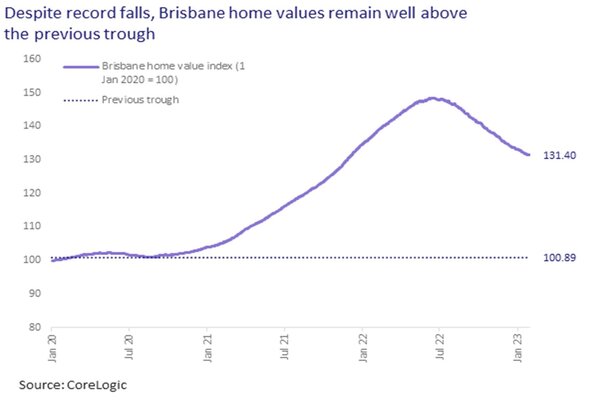

This decline to 28 January revealed by CoreLogic’s Home Value Index comes following a property price increase of more than 43% across Greater Brisbane from August 2020.

The 10.9% decline in Brisbane home values has taken just over seven months, with CoreLogic detailing peak-to-trough declines in the Brisbane market have previously lasted an average of 14 months.

CoreLogic’s Head of Research Eliza Owen said the second largest downturn in Brisbane home values took place between April 2010 and January 2012, requiring 21 months to reach a similar level of decline as the current downturn.

“The second largest period coincided with a national housing market downturn that was fairly broad based, and partly coincided with the RBA lifting the cash rate 175 basis points between October 2009 and November 2010,” Ms Owen said.

“Brisbane now stands out as one of two capital city markets with record declines, the other being Hobart.

“Sydney continues to have the largest peak-to-trough falls of the capital city markets (currently at -13.8%), while peak-to-trough falls remain mild in some cities such as Perth, where values are down just 1.0% from a recent peak in August 2022.”

Despite Brisbane recording record property price falls, Ms Owen detailed this decline has left no dent in the 43% worth of gains made, leaving home values across Brisbane 27.9% higher than August 2020.

What’s next for Brisbane in 2023?

Ms Owen said Brisbane’s housing market is currently in an adjustment period from a sharp increase in borrowing costs over the second half of 2022, which have likely hit buyers hard off the back of extraordinary price rises.

“The median dwelling value in Brisbane has increased from $506,553 at the onset of COVID-19 in March 2020, to $707,658 at the end of 2022,” she said.

“Only Adelaide and Darwin, which are 42.8% and 29.6% higher respectively than at the onset of the pandemic, have performed stronger.

"For this reason, there is marginal risk of negative equity for Brisbane homeowners, with the exception of very recent buyers, who purchased around the peak in June 2022 with less than a 20% deposit.”

Ms Owen expects the Brisbane property market to likely fall further in 2023, yet the possibility remains for this rate of decline to taper.

PRD Chief Economist Dr Asti Mardiasmo echoed this sentiment, noting that there lies the potential for a steadier market in 2023.

“More innovation in the construction industry is set to bring on more supply as the state government has indicated housing supply is a key focus of 2023,” Dr Mardiasmo told Savings.com.au.

“However, this is a ‘wait and see’ situation, depending on how consumers and broader society react to current economic conditions.

“Buyers are still active and interested in the market, however are taking their time in evaluating their options. In a way this gives the market some very minor breathing space, to create the supply that is needed.”

Despite the 10.9% property price decline recorded by CoreLogic, Dr Mardiasmo detailed that its important to remember that there are markets within markets, depending on the supply and demand balance of each area and property type.

"We need to ask which property types are driving this? More often than not it is those high priced, blue-chip suburbs that see a significant drop in price, as opposed to the more affordable, mid-price range suburbs" she said.

"This is because the more affordable properties are priced still within the capped threshold of grants and schemes - so there is still help to access these properties."

See more: Brisbane suburbs tipped to grow in 2023

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Pixabay via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury