Many people toy with the idea of taking control of their own superannuation and investing it how they see fit. But in weighing up whether to keep your retirement savings in a retail or industry fund or take the step of setting up a self-managed super fund (SMSF), it pays to understand what's involved before choosing.

What is an SMSF?

A self-managed super fund (SMSF) is a superannuation fund you run yourself with up to six members who must all be trustees. The fund must be set up according to a specific legal structure regulated by the Australian Taxation Office (ATO) and subject to superannuation laws.

In simple terms, it means that you are responsible for managing the fund and making sure it complies. But it also means you have more control over your retirement funds, including where and how they are invested.

What is a retail super fund?

Retail funds are super funds managed by financial institutions such as banks or investment companies. While they must also comply with superannuation laws, retail super funds have the competing aim of generating the best returns for their shareholders which may mean their members' interests may not always be the number one priority.

Generally, retail super funds may levy higher fees than other types of funds although many also offer low-fee options. The funds tend to have a wide range of investments and membership is open to everyone. Some of the largest retail super funds in Australia include AMP Super, BT Super, and MLC Super Fund. Many are affiliated with the major banks.

What is an industry super fund?

Industry funds started out to service specific industries, with many being set up by trade unions to manage the retirements savings of their members, although most are now open to anyone. These are not-for-profit funds with the returns reinvested back into the funds themselves.

Industry super funds claim this allows them to levy lower fees and generate higher investment returns. Some of the largest industry super funds include AustralianSuper, Australian Retirement Trust, and Commonwealth Super Corporation.

Other types of super funds

-

MySuper: MySuper is an Australian government product for employees invested in the default option of their own superannuation funds. It aims to provide a simple, low-cost, balanced investment product with a standard level of life and disability insurance. From 1 July 2017, all superannuation accounts in default investment options were required to be invested in MySuper products. Similarly, for people who don't nominate a superannuation fund, their employer will likely pay their super contributions into a MySuper product.

-

Corporate funds: Corporate funds are arranged by the employer for the benefit of their employees but can sometimes be extended to family members and ex-employees. Corporate super funds tend to be relatively low fee and may offer perks and bonuses not offered by other super funds as an employee retention tool or a way to attract talent. Employees are not obliged to be a member of their employer's superannuation fund. Corporate funds will generally return all profits to their members.

-

Public sector funds: Public sector funds cater for government employees. They usually have a modest range of investment options and generally have low fees with some offering MySuper products. Profits generated are returned to the fund.

Market share of superannuation funds in Australia

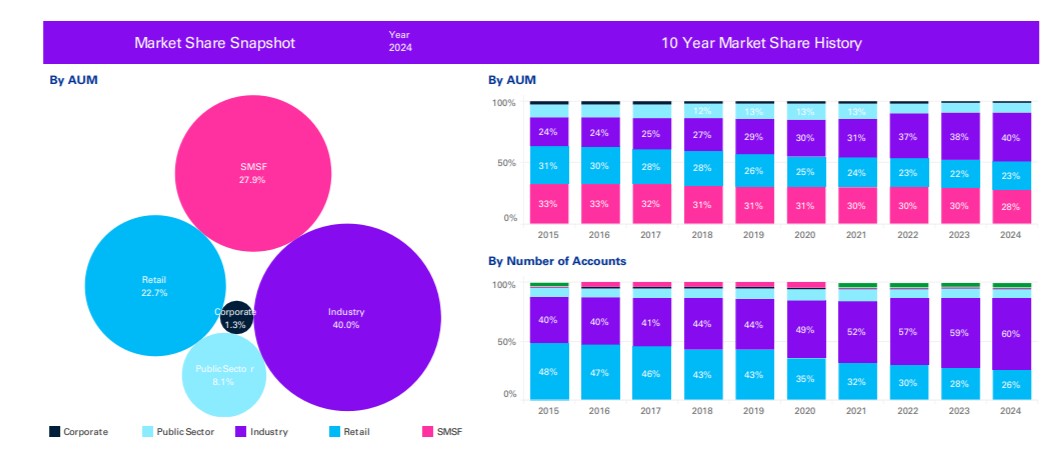

Over recent years, industry super funds have grown their market share of superannuation assets under management to 40% and 60% by number of accounts (as at FY 2024).

Retail super funds account for around 23% of all superannuation assets under management and 26% of total super accounts. Their portion of the overall superannuation pie has diminished over recent years by both measures.

Self-managed superannuation funds hold around 28% of superannuation assets - also down over the past decade - while SMSFs accounts for less than 2% of total super accounts.

Public sector funds hold around 8% of assets and around 13% of all accounts while corporate funds manage around 1.3% of overall superannuation assets in Australia.

The graphic below illustrates market share by assets under management and number of accounts in Australia over the past decade:

Source: KPMG Super Insights 2025

How are SMSFs and APRA super funds different?

First up, SMSFs are regulated by the ATO while industry and retail super funds are regulated by the Australian Prudential Regulation Authority (APRA).

The ATO sets out the key differences between SMSFs and other super funds in a bid to ensure individuals understand what's involved in setting up and managing an SMSF.

Here is a summary:

|

SMSF |

Other super funds |

|

|---|---|---|

|

Members and trustees |

Can have a maximum of six members. All members are either individual trustees or directors of a corporate trustee of the fund. |

Generally, no limit on the number of members and fund is managed by licensed trustee/s. |

|

Responsibility |

All trustees are expected to have knowledge, time, and skills to run and manage their fund and ensure it complies with super laws. Trustees can be fined for breaching the law. |

Compliance risk is borne by the professional licensed trustee with no risk to members. |

|

Investment |

Trustees develop and implement the fund's investment strategy and make all investment decisions in compliance with super laws. |

Members generally can't choose the specific assets the fund will be invested in, but control their risk level and basic asset mix their super will be invested in. |

|

Insurance |

Trustees must consider whether to purchase insurance. Insurance premiums may be higher than in other super funds. |

Most offer insurance cover to members as an option. Can cost less as large funds can secure discounted premiums. |

|

Regulation |

Regulated by the ATO, trustees are required to engage with the tax office to manage their fund. |

Regulated by the Australian Prudential Regulation Authority (APRA), members don't have to engage with APRA as they are not responsible for managing the fund. |

|

Complaints/disputes |

The ATO does not get involved in disputes among SMSF members. Disagreements can be resolved through alternative dispute resolution or in court, at the members' own expense. |

Members have access to the Australian Financial Complaints Authority (AFCA) and may be eligible for statutory compensation. |

|

Fraudulent conduct or theft |

No government financial assistance is available. Members may have legal options under Corporations Law if there's been a loss due to misconduct or bad advice but there's no guarantee compensation will be awarded. |

Members may be eligible for government financial assistance in the event of fraud or theft. |

Source: The Australian Taxation Office (ATO)

To summarise, SMSFs come with a much higher degree of personal responsibility, requiring members to have the knowledge, time, and skills to run and manage their fund. But this is coupled with a higher degree of freedom in investment decisions and management.

What gives better returns: SMSFs or APRA-regulated funds?

This question ultimately comes down to individual funds and time periods - and then, of course, there's the old addendum that past returns are no guarantee of future returns.

While the ATO provides data on income and tax for both SMSFs and APRA-regulated funds, direct comparisons can be difficult because of differences in fund structures, investment strategies, the demographics of members, and how data is collected.

For the past several years, the University of Adelaide's International Centre for Financial Services has been commissioned by the SMSF Association to compare the performance of SMSFs against APRA-regulated funds.

Its data does not include all SMSFs (its most recent research considers 69% of all SMSFs) and the study finds there can be considerable statistical differences between large and small funds.

Here is a summary of the latest research, published in February 2025, for the five-year period ending 30 June 2023:

-

In the 2022-23 financial year, the rate of return (ROR) of APRA funds was 8.4% compared to 6.6% for the SMSF data (provided by a private SMSF software and compliance company in Australia).

-

Over the previous five-year period (1 July 2018-20 June 2023), the annualised ROR was 6.5% for the SMSFs included in the study and 5.3% for APRA funds.

-

The study, carried out over four years, has found annual performance interchanges between the two sectors.

-

One factor explaining the potential underperformance of SMSFs in 2022/23 compared to APRA funds was the SMSF's underweight position in international shares with SMSFs generally more heavily weighted to Australian shares.

-

Large SMSFs tended to outperform smaller SMSFs (7.0% median compared to just 0.4% median for smaller funds).

-

Advised SMSFs tend to outperform non-advised SMSFs (7.6% versus 6.4% for the 2022/23 financial year).

Industry vs retail super funds?

Then there is the question of which type of APRA-regulated fund to invest your money in. Again, this depends on individual funds but generally speaking, the returns of industry funds have led retail funds over many years.

In 2018, a Productivity Commission investigation found retail funds had consistently underperformed industry funds, at the same time levying higher fees on their members. Its report triggered reforms in the superannuation sector, aimed at increasing competition and transparency, and making it easier for members to switch funds.

Since that time, industry funds have grown in both funds under management and number of accounts, largely at the expense of retail super funds.

SMSF vs super funds: Fees

While much of the focus of superannuation is on returns, fees are another important part of the equation. All superannuation funds charge fees and, again, these can be difficult to compare given they rely on a fund's size, structure, investment options, and complexity.

Here is a general guide to fees, expressed as a percentage of funds under management:

-

SMSFs - around 0.65% (Note: this figure can increase significantly for smaller fund balances due to fixed expenses.)

-

MySuper Funds - around 1.00%

-

Industry Super Funds - around 0.75-1.00%

-

Retail Super Funds - around 1.00%-1.50%

What should you use: SMSF or an APRA super fund?

Financial services regulator ASIC had once warned SMSF investors with balances below $500,000 - and limited prospect of increasing them - to be aware of the potential downsides to having an SMSF.

ASIC identified lower-balance funds produced lower returns on average after expenses and tax compared to industry and retail super funds.

But in recent years, that $500,000 benchmark is perhaps less rigid. ASIC's tips to those giving SMSF advice suggest there are other factors that need to be considered including:

-

set-up and compliance costs

-

investment strategies

-

diversification

-

liquidity

-

asset choice

-

trustee responsibility and time commitment

-

potential benefits of professional advice

A University of Adelaide study carried out in 2022 suggested there were no major differences in investment performance patterns for SMSFs with balances between $200,000 and $500,000 compared with APRA funds. However, performance fell away for SMSF balances below $200,000.

Macquarie Bank also suggests SMSFs with a high account balance are more cost-efficient than traditional super accounts of the same value - although the cost of personal time in managing them also needs to be considered.

How to compare super funds

In comparing super funds, the federal government's Moneysmart site recommends using:

-

the ATO's YourSuper comparison tool (bearing in mind, it only compares the government's MySuper products)

-

reading product disclosure statements (PDSs) for each product offered by a fund

-

superannuation comparison websites provided by private companies (bearing in mind, these may not cover all options, and any ratings may be affected by commercial considerations)

Savings.com.au's two cents

At the end of the day, the choice between an SMSF, an industry super fund, and a retail super fund depends on individual circumstances and preferences. Investment knowledge, financial goals, and confidence in managing your own retirement savings should be major factors in any decision.

In general, SMSFs can be better suited to those who:

-

Have a higher fund balance

-

Have higher than average financial literacy

-

Have time they can dedicate to fund management

-

Understand the legal obligations and risks associated with running their own fund

Conversely, an APRA-regulated fund may be better for those who:

-

Have a low to medium superannuation balance

-

Have lower levels of financial literacy

-

Aren't willing to put in the time or money to run an SMSF

-

Aren't prepared to take on the legal risks of managing their own fund

In short, if you're after a hands-off approach to investing your retirement savings that is often cheaper and still has the potential to provide high returns, you're likely better off with an industry super fund. When comparing funds, be sure to consider both past returns and fees, as well as the different investment options, insurances, and any other services the fund may offer.

First published on October 2020

Photo by Aaron Burden on Unsplash