | $0 | $0 | – |

| Disclosure | |||||||||

3.05% p.a. | 4.85% p.a. Intro rate for 4 months then 3.05% p.a. | $736 | 4 months | $0 | $99,999,999 | $0 | $0 | – |

| ||||||||||

0.00% p.a. Bonus rate of 4.85% Rate varies on savings amount. | 4.85% p.a. | $992 | – | $0 | $99,999 | $0 | $0 | $0 |

| Promoted | Disclosure |

Image by The Bored Apeventurer via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!