Under the federal government’s strategy to see 1.2 million homes built in the next five years, Australia would need to add 60,000 dwellings a quarter.

Tuesday’s quarterly data from the Australian Bureau of Statistics shows new dwellings are continuing to lag the ambitious target.

The latest figures put the country’s total housing stock at more than 11.1 million residential dwellings as at December 2023.

However, it’s the record mean price of residential dwellings that perhaps gives the best indication of how low supply and hot demand is fuelling Australia’s property values.

Property prices continue rising

The mean price rose by another $13,400 to $933,800 in the December quarter, with Queensland, South Australia, and Western Australia recording the highest growth rates over the previous quarter.

The mean price of residential property remains highest in New South Wales at $1,184,500.

It’s followed by the ACT where the mean price is $948,500 while it dropped slightly in Victoria to come in at $895,000.

The data put the total value of residential dwellings in Australia at $10,397 billion as at December, up almost $200 billion from the previous quarter.

Of that figure, the vast majority, more than 96%, was owned by owner occupier households.

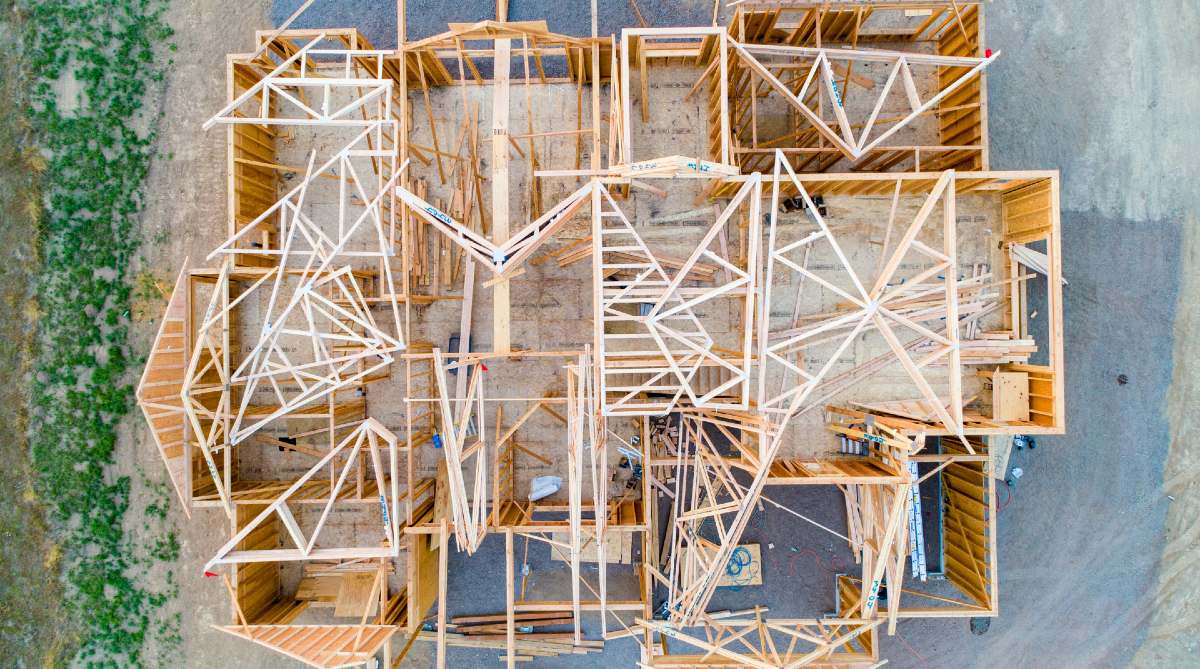

Building approvals sluggish

New figures released on Tuesday shows 12,850 dwellings were approved nationally in January.

Private house approvals led the 1% monthly drop in building approvals for January 2024, following a 10.1% fall in December, seasonally adjusted.

Of the dwellings approved in January, 7,461 were private houses while 5,238 were other residential dwellings, including townhouses and apartments.

Approvals for private houses fell 9.9% in January, although approvals for other private dwellings, excluding houses, rose 19.5%.

However, this followed a significant 25.3% decline in November.

House approvals were down 4.7% over the same time last year although total dwellings have seen a 4.8% annual rise, seasonally adjusted.

Total approvals rose most in Queensland, jumping almost 32% over the previous month, followed by Western Australia at more than 11%.

New South Wales, Victoria, and South Australia saw total approvals fall.

New home market slow

The figures follow forecasts from Housing Industry Australia that fewer than 100,000 new construction projects will begin in Australia in 2024, the lowest in a decade.

HIA predicts Australia will fall short 175,000 homes by 2027.

However, CoreLogic economist Kaitlyn Ezzy said the 230,000 dwellings currently under construction and not yet completed could help offset falling housing approvals amid heightened demand.

On Monday, a CoreLogic report into the ongoing effects of the pandemic noted the number of dwellings being completed in Australia remains well below pre-pandemic levels.

It currently takes more than two years to build units, six months more than before the pandemic.

A house now takes more than nine months on average to complete, three months longer than the pre-pandemic timeframe.

The report forecasts construction time blowouts will likely worsen this year.

Image by Avel Chuklanov on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!