With “nearly half” of Australians having worked from home this year, TaxFox said working-from-home expenses are at risk of going unclaimed in 2019/20 tax returns, adding to the $10 billion of unclaimed expenses seen in a normal year.

The tax deductions app found Australians were claiming an average of $2,576 in deductions each tax season, with an expected rise in this year’s tax deductions because of COVID-19.

The $2,576 average pales in comparison to some of the highest-claiming professions - surgeons took out top spot at $17,729 claimed, while the average anaesthetist claims $16,678.

TaxFox’s calculations are based off Australian Bureau of Statistics' figures, and use the Australian Tax Office’s 80c/hour streamlined claims method, which might not be the best way to claim, depending on your circumstances.

The top ten tax claiming professions

Rounding out the top ten were professions largely in the medical field, which are usually required to have indemnity insurance policies, which are tax deductible and can amount to thousands over a financial year.

- Surgeon: $17,729

- Anaesthetist: $16,678

- Internal medicine specialist: $15,155

- Other medical practitioners: $13,401

- Legislator: $12,821

- Psychiatrist: $11,483

- General medical practitioner: $9,101

- Air transport professionals: $8,660

- Land economist or valuer: $8,625

- Dental practitioner: $8,551

TaxFox co-founder and CEO Maz Zaman said it was important people claiming work-from-home expenses claim all they can.

“There's a lot of different, and some less obvious, expenses in these new working conditions that Australians can claim on,” he said.

“However, to claim on a lot of these deductions, accurate records and logs are required by the ATO, which many people will not have on file.”

What is TaxFox?

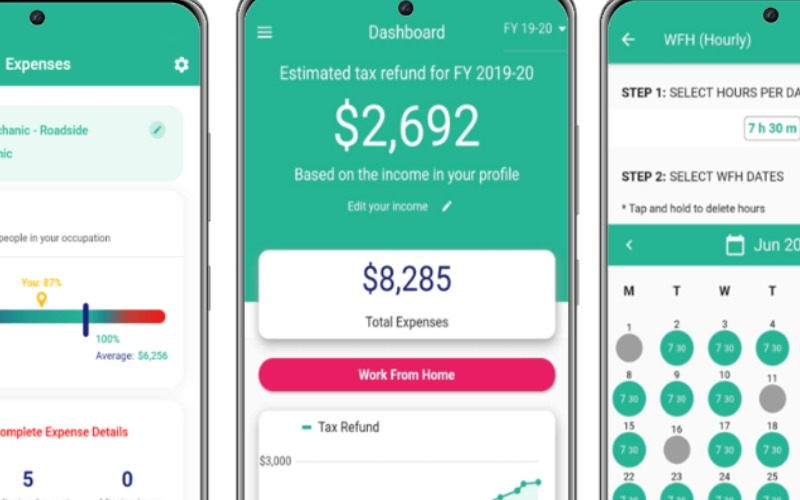

TaxFox describes itself as a 'personal ATO tax refund maximiser app', which helps users claim every eligible tax deduction. The TaxFox app is available on both iOS and Android, downloadable for free.

Founded in 2019, and officially launched in July 2020, TaxFox says it differs from other apps because it offers a benchmarking and insights dashboard to see how your claim stacks up to others in your industry. The app uses historical taxpayer claims data and machine learning to find more tax deduction opportunities, tailored insights, and to warn users of potential audits if they are claiming more than the average.

The app is also said to be developing automatic categorisation of receipts and smart links for bank account transactions, matching transactions and receipts. This is said to speed up the claims process, telling users if what they’re claiming is deductible or not.

Speaking of deductions, TaxFox says there’s a lot of extra things that users might not know they can claim when working from home. Lesser-known items could include plants, anti-glare reading glasses, and home office consumables such as printer ink.

How much does TaxFox cost?

While the base platform is free, allowing up to 12 receipts claimed per financial year, the premium plans start at an annual fee of $47.99, working out to be about $4 a month.

It’s important to note that tax expenses are also tax deductible for the next financial year, which usually includes claiming apps.

TaxFox benefits and features

TaxFox has highlighted some of its key features and benefits:

-

Maximise your ATO tax refund: Get smart tax tips to see what expenses you can and can’t claim for your job

-

See the average deduction claimed for your job: Compare your tax deductions vs the average in your occupation

-

Log work from home hours and expenses: Claim all your your work from home expenses and hours you worked from home

-

Snap & Store your receipts: Save all your receipts safely on the cloud for tax time and never miss out on a deduction

-

Track and grow your tax refund: See your tax refund estimate in real-time as you add new deductions

-

Be 100% organised to get your tax refund early: Easily export all your receipts and summary to make tax time a breeze and be well prepared in case of ATO audits

TaxFox for accountants

Aside from its consumer app, TaxFox also offers its own ‘Accountant’s Portal'. It’s a web-based portal to assist accountants to digitally send and receive tax information to clients and streamline workflow with different bookkeeping software. It also allows accountants to send push notifications to clients via the app for information requests and to keep audit trails.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)