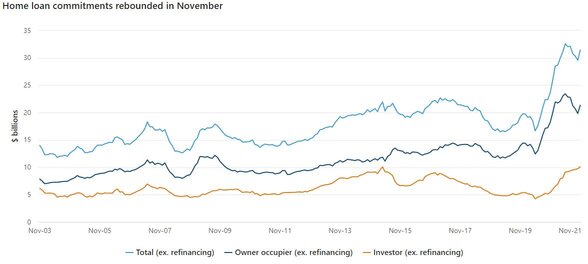

ABS data highlights the value of new loan commitments to investors rose 3.8%, reaching an all-time high of $10.1 billion in November.

This increase amounts to an 86.9% yearly change on new investor borrower-accepted loan commitments.

ABS head of Finance and Wealth Katherine Keenan said investor lending has grown for the past 13 months accounting for around one-third of the value of new housing loan commitments in November 2021.

"The previous investor lending peak in April 2015 accounted for 46% of new housing loan commitments," Ms Keenan said.

Increases in investor loan commitments were strongest in New South Wales up 7.8%, Queensland up 5.0% and Victoria up 3.6%.

Source: ABS

Owner-occupiers rebound

The total value of new loan commitments for housing rose 6.3% to $31.4 billion, backed by a 7.6% rebound for owner-occupiers following three months of falls.

"This rise was the first since May 2021 and the largest since January 2021," Ms Keenan said.

"Owner-occupier loan commitment increases were strongest in New South Wales, rising 9.6% and Victoria, rising 9.7% corresponding with restrictions easing in those states in October and November.”

Nationally, the average loan size for owner-occupier dwellings rose to an all-time high of $596,000.

First-home buyers bite the bullet before year's end

New loan commitments for owner-occupier first home buyers increased 1.9% in November, breaking a constant trend of declines since January 2021.

Yet the number of these commitments was 17.4% lower compared to a year ago, showing first-home buyers more broadly are willing to wait for signs of the property market cooling down.

"Victoria had the strongest rise of 12.3% in the number of owner-occupier first home buyer loan commitments," Ms Keenan said.

"The number of these commitments was 6.7% lower than a year ago, after falling from record highs seen earlier in the year.”

CommBank Senior Economist Kristina Clifton said while November showed a bounce, new lending is below its recent peak.

Image by Maximillian Conacher via Unsplash.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Arjun Paliwal

Arjun Paliwal

Harrison Astbury

Harrison Astbury