These “predatory” loans were taken out by around 1.77 million Aussie households and generated approximately $550 million in net profit for lenders.

Payday loans (also known as small amount credit contracts or SACCs) are high cost, fast loans of up to $2,000 for a period of 16 days to a year.

The report found one loan can quickly turn into multiple, with equivalent annual interest between 112.1% and 407.6%.

The popularity of the loans is being attributed to digital platforms: a decade ago, only 5.6% of payday loans originated online.

By the end of 2019, that figure is predicted to hit almost 86%.

Meanwhile, the number of women using payday loans has risen from 177,000 in 2016 to 287,000 in 2019, with 41% of them single mothers.

The report was released today by the ‘Stop the Debt Trap Alliance’, a coalition of over 20 consumer advocate bodies.

Consumer Action CEO and Alliance spokesperson Gerard Brody said the research was commissioned to investigate the real harm of payday loans.

“The harm caused by payday loans is very real, and this newest data shows that more Australian households risk falling into a debt spiral,” Mr Brody said.

“Meanwhile, predatory payday lenders are profiting from vulnerable Australians to the tune of an estimated $550 million in net profit over the past three years alone.”

"These loans are toxic ... it becomes a debt trap."

— News Breakfast (@BreakfastNews) November 11, 2019

Have you ever taken out a payday loan?

They could be doing you more harm than good, says @gerardbrody pic.twitter.com/GfKk4Swnih

Consumer groups call for reforms

It’s been over four years since then Assistant Treasurer Josh Frydenberg initiated the SACC review and the government accepted the recommendations of said review three years ago.

The Alliance wants these recommendations passed into law before Parliament finishes sitting for the year.

“Prime Minister Scott Morrison and Treasurer Josh Frydenberg are acting all tough when it comes to big banks and financial institutions, following the Financial Services Royal Commission,” Mr Brody said.

“Why are they letting payday lenders escape legislative reform, when there is broad consensus across the community that stronger consumer protections are needed?

“The consultation period for this legislation has concluded. Now it’s time for the Federal Government to do their part to protect Australians from financial harm and introduce these changes to Parliament as a matter of urgency.”

In a statement made in September, Assistant Treasurer Michael Sukkar said the government was progressing changes.

“We recognise the need for reform in these areas and that reforms must strike the right balance in enhancing consumer protection, while also ensuring these products and services can continue to fulfil an important role in the economy,” Mr Sukkar said.

What makes payday loans so dangerous?

Payday loans cannot exceed $2,000 and have a maximum fee of 20% when you take out the loan, as well as a 4% monthly fee.

When you compare their fees to credit cards and bank loans, you’re paying over $170 more in fees with a payday loan in just a three month period.

| Payday Loan | Credit Card | Bank | |

| Sum borrowed | $600 | $600 | $600 |

| Length of loan | 3 months | 3 months | 3 months |

| Total fees and equivalent interest charges | $192 | $19.07 | $13.04 |

Note: Payday loan cost charged at the statutory cap; credit card cost charged at 18.97% APR (average platinum card rate); bank loan cost charged at 12.99% APR (typical bank rate).

The report revealed that payday lenders typically target more vulnerable households, assisted by the ease of access to digital platforms.

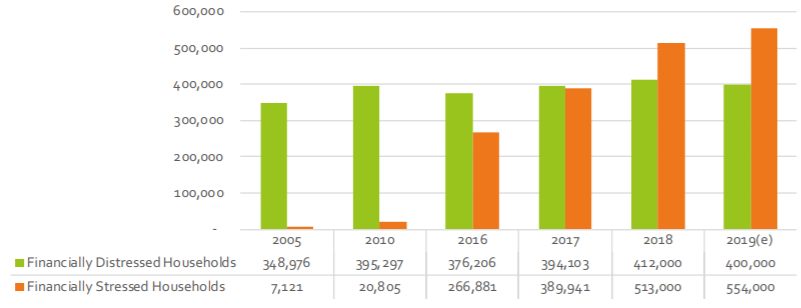

In the analysis, financially stressed households are defined as those that are generally ‘coping’ with their current financial situation, for example by short term borrowing from family, friends, or juggling multiple credit cards.

Financially distressed households are defined as those not meeting their financial commitments as they fall due, exhibiting chronic repeat behaviour, and are more likely to receive social security.

From 2016 to 2019, the number of financially stressed and distressed Australian households with payday loans rose to 310,913.

The growth was cited as particularly concerning as these people are persuaded to take out high-cost loans to meet an immediate need, which inevitably leaves people stuck in a debt trap.

Number of households with payday loans

Source: Consumer Action

Which state has the most payday loans?

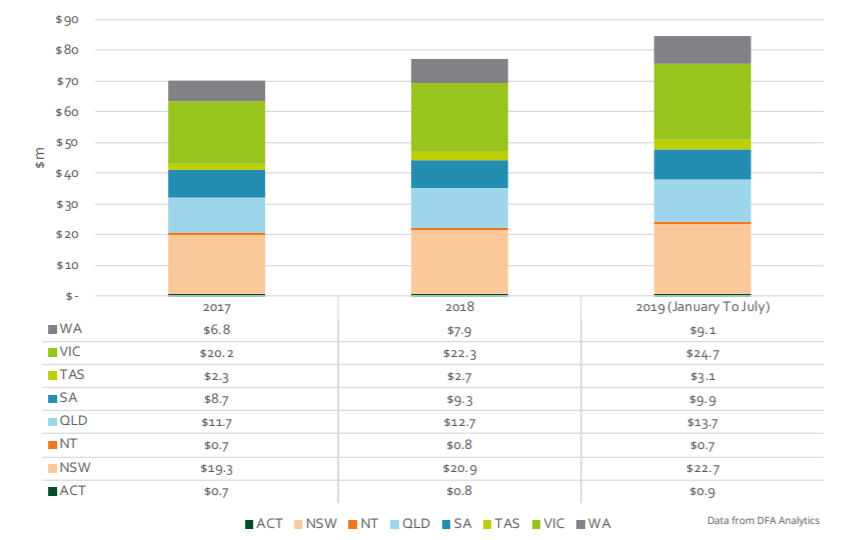

The report found Victorians are leading the country in the net growth of households using payday loans as well as the value of loans being written.

Each month sees $24.7 million worth of loans written in Victoria, followed by New South Wales at $22.7 million.

Of the 509,000 households that used payday loans between 2016 and 2019, approximately:

- 148,000 came from Victoria,

- 136,500 from New South Wales,

- 82,500 from Queensland,

- 54,500 from Western Australia.

Payday loans are also rapidly growing in Western Australia and Tasmania, with these households showing the highest growth rates at 13.5% and 15.5% respectively from January to July of this year.

Average value of new payday loans per month by state ($m)

Source: Consumer Action

Denise Raward

Denise Raward

Aaron Bell

Aaron Bell