The report provides analysis into housing demand and supply across Australia, as well as long-term projections, with a view to identifying potential drivers of, and challenges to, housing affordability.

The report predicts the demographic of home owners is expected to shift over the next decade, with increased supply the key to providing affordability for first home buyers.

"More than 1.7 million new households are expected to form across Australia from 2022 to 2032," the report said.

"By household type, the strongest growth in new households is expected from lone person households (595,000), followed by couple families without children (488,000), then couple families with children (361,000).

According to the report, record low interest rates combined with government stimulus continues to impact positive construction activity.

According to the report, new net housing supply additions are expected to outpace new household formation by 115,300 in 2022, and 35,500 in 2023, as international border restrictions are relaxed and Net Overseas Migration (NOM) begins to recover.

NHFIC expects more than 550,000 new completions by 2024, with detached dwellings leading the cycle.

"Supply constraints, combined with strong demand for construction, has seen price growth for some materials (such as timber, aluminium and steel) soar by 20–34% in 2021," the report said.

"Closed international borders have also led to labour shortages."

NHFIC data suggests it can take more than six years to get new housing supply to market.

"If authorities actively slow or impede the flow of new housing supply, it can exacerbate upward pressure on rents and prices, something that should be avoided if improving housing affordability is a primary objective."

Housing affordability worsening

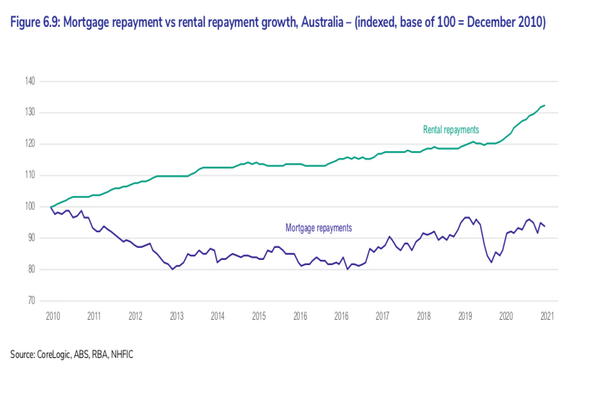

According to the report, housing affordability has worsened for renters and first home buyers.

In Sydney and Hobart, less than 10% of properties are affordable for more than 60% of households.

"Affordability challenges primarily burden prospective first home buyers, as increases in property prices make it more difficult to save for a deposit," the report said.

"The average first home buyer now faces a $460,000 debt. A figure that has risen $50,000 in a year and has tripled since the early 2000s.

"The time it takes to save for a deposit has doubled since the early 1990's, from four to eight years."

The report also reinforced saving for a deposit is largely impacted by the high cost of renting and rents are likely to continue to rise in the near term as international border restrictions are relaxed.

"A shortage of multi-unit dwelling completions is expected in the next 2 to 3 years, especially as rental markets are already tightening, and demand will lift as international border restrictions are relaxed. More higher density dwellings will be required closer to CBDs to meet unmet demand."

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Matt LaVasseur via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!