The Australian Competition and Consumer Commission (ACCC) today released draft guidelines on how electricity retailers and generators should comply with three new laws designed to restrict electricity companies from keeping prices unnecessarily high.

The new laws, introduced in late 2019 and set to come into effect 10 June 2020, will prohibit the following conduct:

- electricity retailers charging small customers prices which are not adjusted to reflect sustained and substantial cost reductions in their underlying costs

- generators restricting access to electricity hedging contracts for an anti-competitive purpose

- bidding practices by generators which are engaged in fraudulently, dishonestly or in bad faith and/or for the purpose of distorting or manipulating prices in an electricity spot market.

According to the ACCC, such conduct can have flow-on effects to the prices consumers and businesses pay.

ACCC Chairman Rod Sims said electricity competition and compliance will be key regulatory and enforcement priority in 2020.

“The ACCC will seek to ensure electricity companies set fair prices for customers and do not abuse their market position,” Mr Sims said.

“Retail electricity prices have already come down under reforms introduced last year, and these guidelines are designed to help power companies understand how to fully comply with the new laws, for the benefit of consumers.”

Australia already boasts some of the world's highest electricity prices.

The ACCC reported in December 2019 that the average annual bill for households fell by 4% ($65) on the previous year, but prices have increased by 50% over the last decade.

According to the data, the average annual household bill is $1,509.

86 400 launches energy switch tool

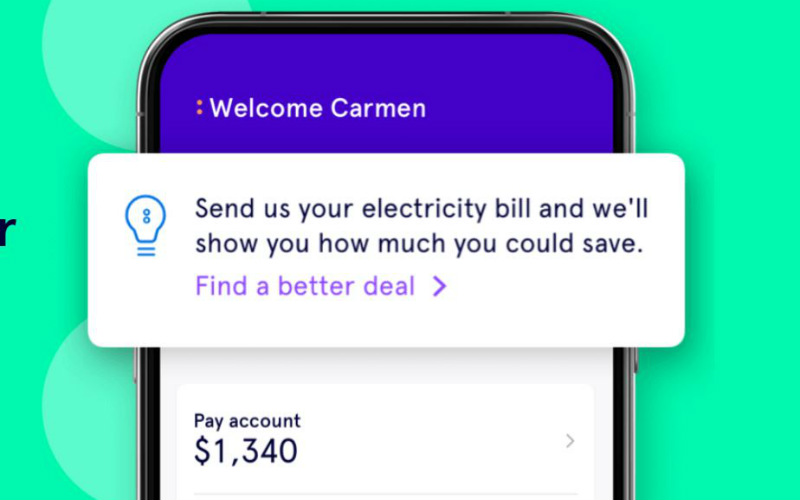

Amid the release of the ACCC's draft guidlines, neobank 86 400 has launched its free Energy Switch tool.

The tool, according to 86 400, allows customers to easily find a better electricity deal by:

- Emailing a PDF of your latest electricity bill to 86 400

- Receiving up to five different plans from 86 400 along with an estimate of how much they can save you

- Selecting the best provider and having 86 400 handle switching for you

86 400 said it is the first Australian bank to offer a free and independent energy switching service, not receiving any kickbacks for recommending certain plans.

The process should take only a few minutes, and 86 400 data shows it could save the average customer $420 - an amount that CEO Robert Bell says require a deposit of $30,000 to earn in interest over a year at the average big four bank interest rate (1.39% p.a.)

"With smart services like Energy Switch, you can make that back without locking up your life savings," Mr Bell said.

"When we announced this service, many people asked: where’s the catch? People were understandably suspicious – why would a bank want to help me make the most of my money?

"But from day one, that’s exactly what we’ve done. We’ve designed and built a bank that helps Australians take control of their money, and this service is just one of the ways we’re doing it.

"With Energy Switch, our customers can make an average saving of $420 in just a few minutes."

Financial commentator and early Energy Switch adopter Canna Campbell meanwhile said the service could be a "game-changer" for Australian consumers.

“For most consumers, sourcing a better electricity deal can be very confusing and time-consuming," Ms Campbell said.

"It’s refreshing to see a bank that is in sync with the way consumers think, work and engage with technology. 86 400 has innovated what Australian consumers have been missing, a bank that offers a simple way to make meaningful savings on regular expenses.”

"Through three easy steps, Energy Switch does the heavy lifting for consumers who are looking to avoid bill shock and bag extra hip pocket savings."

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury