With a backlog of arrivals waiting to enter Australia after two years of border closures, there is an opportunity for investors seeking both capital growth and rental returns to cash in on the Queensland coastal unit market according to Buyers Buyers Agency.

Sunshine Coast took out the top two spots in the top 10, with Cairns and the Gold Coast combining for six out of the top 10 on the list.

The report by Buyers Buyers said some of the trends created by border closures and pandemic restrictions could mean long term growth in Queensland's coastal regions.

"Our analysis shows that there are some strong opportunities for investors in coastal Queensland with a wide range of budgets," the report said.

"Investors seeking long-term capital growth and strengthening rental returns should focus on certain opportunities as rents get set to rise.

"In the unit market, there are solid opportunities in many of the coastal markets of Queensland, both on the Sunshine Coast and at the Gold Coast, and further north for those with a different budget level.

"Generally speaking, we look for boutique unit developments with reasonable strata levies, and if the budget permits, look for family-friendly units with owner-occupier appeal, in those popular suburbs where the supply is somewhat capped.

"Reserve Bank of Australia research has previously shown that new migrants and arrivals to Australia tend to have only a limited impact on the housing turnover rate, because most new arrivals are renters initially, especially international students.

"That means a lot more demand for rentals is coming in 2022. As the border reopens many parts of Australia may experience chronically tight rental markets…including coastal Queensland."

Top 10 suburbs for coastal QLD apartment investors

| Suburb, Region, Postcode | Number of properties | Median unit price ($) | 12-month price growth (%) |

| Mooloolaba, Sunshine Coast, 4557 | 4,390 | $702,963 | 35 |

| Coolum Beach, Sunshine Coast, 4573 | 1,753 | $738,762 | 35 |

| Port Douglas, Cairns, 4877 | 3,512 | $282,262 | 10 |

| Trinity Beach, Cairns, 4879 | 1,557 | $304,317 | 20 |

| Palm Cove, Cairns, 4879 | 1,482 | $356,426 | 19 |

| Palm Beach, Gold Coast, 4221 | 4,370 | $736,253 | 35 |

| Miami, Gold Coast, 4220 | 2,447 | $718,095 | 35 |

| Tugun, Gold Coast, 4224 | 1,715 | $761,476 | 35 |

| Airlie Beach, Whitsundays, 4802 | 1,094 | $366,430 | 21 |

| Bowen, Whitsundays, 4805 | 782 | $260,584 | 13 |

Source: Buyers Buyers

Queensland set for growth

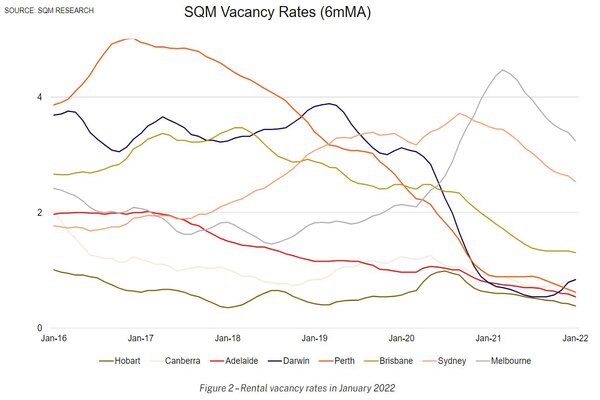

According to SQM Research, interstate migration to Queensland is the highest in over 15 years and rental vacancies are already tight across the coastal regions.

Buyers Buyers agency said it expects national rental price growth rising 10 to 20%, with most rental markets around the country already experiencing tight conditions.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan