It’s the high wages! No wait, it’s the high house prices! No wait, it’s XYZ!

Every day it seems like there’s a new headline about how expensive it is to live in Australia, particularly the capital cities. And particularly Sydney and Melbourne. But how does it actually stack up globally? If you’re looking to justify whinging about how expensive everything is, you might want to look away now.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

How does the Australian cost of living compare globally?

Insurer Budget Direct has a super handy guide to determining the cost of living in Australia’s cities and comparing them to cities globally. If you’ve been planning to move to say, London, and want to see how far your dollar - or pound sterling goes - this tool can provide a handy insight. It compares everything from wages, to rent, to utilities, to a pair of jeans or a movie ticket.

If you thought Sydney was expensive, think again. Compared to London, rents are nearly one-fifth lower, while wages are higher. Where London wins out is in the grocery department, which is nearly a third less expensive compared to Sydney. Everything else pretty much goes to Sydney.

When you compare top global destinations to other Australian cities, such as Brisbane, things look pretty good back home.

As per the Globalization and World Cities Research Network (GaWC), London and New York City are the only cities in the world rated 'Alpha++', often with price tags to match.

Sydney is rated two spots down, at the 'Alpha' level, on par with Los Angeles and Toronto, and has slipped one rung. Melbourne is rated 'Alpha-', on par with Boston, San Francisco and Montreal, and has also slipped one rung. Meanwhile, Brisbane is rated 'Beta+' - on par with Vancouver, and has jumped one rung.

This places Australian cities in pretty good company, and it can be useful to compare similar cities using this scale.

See Also: Where has the Aussie Dollar strengthened?

However, it’s not all rosy, according to Budget Direct general manager Warren Marsh.

“The cost of living in Sydney is getting surprisingly close to that of New York, yet the cost of living in London is much more expensive,” he told Savings.com.au.

“The slow wage growth in Australia compared to the cost of living means living in Australia is still relatively expensive.”

That’s true - wage growth throughout 2020 was flat, and in some cases, real wage growth actually went backwards.

See Also: Your Financial Checklist Before Moving Overseas

What traps do wannabe Aussie expats fall into?

Yes, Australia is expensive when you compare it to somewhere like, say, Tehran (Iran). There, consumer prices are 120% lower than in Sydney.

In the words of Mr Marsh:

“From a cost of living point of view, when people are moving internationally for work, the biggest trap is not understanding the real cost of moving to certain locations,” he said.

“While the lure of a new role and a fantastic salary can be hard to ignore, it can be a trap if the cost of housing is 41% more, or your groceries cost you 33% more each week.”

Indeed, most Aussie expats are hardly moving to third-rate cities. Research from PricewaterhouseCoopers (PWC) indicates Australian diaspora amounts to more than one million people. The bulk of them are concentrated in California and New York, presumably in Los Angeles, San Francisco, and New York City. Vancouver, Canada also ranks highly. A large portion is also in Europe, with heavy concentrations in the United Kingdom, presumably in London.

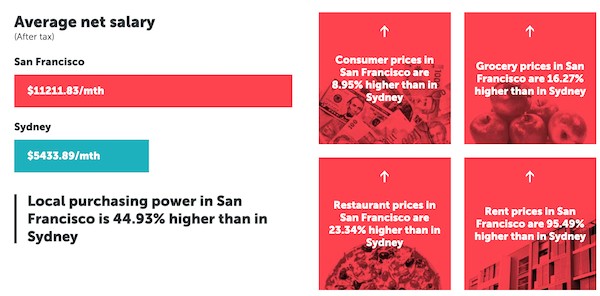

In San Francisco you’re looking at $3,800 a month for a one-bedroom apartment, amounting to more than $800 a week. To compensate, the average salary after tax is more than $11,000, according to Budget’s calculator.

“The relationship between average monthly earnings and the cost of housing and utilities is what is ultimately driving how affordable it is to live in these locations compared to living in Australia,” Mr Marsh said.

If we’re looking at North America, where they win is how cheap some consumer goods are. A monthly rail pass is about half the cost in San Francisco compared to Sydney. However, in just about most other metrics, Sydney wins out, though, San Francisco’s higher salaries more than makes up for the expensive cost of living, especially if you score one of those fancy tech jobs.

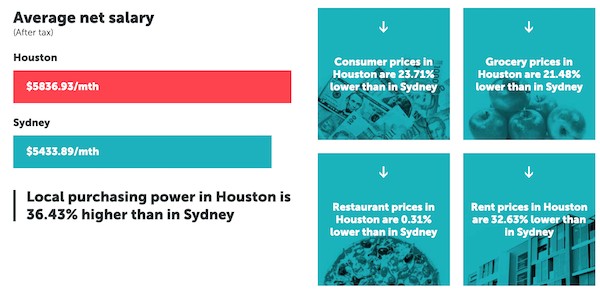

If you look at Houston, it’s arguably got a similar deal to Sydney. It has a population of about five million in the urban area, and salaries are pretty line-ball. However, Houston housing is significantly cheaper to buy - less than a quarter of the cost per square metre than Sydney.

Fuel prices in Houston are also nearly half the price they are in Sydney, even accounting for exchange rates. Buying a pair of Levi’s 501 jeans are also nearly half price compared to Sydney, and ultimately, consumer prices are 23% lower in Houston than in Sydney.

However, if you moved to Houston you’d have to deal with antics like this:

To sum it up, we’ll leave it to Mr Marsh.

“It can be argued though that the quality of life in Australia is higher than that of some international destinations,” he said.

Savings.com.au’s two cents

If you’re itching to move overseas, or you think Australia is too expensive, think again. While some things certainly are - buying a home, consumer goods - the relatively high salaries might more than make up for it, although that will depend on your own situation. One surprising thing to learn is that a lot of the time, groceries are cheaper in Australia than they are in places such as London and North America. Australia is expensive, but then so are a lot of other desirable places in the world to live.

.jpg)