Australians have been faced with a series of unprecedented recent events. From drought and bushfires, to floods and now the coronavirus outbreak.

In the short space of just a few weeks, it feels like our world has turned upside down.

The World Health Organization (WHO) declared COVID-19 a pandemic. The number of cases and deaths are rising. Governments are implementing social distancing measures to control the spread of the virus so our health systems can handle it, whilst introducing stimulus packages to help cushion the impact on the economy from businesses being disrupted. For the first time ever, the Reserve Bank of Australia (RBA) made two cash rate cuts in a month during March to a new record low of 0.25%.

Social distancing measures are seeing us swapping our face-to-face interaction and turning to social media more than ever to remain connected. But social media can also cause much fear and anxiety – ingredients for disaster when it comes to investing. Instead, reason and rationality are what’s needed when considering what to do with your investment money.

Yes, it’s hard to stomach seeing your life savings fall with the plummeting market. But whilst volatile markets tend to induce investor anxiety, it can also create additional opportunities to seek long-term investment returns.

Sounds contradictory, I know.

To show how volatility can be more of an opportunity than an inconvenience, let’s…

- …take a look at the current state of the market,

- …share some of the biggest lessons learned from investors during times of market volatility and;

- …get some top tips for positioning your super to thrive under any market condition.

What’s the current state of the market and outlook for the rest of 2020?

We’re no doubt experiencing the greatest health and economic pandemic of our times. Stock markets are taking a dive with investors panic selling. But should you panic about your super in this environment?

Let’s put this all into context.

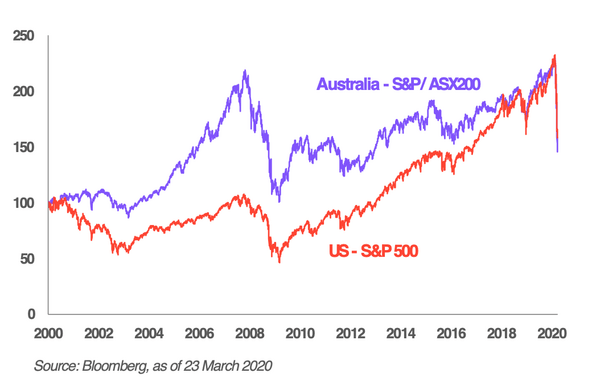

The recent market weakness came after a stellar run over the last 10 years. The S&P 500, a stock market index that measures the performance of 500 large US-listed companies, was up 383% since 1 March 2009 to its peak on 19 February 2020, before falling 32% most recently (to 23 March 2020).

What’s the outlook?

In a statement by The Australian Health Protection Principal Committee (AHPPC), we can expect that social distancing and self-isolation measures may need to continue for more than 6 months. This implies we’re in for a bumpy ride over the coming months. More volatility is likely as the impact of possible widespread shutdowns affect firstly, sentiment but secondly, economic activity generally.

A key number to watch is the daily number of new coronavirus cases. As the number of cases reaches a peak and improves, the market will likely bottom out creating attractive investment opportunities as it rebounds later in the year. But timing the bottom of the market is hard.

So, how do you position your investment portfolio during the current market volatility? Here are 5 tips to help you make your super work for you.

1. Don’t be afraid of market volatility

Markets move in cycles. This is a fact. Whether you’re investing in stocks, property or even crypto assets, you’ll know prices fluctuate. Market volatility can bring about opportunities. It’s better to embrace it than be afraid of it.

“Volatility does not determine the risk of investing…If you understand the economics of the business in which you are engaged, and you know the people with whom you're doing business, and you know the price you pay is sensible, you don't run any real risk." - Warren Buffett –

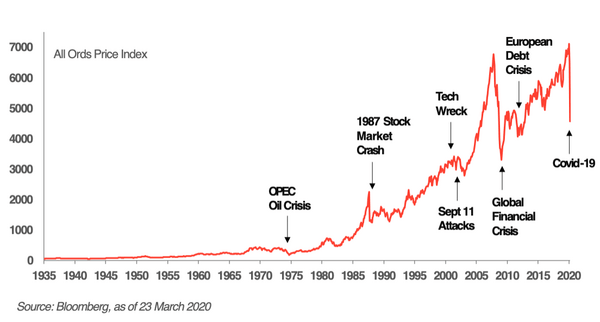

Let’s take a historic look back at the Australian sharemarket.

What can we learn from the ups and downs?

- Market corrections – typically defined as more than a 10% decline from a recent high - whilst unsettling for investors, are fairly common.

- There’s usually a sharp upswing after a dip, showing that markets can recover quickly after corrections.

- Looking at a short window, the peaks and troughs in the chart can appear quite sharp but over a long-term period the slope is more gradual, and trends upwards.

- Returns over the last 30 years was ~190% (to 23 March 2020), even after the recent sharp decline of over 37% from the COVID-19 outbreak to date.

If you’re keen to learn more on market volatility, here’s a useful, visual guide that won’t put you to sleep.

Now let’s look at how these observations can help with guiding your super investments.

2. Invest for the long term

Given markets go up and down, the obvious strategy is to invest low and sell high.

However, if you’ve tried this approach, you’ll know trying to time the markets can be futile.

Unless your crystal ball can reliably predict the future, selling out after a brief period of decline rather than focusing on your long-term goal can cause you to miss out on significant returns when markets rally.

Looking at the above charts as examples, the last major market correction was during the 2008 global financial crisis – for instance, the U.S. S&P 500 Index dropped by ~40% during that year.

Investors who panicked and sold out – moving all their investments into cash – would have locked in their losses and missed out on the subsequent ~155% returns for the U.S. S&P 500 Index since the beginning of 2009 as markets rebounded to 23 March 2020, even after the recent fall.

That’s why many super funds tend to remain invested in the stock market to varying degrees at all times.

3. Check in on your super

For many of us, superannuation is our biggest asset. If you’ve checked your balance recently you might be worried to see it’s taken a dive. It’s a great time to check in on your super account to see if your super fund’s strategy and values align with yours.

But before you panic, taking a step back and looking at the lessons learnt from the above tips will hopefully reassure you that the current disruption will pass.

The inherently long-term nature of super means that if you’re 25 years old, your investment timeframe could be 40 years out.

As the above charts show, when you take a long-term view and look back, this will be another blip in the stock market cycle and you have the opportunity to ride it out.

4. Start early and invest regularly

A good way to take emotional biases and investment risk out of timing the markets is to get into the habit of investing regularly, building up your super over time.

You can set up regular voluntary super contributions to invest a fixed amount each month where you let your money work in the background. This technique of investing a fixed amount at regular intervals is often referred to as Dollar-Cost Averaging.

This is how Dollar-Cost Averaging works:

If you invest in a super fund, the unit price of the fund is typically calculated based on the price movements of the underlying investments the fund invests in. If you invested $300 on the 15th of each month, you will be buying into the fund at the unit price on the 15th of each month. So over time, the overall buy-in price of your investment will be the average of the unit prices on the 15th of each month. As markets dip, it effectively helps to reduce your average buy-in price.

When you start early, invest regularly and have a long-term mindset, there’s potential for a magnified result with the powers of compounding coming into play.

Compounding is simple but powerful mathematics and a frequently cited investing concept whereby any returns you make on your investments are reinvested, so you can earn returns on the returns and help scale your investments significantly over time.

Let’s circle back to the previous example where you invest $300 every month. If you started this when you turn 25 and manage to achieve an 8% return each year, you’ll have over $1 million before you turn 65 years old.

5. Stick to fundamentals, not emotions

As a young analyst, I experienced daily emotional highs and lows depending on what happened in the markets and how the portfolio moved. For everyday investors, it can be just as tempting to check how your super is doing on a daily basis – almost like an addiction.

Staying on top of your super and knowing exactly where your money is going is a good thing, but don’t fall into the danger of letting your emotions guide your decision making.

The key is to try to understand what’s driving the price movements and stick to your investment goal. Over the years I’ve learnt to filter out the noise and not follow the herd. Dig into the fundamentals of what you’re investing in, and only then assess how the news affects the long-term prospects of your superannuation investment portfolio.

Keep calm and try to enjoy the (sometimes bumpy) ride; it can be a rewarding journey for those who are willing to stay the course.

Jade Ong is the co-founder of Elevate Super and investment platform AtlasTrend.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!