Term deposits and savings accounts are widely considered to be the safest places to park your cash. There is virtually no chance of you losing money with them – or so you might think. While you might not actively lose money with them like you can with shares or property, the combined effects of inflation and tax can actually make the interest earned on your account redundant.

Looking for a good term deposit? The table below displays some of the highest term deposit interest rates available for a 6-month term.

What is inflation?

Inflation is broadly defined as “the general increase in price and a fall in the purchasing power of money”. It’s a natural thing that occurs in growing economies, as more and more people buying things increases the prices of goods and services. Your parents or grandparents might have been able to buy a loaf of bread for a few cents, whereas today one loaf easily costs $2 or more. That’s inflation in action.

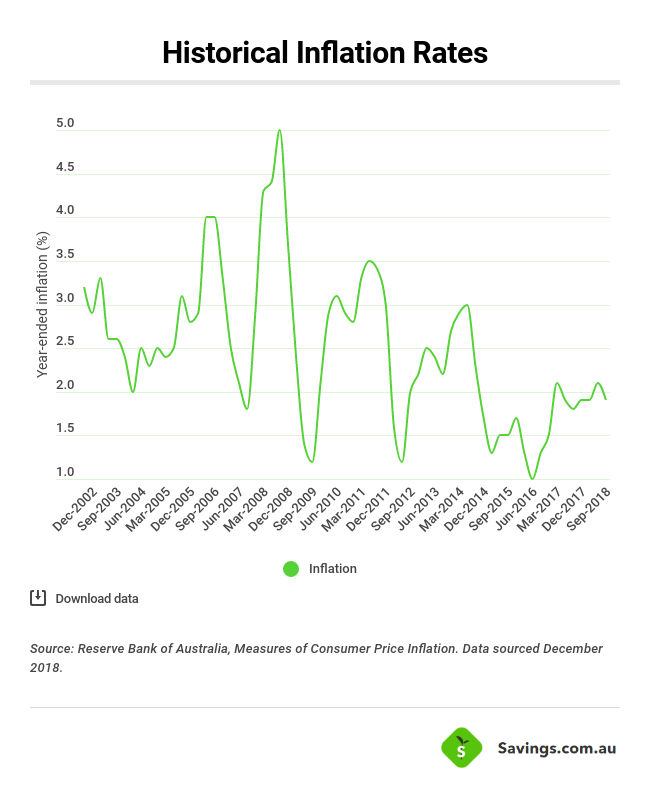

Inflation is dependant on several key economic factors, such as wage growth, consumer confidence, an increase in supply and so on. Central banks such as the RBA (Reserve Bank of Australia) or the US Federal Reserve often have inflation targets that they believe are conducive to a healthy economy. The RBA’s target is for an annual inflation rate in Australia of 2-3%. As at the September 2018 quarter, inflation is sitting just outside this target band at 1.9%. See how this rate has moved since September 2002 in the graph below.

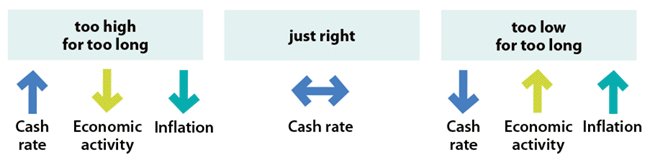

Both high and low inflation can be harmful since either can impede on a country’s economic activity and business conditions, which, in turn, hurts the job market. To help keep inflation within its targets, the RBA can adjust the official cash rate. In theory, raising the cash rate lowers the inflation rate while lowering the cash rate increases it.

Source: Reserve Bank of Australia.

Inflation also influences investment decisions, because a higher rate of inflation can seriously reduce earnings on investments.

How does inflation affect term deposits?

Term deposits and savings accounts both earn interest on the money deposited in different ways. With a term deposit, you’re paid interest at maturity (the end of your term) or in different instalments depending on how long your deposit is, while savings accounts tend to pay interest monthly and allow for compounding.

