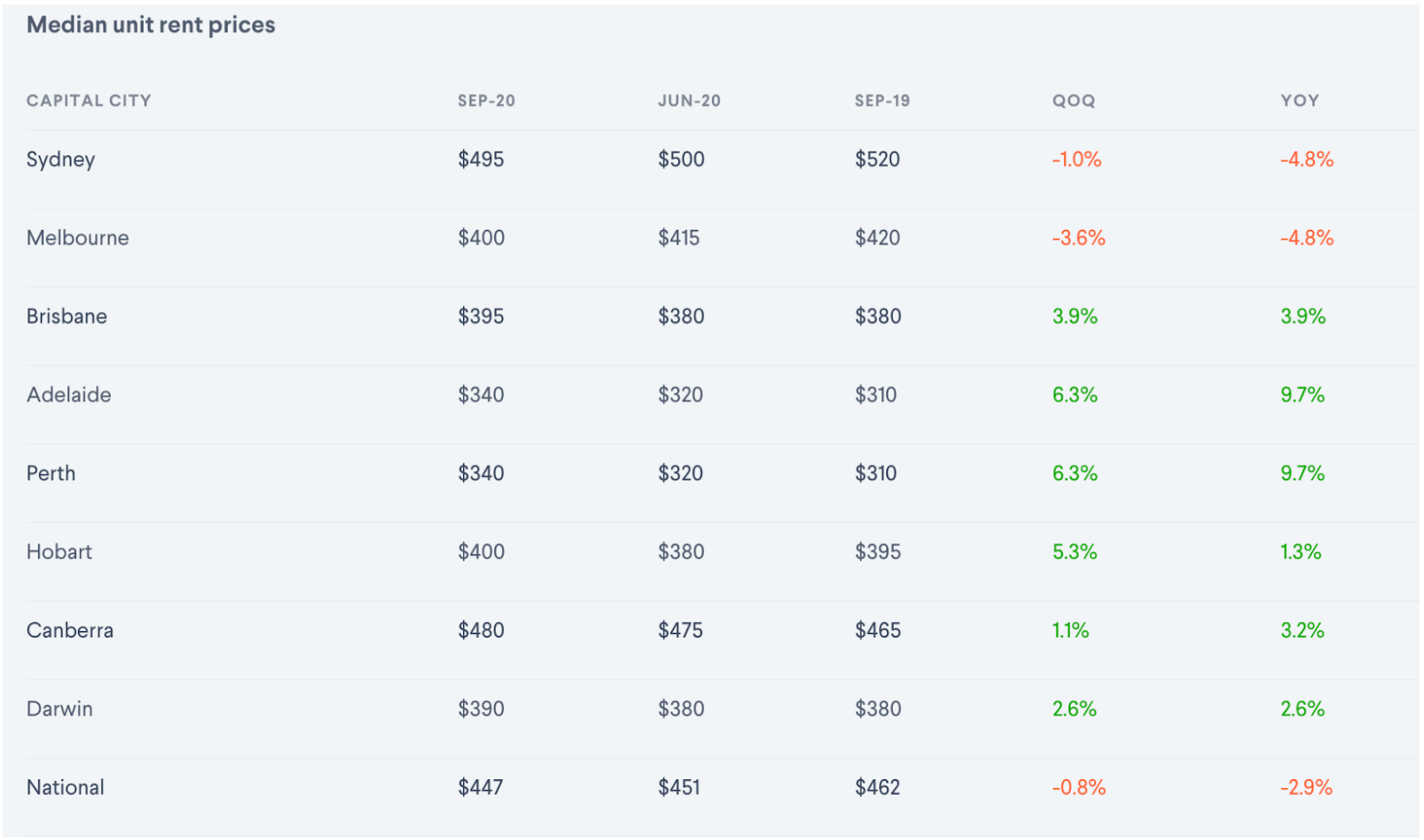

The Domain Rental Report for the September quarter (July, August, September) shows a 4.2% fall in the national apartment asking rent price since March.

This equates to a $20 a week reduction, while the annual fall represented a $15 reduction.

"This is the deepest fall over two consecutive quarters and steepest annual fall since the start of Domain’s Rent Report in 2004,” said Domain Senior Research Analyst Dr Nicola Powell.

This was driven by Sydney and Melbourne apartment rentals which were the hardest hit, with both cities experiencing the sharpest falls in two consecutive quarters ever recorded by Domain.

Sydney apartment rent prices plunged by 4.8% since March, shaving $25 off the weekly median rent, while Melbourne apartment prices fell 3.6% over the September quarter to a new median of $400.

Buying an investment property or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for investors.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Apartment rents in other capital cities all increased over the quarter.

