While consumer goods have increased in price and our wage growth has slowed, we're still doing better than 20 years ago when it comes to our purchasing power, according to a Productivity Commission report released today.

In the year 2000 it took 13.9 hours of work for the average Aussie to afford a week's rent for a 3-bedroom house - in 2019 it took 11.8.

This is despite housing rental costs rising in real dollar terms over that period.

Other consumer items to become significantly cheaper over the last two decades included bicycles, antibiotics, break and milk:

- In 2000, to buy a bicycle you had to work 17.8 hours - in 2019 just 7.5. In 1901 a bicycle took over a month's work (527.4 hours) to pay for.

- A 'game of football' in 2000 took 1.2 hours to pay for - the same as today.

- 1kg of rump steak in 2000 took 41.8 minutes to buy - in 2019 just 38.

- Startlingly, it took 18 minutes to buy antibiotics in 2000, and only 8.6 in 2019.

- Bread: 7.7 in 2000, now 5.5, and milk 4.7 - now just 2.2 minutes worked.

Source: Productivity Commission Productivity Insights 2020

Aussie smokers however are required to work a lot longer to earn their smokes, with a single pack of cigarettes in 2019 costing 92.5 minutes' work - up from just 37.4 minutes in 2000, invariably due to government excise increases.

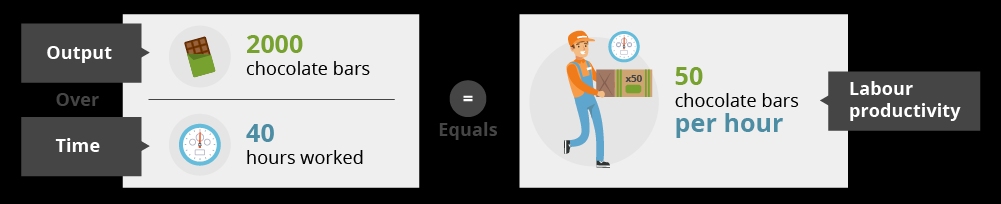

The positive purchasing power data is despite Australia experiencing a productivity slump, with both labour productivity (output per worker) and multifactor productivity (output per combination of inputs such as labour and machinery) in the market sector falling over 2018-19 - the first fall since the peak of the mining boom.

Labor productivity fell by 0.2% while multifactor productivity fell 0.4%.

"During the mining boom, much of the benefit of a higher exchange rate was, desirably, passed through to workers as higher purchasing power," the report outlined.

"But as the commodity price boom has dissipated and the exchange rate has fallen, much of the effect has similarly passed through to consumers as slower growth in the purchasing power of their wages."

What does productivity mean for wages?

The fall in productivity doesn't bode well for wages growth.

According to the Productivity Commission, about half of the slowdown in wages growth in recent years has been driven by labour productivity decline.

Meanwhile, about a fifth of the wages slowdown can be attributed to a continued decline in the labour share of income since 2000.

This has been mainly attributed to the labour share of income being reallocated to the mining sector, and increased profitability in the finance sector.

However, that's all come to a slowdown, as investment in mining has fallen since 2012-13, with productivity generally having a direct relationship with wage growth.

Australia is slowing in productivity like other developed nations, such as the US and UK, despite still riding the waves of the mining boom.

"It is possible that labour productivity will continue growing at historically slower rates indefinitely and that the labour share of income may fall again in the future," the report noted.

The Productivity Commission also revealed economic growth had been driven by labour, rather than business investment.

This is despite the Reserve Bank cutting interest rates to historic lows, theoretically making the cost of doing business more attractive.

Productivity explained. Source: Productivity Commission

Biggest industry winners and losers

The Productivity Commission revealed the biggest fall in productivity by sector was experienced by the drought-affected agricultural sector.

That sector was down 10.1% in productivity, and contributed 29% to the overall slowdown.

Just six of the 16 market sector industries experienced an increase in productivity.

The biggest winner was the arts and recreation sector, up 4.9% in productivity.

However, the mining sector is still the biggest winner when it comes to GVA (gross value added) - in 2018-19 it grew 6.1% largely due to gas extraction and its export as LNG (liquefied natural gas).

In non-market sectors (public administration and safety, education and training, and health care and social assistance), the biggest loser was public administration and safety.

That sector lost 8.3% in productivity, yet experienced an increase of 11.6% in hours worked.

Source: Giphy

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)