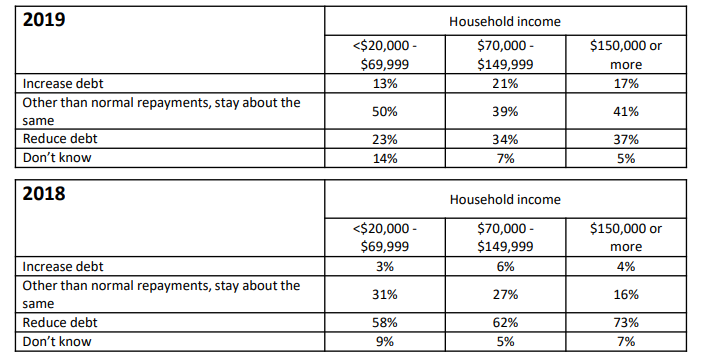

EY’s Consumer Outlook in Australia survey asked respondents whether they expected to reduce, increase or maintain their personal debt levels in 2019.

The proportion of those saying they would have to increase debt rose significantly from 4% in 2018 to 16% in 2019.

Meanwhile, the proportion of those saying they would reduce their debt has fallen from 60% in 2018 to only 28% in 2019.

Almost half (45%) expect their debt levels to remain the same in 2019, while 12% said they didn’t know.

This is an increase from 28% saying their debts would stay the same in 2018.

EY Chief Economist Jo Masters told Savings.com.au the cost of living was a major factor in these responses.

“Our survey also shows that nearly two-thirds of Australians are extremely concerned about the cost of living,” she said.

“As non-discretionary bills (the cost of essential services and increasing energy prices) take up a larger portion of household budgets, and wage growth remains weak, there’s less capacity to pay down debt.”

Other key results

Breaking the results down into different tax brackets, people on $70,000-$149,999 incomes saw the biggest rise in debt problems, with 21% of them expecting to increase their debts in 2019 compared to 6% in 2018.

73% of higher income earners ($150,000+) said they expected to reduce their debts in 2018. Now, that figure is only 37%.

Only 23% (down from 58%) of lower-income earners (<$20,000-$69,999) said the same.

Less people overall are content with their current financial situation and overall comfort.

27% of people feel they’re worse off now than 12 months prior. 17% of people said this in last year’s survey.

42% of people meanwhile say they’re extremely or very satisfied with life at the moment, which is down from 47% 10 years ago.

Ms Masters told The Australian Financial Review the Federal Government’s proposed tax cuts would be welcomed by many to help reduce debts.

“Our survey results suggest that income tax cuts will be welcome by households feeling the pinch, although there is a risk that a portion is directed to debt reduction rather than spending,” Ms Masters said.

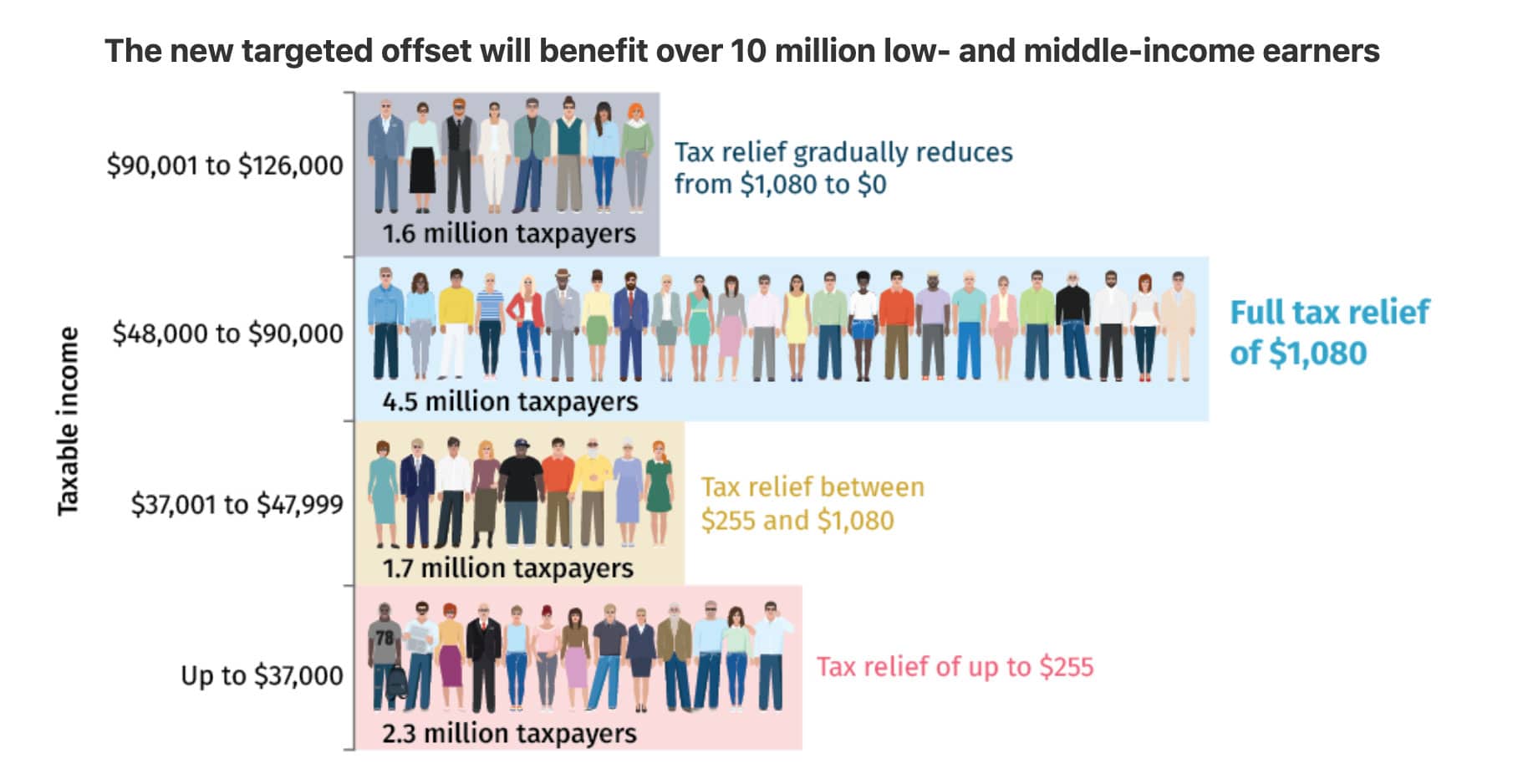

Under the proposals outlined the 2019-20 Federal Budget, tax offsets up to $1,080 per year for single income families and $2,160 per year for dual income families will be made available depending on income.

The maximum offset is available for those in the sweet spot of $48,000-$90,000 a year, while those earning between $37,001-$47,999 a year will get between $255 and $1,080.

For feedback or queries, email will.jolly@savings.com.au

Photo by Richard Boyle on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly