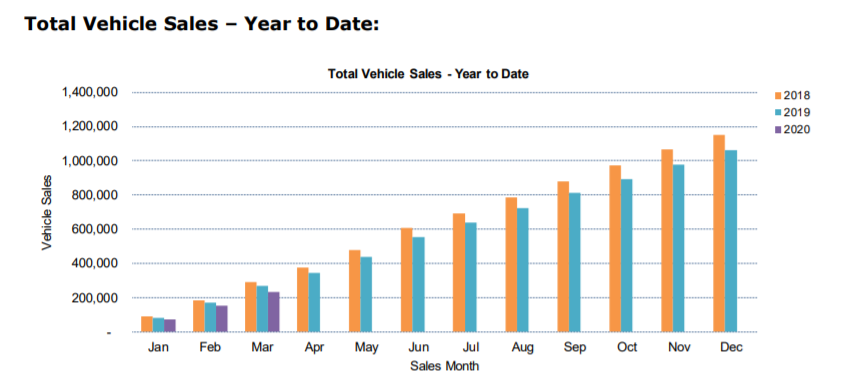

The Federal Chamber of Automotive Industries (FCAI) today reported 81,690 total new vehicles were sold in March 2020, a 17.9% decline from March 2019.

This is a huge decline compared to previous months, and represents a fall of more than 17,500 vehicles.

In the market for a new car? The table below features car loans with some of the lowest fixed and variable interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Vehicle Type | Maximum Vehicle Age | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.99% p.a. | 7.12% p.a. | $580 | Variable | New | No Max | $8 | $400 | $34,791 |

| Promoted | Disclosure | ||||||||

6.52% p.a. | 6.95% p.a. | $587 | Fixed | New, Used | No Max | $0 | $350 | $35,236 |

| Promoted | Disclosure | ||||||||

6.28% p.a. | 6.28% p.a. | $584 | Fixed | New | No Max | $0 | $0 | $35,034 |

| Promoted | Disclosure |

Throughout 2019 there was a 7.8% year-on-year fall, while November's figures saw a 9.8% decline.

The March monthly result represents the 24th consecutive month of negative growth for the automotive industry in Australia, which is now two full years of no positive growth in car sales.

Source: FCAI

FCAI attributed this month's significant decline to the difficult economic conditions created by the COVID-19 pandemic, but chief executive Tony Weber reiterated that despite the difficult conditions, a number of car dealerships remain open.

“Many dealerships have opted to remain open to maintain support for customers, particularly from a service perspective, during this difficult period," he said.

“Of particular importance are first responder and essential services vehicles. We must keep these vehicles on the road to ensure our communities continue to function and remain safe.

“In addition, we need to ensure those who physically attend their workplace can travel safely."

Mr Weber also said motor vehicles are a safe form of transport in a time of social distancing.

“Within dealerships, customer safety is of the highest priority, and automotive brands have initiated a variety of enhanced hygiene protocols and contactless consultations to maintain personal distance,” Mr Weber said.

Toyota was the best-selling brand in March, with 17,583 sales recorded.

In second place was Mazda with 6,819 sales, followed by Mitsubishi with 6,002 sales, Kia with 5,654 sales and Hyundai with 5,306 sales.

The Toyota Hilux was the most popular March vehicle, as it usually has been in previous months, followed by the Ford Ranger, Toyota RAV4, Toyota Corolla and Holden Colorado.

Sales for the month consisted of 21,777 passenger vehicles for a 26.7% market share, 39,171 SUVs (48.0%) and 18,162 light commercial vehicles (22.2%).

Used car buyers urged to exercise caution amid COVID-19 frenzy

More people are looking to buy used cars during the pandemic, according to GlobalX, as people seek to avoid places like dealerships and instead go for a more private method of car buying.

However, most second-hand car buyers fail to confirm if the vehicle they're buying is encumbered in any way (such as still having finance owing on it) through the Personal Property Securities Register (PPSR), according to the 2019 Gumtree Second Hand Economy Report.

GlobalX CEO Peter Maloney has urged buyers to secure their purchase of a second-hand car before buying.

“Sellers are often happy to provide condition reports, roadworthiness certificates or proof of registration, but it’s unlikely they would disclose whether the vehicle had a dubious history,” Mr Maloney said.

“Purchasers can conduct the necessary checks through a PPSR report to ensure the asset they are about to purchase will not cause unnecessary strife in years to come."

Meanwhile, a car-subscription service Popcar is significantly cutting down on membership fees and hourly rates to make it easier for people to rent a car rather than buy one.

"One of the serious implications for many people will be the impact on their ability to get around, as confidence in public transport diminishes due to strengthening of the Government’s social distancing measures and concerns about contagion," Popcar director Anthony Welsh said.

“We recognise we have a role to play in supporting locals and businesses in our community, by providing an affordable and safe transport option to those who do not have access to their own car, or otherwise typically rely on public transport, taxi services or ride sharing."

Popcar's changes include:

- Waiving all membership fees for new and existing customers, including business customers

- Cutting hourly and daily rates by 50%

- Charging just $1 for signups

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan