In a series of responses to questions from MPs on Wednesday about the effect of rate cuts on households, Australia’s central bank disputed the claim that many older Australians rely on income solely derived from interest.

“There are certainly people for whom interest income is a significant fraction of their income, but in the older age group category the bulk of income comes from pensions, superannuation fund income, dividends and, increasingly, increased participation in the labour market,” the RBA said.

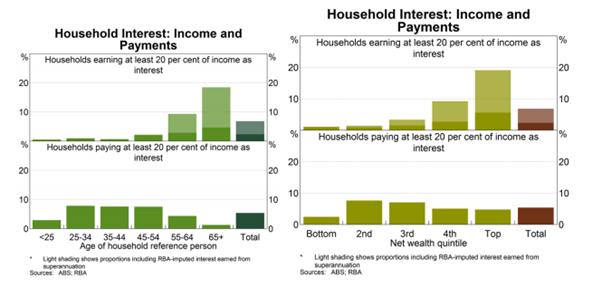

Quoting data, seen in graphs below, the RBA reported that only “a very small share of households earns more than 20% of household income as interest”.

While for direct interest earnings, such as bank accounts, they found the share was “in the low single digits for most age cohorts”.

The RBA also pointed to the fact that “the majority of households earning at least 20% of their income as interest are in the most wealthy and second-most wealthy quintiles of households”.

Source: RBA

The 17-page statement also discussed the possible unconventional monetary measures the bank could take if the economy were to drastically underperform, outside what they have assessed.

Measures such as “very low and even negative policy interest rates” could be considered if required, but remained “unlikely”.

However, the RBA estimated that lowering the cash rate by 100 basis points could lift GDP growth by 0.5% – 0.75% higher than it would be otherwise over the next two years.

The bank was also forced to defend its recent backflip on its economic outlook last year, after saying interest rates would most likely go up, then saying they would remain stable.

“In sum, as the evidence has come in, as is always the case, we have reassessed our view of the path that the economy was on, and adjusted monetary policy in line with that reassessment.

“The Bank seeks to be as transparent as possible regarding how it views the economic outlook, recognising that often things turn out different from what was expected.”

Effect of low-interest rates differs between households

The RBA said it believes lower interest rates and a stronger economy benefit the community as a whole, but the effects on individuals may differ.

“Those with a variable rate mortgage benefit from lower required mortgage repayments when banks reduce their standard variable rates.”

The bank said some households will maintain their current repayments and reduce the amount of time they pay their mortgage.

Others will reduce their payments, with banks more willing to accommodate good borrowers as a result of online communications making it easy to communicate with lenders.

Additionally, the RBA said households benefit from the flexibility of features like offset accounts, which can enable households to change their spending patterns where necessary.

The bank emphasised there are many different factors which affect mortgage holders and non-holders alike.

“A comparison of the ‘comparable stimulatory impact of reduced interest rates on Australians with and without a mortgage’ depends on their personal circumstances, such as employment status, asset holdings and other debt.

“For example, a mortgage holder will benefit from lower interest rates through higher cash flow, among other channels. The non-mortgage holder may benefit from higher asset values, and/or a stronger labour market.”

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

Aaron Bell

Aaron Bell