- Brisbane rents went up by 3.9% ($395 median rent)

- Adelaide rents went up by 9.7% ($340 median rent)

- Perth rents went up by 9.7% ($340 median rent)

- Hobart rents went up by 1.3% ($400 median rent)

- Darwin rents went up by 2.6% ($390 median rent)

- Canberra rents went up by 3.2% ($480 median rent)

Source: Domain

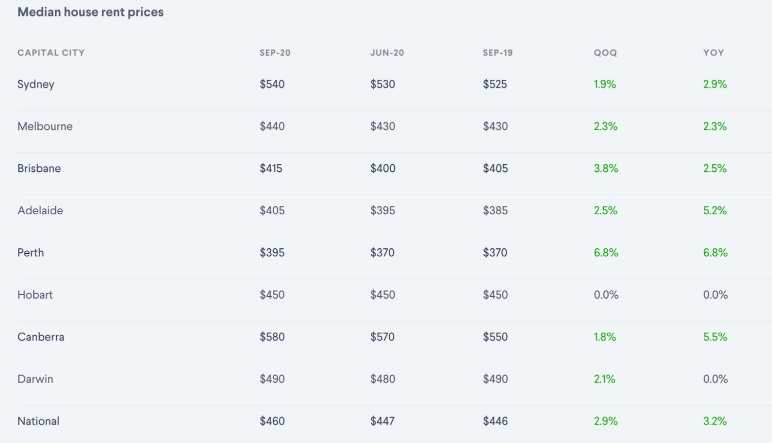

House rents increase 2.9% in September quarter

House rent prices fared quite differently from apartment rent prices in the September quarter, posting a 2.9% rise.

Median weekly house rents in Sydney ($540 per week), Melbourne ($440 per week), Brisbane ($415 per week) Adelaide ($405 per week), Perth ($ 395 per week), Canberra ($580 per week) and Darwin ($490 per week) all increased, but Hobart saw no change at all.

Annually, national house rents have risen by 3.2%, with Perth seeing a large 6.8% increase.

Source: Domain

Ms Powell said fragmented conditions in the rental market remain evident in the September quarter, with apartment rents plunging compared with houses.

"This is particularly so in inner-city areas which are more susceptible to changes in overseas migration and international students, tourism and job losses associated with COVID-19," Ms Powell said.

"Nationally, house rents have regained all of last quarter’s fall.

"Overall, while inner city dwellings may be in less demand, outer regions are performing better as more Aussies cast their eye to these locations."

Read: Now that it's a renters market, should you take advantage and find a new rental?

Sydney rent falls

According to Domain, tenants in inner-city areas have benefited from greater falls in asking rents and are better placed to negotiate lower rents than those in outer suburbs.

“Sydney rental prices have been swiftly adjusted to changes in supply and demand induced by pandemic associated restrictions. Changes in demand have been more pronounced in inner areas because they have a greater exposure to international students as well as lockdown job losses," Dr Powell said.

"They are also more likely to have properties that have been converted from holiday leases to private rentals. Tenants have a unique opportunity during this rental shift, whether by nabbing a lower price or being able to afford a home with more amenities.”

Weekly unit rents have now fallen $55 from peak prices in 2017 and are now the lowest in six years.

“Since March, house and unit asking rents in the city and east region have had the largest decline in Sydney - by $125 and $80 a week, respectively. This is followed by a $70 a week reduction to unit asking rents in the lower north shore. These are the only areas in Sydney to record double-digit percentage falls over this six-month period. Tenants are now paying the same price they were in 2013," Dr Powell said.

Domain's report states that a number of short-term holiday homes have moved to the long-term market with domestic and international travel off the cards.

"While domestic tourism is returning as restrictions ease, many former holiday-lets remain advertised for long-term rent," Dr Powell said.

"There are fully-furnished high-end luxury properties available to rent in some of Sydney’s elite beachside suburbs that were once only premium holiday homes. When international borders open, allowing migration and tourism to resume, demand for rentals will lift. This is likely to coincide with reduced dwelling construction and investment activity, and this will eventually help to rebalance the rental market."

Melbourne rent falls

Tenants in Melbourne are in a similar position to those in Sydney.

“The pandemic has had a once in a lifetime impact on the rental market, reducing demand at a time supply has bounced. In a matter of months Melbourne has become a tenants’ market, with the number of vacant rental properties more than doubling since March, though this is magnified in inner-city areas which are more susceptible to changes in overseas migration and international students, tourism and job losses associated with COVID-19," Dr Powell said.

“The decline in Melbourne unit rents has been the greatest of all the capital cities, accelerated by the stricter stage-four lockdown. Unit asking rents dropped another $15 a week over the September quarter. Tenants will find asking rents are $30 a week lower than the March peak, before the pandemic. The median weekly asking rent now sits at $400 a week, the lowest in roughly three years. This is the first time Melbourne and Hobart unit rents are the same.

“Units in Melbourne’s inner-ring have had the biggest reduction in asking rents. Since pre-pandemic March, unit asking rents in the inner-city, inner east and inner south slipped by $65, $35 and $30 a week, respectively. This marks the deepest fall over two consecutive quarters since the start of Domain’s Rent Report in 2004.

“House rents have reversed the fall recorded last quarter, pushing to $440 a week, supported by gains across Melbourne’s outer suburban areas. Government policies have supported renters and landlords during an economically challenging time, which has stopped significant widespread rental price falls. It may also reflect changing preferences as tenants seek larger homes and outdoor space in outer-suburban areas."