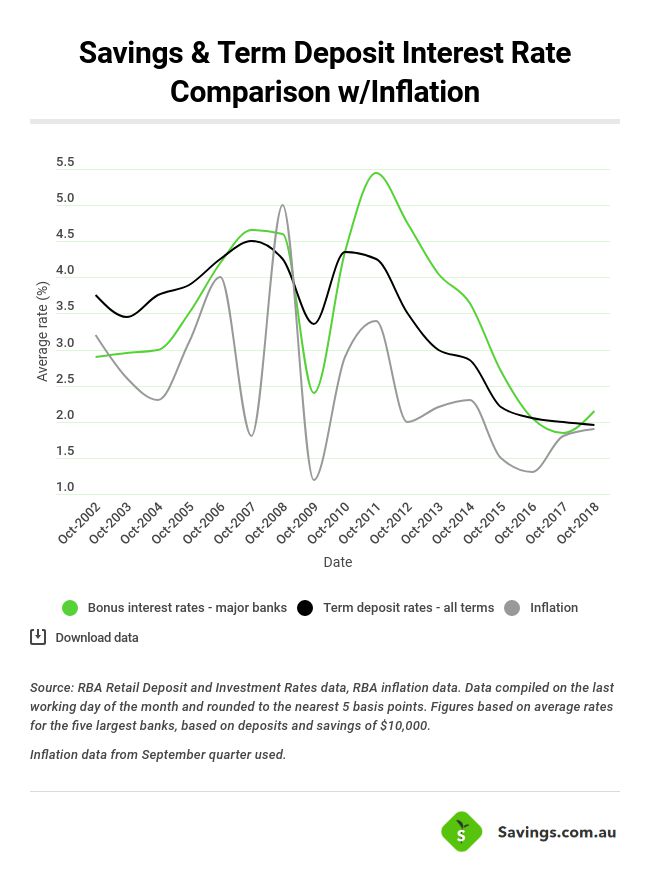

The infographic below shows the average interest rates on offer from Australia’s five biggest banks for both savings accounts and term deposits.

Real rate of return

Let’s say you had a one-year term deposit paying 2.00% p.a. – about the average rate you’d get from a big bank. By investing $10,000 with interest paid at maturity, you’d earn $200 in interest. Not bad, but when you factor in inflation you’ll probably be disappointed.

After annual inflation of 1.9%, that 2.00% p.a. interest rate is worth just 0.10% p.a. This is known as your real rate of return – the initial interest rate minus the inflation rate. So after taking inflation into account, that $200 in interest would actually be worth just $10 in real terms. Unlucky.

According to the RBA’s Retail Deposit and Investment Rates data, the average term deposit interest rates from Australia’s five largest banks in September 2020 were:

- One month: 0.15% p.a.

- Three months: 0.55% p.a.

- Six months: 0.60% p.a.

- One year: 0.75% p.a.

- Three years: 0.95% p.a.

Of course, these rates aren’t the highest you can get, but pickings are pretty slim. As at October 2020, you can get an interest rate as high as 1.55% p.a on a three-year term deposit, which would give you a real return of 0.85% p.a. assuming inflation stays the same. But using the average figures of the big five banks, inflation doesn’t leave you with much left, assuming the September 2020 quarter’s year-ended inflation figure of 0.7%:

| Average interest rate (term deposits) | Inflation | Real rate of return |

|---|---|---|

| One month: 0.15% p.a. | 0.7% | -0.55% p.a. |

| Three months: 0.55% p.a. | 0.7% | -0.15% p.a. |

| Six months: 0.60% p.a. | 0.7% | 0.10% p.a. |

| One year: 0.75% p.a | 0.7% | 0.05% p.a. |

| Three years: 0.95% p.a | 0.7% | 0.20% p.a. |

So if you invested $10,000 in a one-year term deposit at the average rate of 0.75% p.a, you’d only end up with $5 in interest at maturity in real terms after factoring in inflation. And that’s before we even take tax into account.

Tax on interest earned

Don’t forget, you generally have to declare investment income in your tax return, which includes interest earned on savings accounts and term deposits. This interest is taxed at your marginal rate. If you weren’t already familiar, the current residential tax rates for 2020–21 (excluding the Medicare levy) are:

| Taxable income | Tax on this income |

|---|---|

| 0 – $18,200 | Nil |

| $18,201 – $37,000 | 19c for each $1 over $18,200 |

| $37,001 – $90,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $90,001 – $180,000 | $20,797 plus 37c for each $1 over $90,000 |

| $180,001 and over | $54,097 plus 45c for each $1 over $180,000 |

Source: ATO

So if your income fell within the $37,001 – $90,000 tax bracket, that $735 in interest earned through the three-year 2.45% p.a. term deposit would be taxed at 32.5%, so you’d have a tax bill of around $240. This is more than your real return of $165, so, after tax and inflation, your $10,000 investment would’ve actually fallen in value by around -$75 to $9,925!

So without you even realising it, you could be making a loss.

What other investments can get you ahead of inflation and tax?

At the current rate of 0.7%, it isn’t too hard to get ahead of inflation, even with interest rates as low as they are. It’s commonly acknowledged that one of the best ways to get ahead over the medium-to-long term is to invest in a diversified portfolio of assets: shares, property, managed funds, bonds and yes, even term deposits. These investment options carry a higher degree of risk than savings accounts and term deposits but have the possibility of much higher returns.

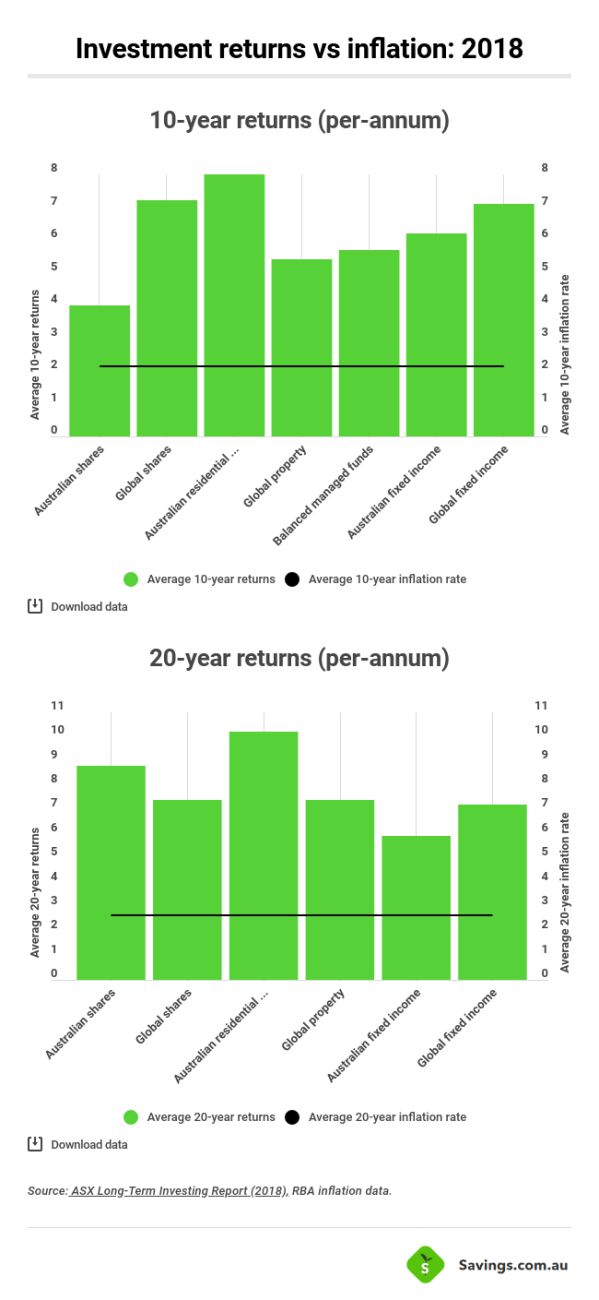

Australia’s inflation rate

According to data going back to September 2010, Australia’s average annual inflation rate over the past 10 years is 2%. Meanwhile, the ASX’s Long-Term Investing Report for 2018 shows that over the last 10 years:

- Australian shares returned 4.0% p.a.

- Global shares returned 7.2% p.a.

- Residential property returned 8.0% p.a.

- Global property returned 5.4% p.a.

- Balanced managed funds returned 5.7% p.a.

- Australian fixed income (aka bonds) returned 6.2% p.a.

- Global fixed income returned 7.1% p.a.

At the current rate of 0.7%, it isn’t too hard to get ahead of inflation, even with interest rates as low as they are.

According to data going back to September 2010, Australia’s average annual inflation rate over the past 10 years is 2%.

Over 20 years the average inflation rate is higher at 2.64%, while these investments would have given you more over this longer time period.

- Australian shares: 8.8% p.a.

- Global shares: 7.4% p.a.

- Residential property: 10.2% p.a.

- Global property: 7.4% p.a.

- Australian fixed income: 5.9% p.a

- Global fixed income: 7.2% p.a.

The infographic below should give you a visual representation of how further ahead of inflation these investments can get you.

For example, 10 years of investing in global shares would give the average person a real rate of return of more than 5% p.a. But you can earn much more than this.

If you want your money to put in work for you over the long-term, you need to accept a certain level of risk by investing in some of these options shown. Otherwise, you risk going backwards or staying stagnant thanks to our friends: inflation and the tax-man.

Savings.com.au’s two cents

Savings accounts and term deposits are ‘safe’ options. Given today’s current low interest rates, they’re better for storing money away for a rainy day and practising good savings habits than they are for giving you strong returns. After you take inflation and tax into account, you’d be hard-pressed to get more than 1.00% p.a. on your deposit in real terms. If stronger long-term returns are what you’re after, you might be better off going for a diversified portfolio of:

- Stocks & managed funds

- Property

- Bonds & fixed income

Of course, you might not be able to afford the substantial investments in things like property, but that’s okay, because you can get a good amount of diversification with the help of investment products like ETFs (exchange traded funds) which can give you exposure to a wide range of assets in one trade. Just don’t count term deposits and savings accounts out entirely – they can still be useful for meeting savings goals.

Below are some of the current Term Deposit options available in the market:

Article first published January 16, 2019. Updated December 1, 2020.

Bea Garcia

Bea Garcia

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan