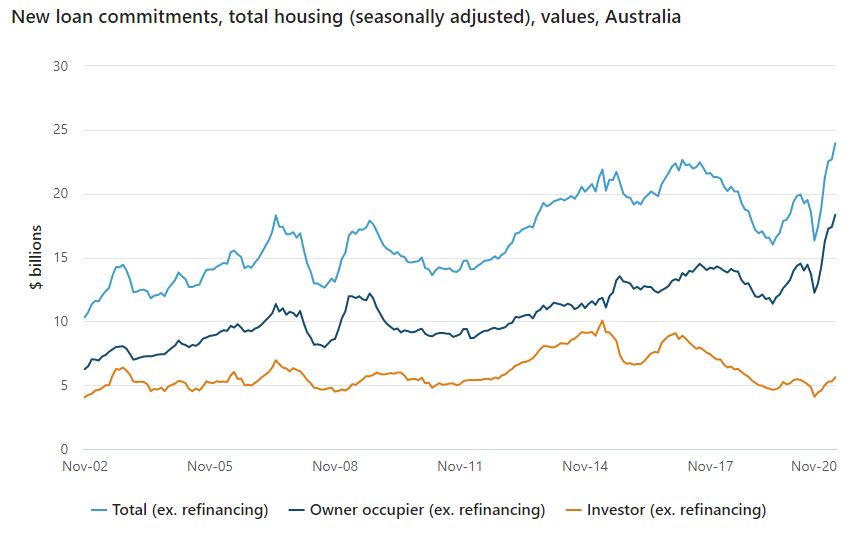

Data from the Australian Bureau of Statistics (ABS) found the total value of new loan commitments for housing rose 5.6% in the month to $24 billion, seasonally adjusted, an impressive 23.7% increase on November 2019.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

The sharp increase in commitments was driven largely by first home buyers, with commitments from the group rising 3.1% in November to 13,905, seasonally adjusted, a 42.5% rise since the start of the year.

This is also the highest level of first home buyers seen since October 2009, when similar rapid growth occured due to the temporary tripling of the First Home Owner Grant (FHOG) as part of the government response to the Global Financial Crisis.

ABS head of Finance and Wealth Amanda Seneviratne said the strong increases were also driven by the HomeBuilder scheme and commitments to existing dwellings.

“Loan commitments for existing dwellings rose 5.9% and were the largest contributor to the rise in November’s owner occupier housing loan commitments," Ms Seneviratne said.

“The value of construction loan commitments grew 5.6% in November, rising 75% since July. This follows the implementation in June of the Government’s HomeBuilder grant in response to COVID-19.

“Other federal and state government incentives and ongoing low interest rates also contributed to the continuing growth in new housing loan commitments.”

Source: ABS

Housing Industry Australia (HIA) economist, Angela Lillicrap said she expected construction loan activity to continue its strong growth into 2021.

“The number of construction loans to owner occupiers in the three months to November was 83.7% higher than the same time last year," Ms Lillicrap said.

“HIA New Home Sales data suggests that detached housing finance approvals will continue to be strong over the coming months.

"The extension of HomeBuilder at the end of November is not a factor in this month’s result but will see the strength in housing finance data extend into 2021."

Victoria saw owner occupier home loan commitments rise sharply, up almost 20% in November, sesonally adjusted, mostly due to increased commitments for vehicles.

Commitments to vehicles also saw a strong increase in commitments for fixed term personal finance, up 13.2%.

Investor housing commitment also saw a strong increase in November, up 6% to reach $5.6 billion.

“Investors are returning to the market, with the value of lending to investors up by 3.7% for the three months to November 2020 compared to the same time last year. This was driven by loans for the purchase of existing dwellings," Ms Lillicrap said.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Rachel Horan

Rachel Horan