Brisbane rent rises

Brisbane's house and rental market is at record highs, according to Domain.

"House rents are now at $415 and unit rents $395 a week. Brisbane is the fourth most affordable capital city to rent a unit. Brisbane unit rents could overtake Melbourne in the coming months, as Melbourne unit rents tumble pushing the rent price gap to $5 between the two cities - a four year low," said Dr Powell.

“Amid the pandemic, the estimated number of vacant rentals has returned to expected levels following a dramatic bounce in April. Brisbane’s vacancy rate is on par with pre-pandemic March, with the volume of empty rentals down marginally compared to this time last year. The reduction in available vacant rentals aligns to the easing of restrictions.

“Brisbane is a two-speed rental market, with the inner-city more exposed to changes in supply and demand as a result of COVID-19 restrictions. The reduction in demand for inner-city apartments has been magnified by the closure of international borders, significantly reducing the number of migrants, international students and tourists. As restrictions slowly ease, demand from short-term domestic travellers will increase and landlords unable to secure a tenant will revert to their original investment strategy of leasing short-term.”

Perth rent rises

Asking rents in Perth have surged, posting the highest gains of all the capital cities.

"House rents jumped $25 to $395 a week, the highest asking rent since early 2016. Units are back to mid-2016 asking rents, increasing by $20 to $340 a week. This is the steepest quarterly gain since 2012 for houses and 2013 for units. This is a significant turnaround and unfamiliar territory for tenants who have been in the driving seat, following many years of falling rents," Dr Powell said.

“Current tenants could remain for longer and may be disinclined to move - given the rapid rent rise in recent months, many will now be paying below market rate. This is likely to have been further exaggerated by the state government extension of the residential tenancy eviction and rent increase moratorium, which could also deter investor activity further.”

Adelaide rent rises

"Adelaide asking rents reached a new record over the September quarter, at $405 a week for houses and $340 for units. Unit rents posted the strongest quarterly gain out of all capital cities, along with Perth. Affordability is becoming stretched - rental prices have recorded the highest annual growth since 2007 for units and 2010 for houses," Dr Powell said.

“Adelaide’s vacancy rate is once again on par with pre-pandemic March, as the estimated number of vacant rentals declines following a strong April bounce. The reduction in empty properties aligns to the easing of COVID-19 restrictions, perhaps reflecting the conversion of rentals back to holiday lets as short-term demand increases. Tenants will find securing a long-term rental highly competitive because Adelaide is one of the tightest rental markets out of all the capitals. Landlords have stronger ground to raise rents as prices rise, stock levels decline and vacancy rates tighten.

“The inner-city bucks Adelaide’s overall trend with a weaker rental market favouring tenants. In the wake of the pandemic, vacancy rates have remained heightened in the CBD providing tenants with greater choice. Job losses associated with the health pandemic have been concentrated in city centres, and less demand from students and short-term travellers, providing tenants more choice."

Hobart rent rises

"House rents are stable over the quarter and year but remain $20 per week, or 4.3 per cent, below the record achieved in March. Hobart has had the largest fall in house rents of all the capitals since March. This has resulted in gross rental yields deteriorating from the highest yielding capital city to the fourth highest," Dr Powell said.

“Following a steep decline last quarter, unit asking rents have regained half of the loss over the September quarter. Unit rents are $20 a week lower than the March price peak. This 4.8 per cent drop makes it the second hardest hit unit rental market over the past six months, along with Sydney but behind Melbourne. Unit rents are now $400 a week. This is the first time Melbourne and Hobart unit rents are the same price since the start of Domain’s Rent Report in 2004.

“Despite an increase in empty rentals in recent months, choice has fallen. While elevated compared to this time last year, Hobart has the lowest vacancy rate and remains the tightest rental market of all capitals."

Canberra rent rises

"Canberra remains Australia’s most expensive city to rent a house, at $580 a week, and second most expensive to rent a unit, at $480, behind Sydney, though the difference in unit rents between the two cities has hit an eight-and-a-half year low. If Sydney rents continue to fall and Canberra grows, the nation's capital could soon become the most expensive capital city for unit rents," Dr Powell said.

“The rise in vacant rentals at the height of COVID-19 restrictions was short-lived, and the vacancy rate has tightened again. Canberra has been insulated to the impact of the current health crisis compared to other capital cities. Though international border closures will reduce the flow of migration, international students and overseas tourism to the nation's capital, the change in demand will be less severe compared to Sydney and Melbourne."

Darwin rent rises

"House and unit rents increased by $10 over the September quarter to $490 a week for houses and $390 for units. Unit rents are also $10 higher than the same time last year. This is the first time unit asking rents have increased annually since mid-2014 and it is the first time house rents have remained stable over the year since late 2017. This marks a significant turning point following a multi-year deterioration of asking rents," Dr Powell said.

“Darwin’s economy struggled to recover post-mining boom and the exodus of residents interstate has been a drag on the rental market for the past six years. The containment of the virus in the Northern Territory has made it an attractive destination to relocate, accelerated by the prospects of working from home, and helped to deter residents from moving interstate."

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy