According to the latest lending indicators data from the ABS, the value of new loan commitments for total housing rose 2.6% to a record high of $33.7b in January, 18.2% higher compared to a year ago.

New investor housing loan commitments rose 6.1% to a record high of $11.0 billion (seasonally adjusted), while owner-occupier housing rose 1.0%.

This marks 15 consecutive months of investor loan commitments rising.

The January rise was driven by strong growth for investor loans in New South Wales (+9.8%), Victoria (+11.1%), and the Australian Capital Territory (+22.8%).

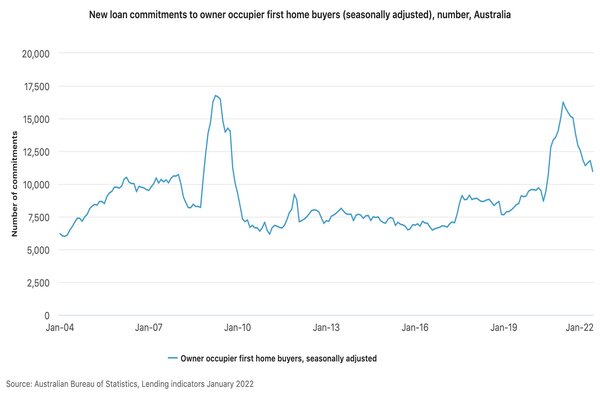

Number of first home buyers drops further

In January 2022 the number of new loan commitments for first home buyers fell 6.9% (seasonally adjusted).

The January decrease shows the number of first home buyers entering the market is 32.6% lower compared to a year ago.

State by state, the number of first home buyers in January fell:

- Queensland -16.1%

- Western Australia -8.1%

- Victoria -2.2%

- New South Wales -2.0%

- South Australia -4.6%,

- Tasmania fell 12.5%

- Northern Territory -1.6%

This decrease in first home buyer numbers has been influenced by worsening affordability, as house prices have skyrocketed over the last 12 months.

At the national level, the average loan size for owner-occupier dwellings (which includes construction and the purchase of new and existing dwellings) rose $17,000 to another record high of $619,000 in January.

ABS head of Finance and Wealth Katherine Keenan said commitments drove up the average loan size.

“The strong rise in the average loan size for owner-occupier dwellings in January was due to an increase in the value of commitments, and a largely unchanged number of new loan commitments.

"All states and territories rose to new highs except Tasmania and the Northern Territory.”

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Aaron Burden via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

Harrison Astbury

Harrison Astbury