The survey of 4,000 members, showed that the least informed were young Australians (18-24), with 24% not knowing what options their super was invested in.

The survey also showed that 52% of all Aussies don't know how much they are paying in fees to their current fund.

Superhero co-founder and CEO John Winters said that while all customers want growth, many aren't actively checking where their money is going.

“It’s shocking to think that so many don’t know what their super is being invested in.”

"While retirement is thought of as something down the track for many, understanding how super works and how Aussies can set themselves up for a successful retirement should be considered a priority from when they enter the workforce,” he said.

Where Aussies want to invest their super

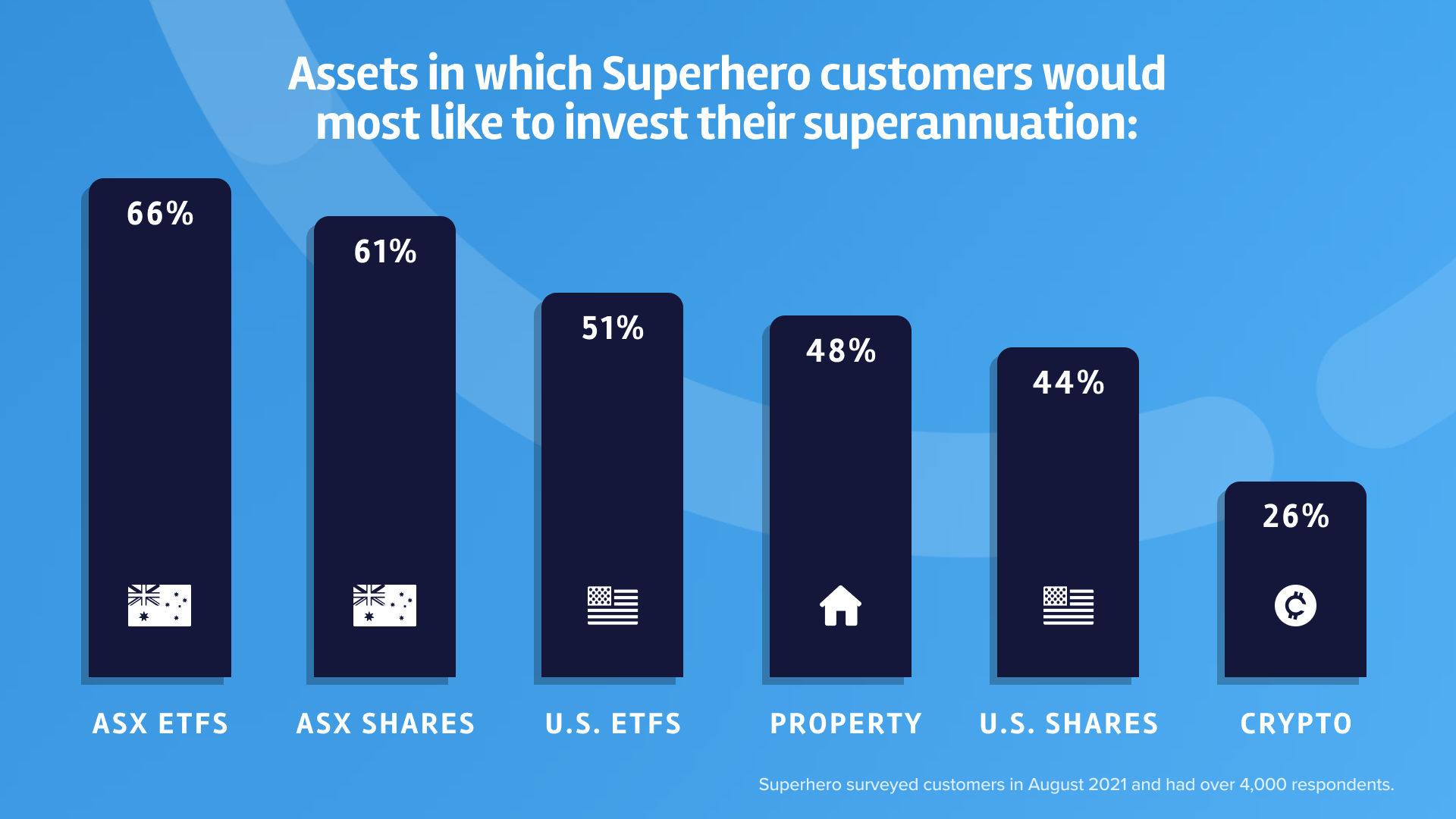

The research also showed the assets in which Superhero customers would most like to invest their superannuation.

Nearly three quarters (73%) of 18-34 year olds and 66% of 35 to 44 year olds want their super invested in ASX ETF's.

"We’ve learnt that our customers want increased control and flexibility when it comes to how their superannuation is invested," Mr Winters said.

"ETFs themselves are a great way to have multiple bites of the cherry when it comes to investing as they’re made up of several different assets."

Additionally, over two-thirds (69%) of customers aged 45 and over would prefer to invest their super in ASX shares.

The data also found that younger Australians are more likely to want to invest their super in cryptocurrencies with nearly 28% of Superhero customers between 25 and 34 interested in doing so compared with just 15% of Superhero customers aged 55+.

"Crypto is an interesting one too – it’s obviously a newer form of investment and younger Aussies clearly see the potential.”

Source: Superhero

Advertisement

Looking to take control of your retirement? This table below features SMSF loans with some of the most competitive interest rates on the market.

Lender | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | N/A | More details | |||||||||||

| FEATURED | loans.com.au – Variable SMSF Loan P&I <70%

| ||||||||||||

Disclosure | |||||||||||||

loans.com.au – Variable SMSF Loan P&I <70%

Disclosure

| |||||||||||||

| Variable | N/A | More details | |||||||||||

Reduce Home Loans – Ezy SMSF 70 Metro (Refinance)

| |||||||||||||

Disclosure | |||||||||||||

Reduce Home Loans – Ezy SMSF 70 Metro (Refinance)

Disclosure

| |||||||||||||

| Variable | More details | ||||||||||||

Disclosure | |||||||||||||

Firstmac – SMSF Loan P&I <70%Disclosure

| |||||||||||||

| Variable | N/A | More details | |||||||||||

Liberty Financial – Residential SMSF (LVR <80%) | |||||||||||||

| Variable | More details | ||||||||||||

La Trobe Financial – SMSF Residential | |||||||||||||

| Variable | More details | ||||||||||||

Yard – SMSF Loan <60% LVR | |||||||||||||

| Variable | More details | ||||||||||||

Disclosure | |||||||||||||

Firstmac – SMSF Loan P&I <80%Disclosure

| |||||||||||||

| Variable | N/A | More details | |||||||||||

WLTH – Ocean SMSF 60 P&I ($50k - $3.5) | |||||||||||||

| Variable | More details | ||||||||||||

| FEATUREDRate will drop 0.25% on 3rd of June | loans.com.au – Variable SMSF Loan P&I <80%

| ||||||||||||

Disclosure | |||||||||||||

loans.com.au – Variable SMSF Loan P&I <80%

Disclosure

| |||||||||||||

- Minimum 30% deposit needed to qualify

- Available for purchase or refinance

- No application, ongoing monthly or annual fees.

- Dedicated loan specialist throughout the loan application

Image by Campaign Creators via Unsplash

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury

Aaron Bell

Aaron Bell