Auction clearance rates provide an indication towards the current trends of the property market based on the number of properties sold via auction each week. This rate is expressed as a percentage of auctions that led to a successful property sale. Generally, if an auction clearance rate sits close to 80%, it is considered ‘high’ and could indicate buyer demand for purchasing property is exceeding current market supply.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

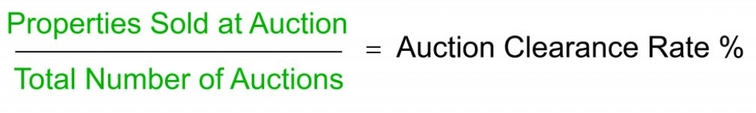

Calculating the auction clearance rate

To calculate the auction clearance rate, the total number of properties sold at auction is divided by the total number of properties listed for auction.

Source: Domain

High vs low auction clearance rate

High auction clearance rates typically indicate:

-

Strong buyer demand

-

Growing property market

-

Under-supply of available properties

-

Hot market for sellers

On the other hand, low auction clearance rates typically indicate:

-

Weak buyer demand

-

Slowing property market

-

Over-supply of available properties

-

Market moving in favour of buyers

Traditionally, auction clearance rate data is calculated on a Saturday evening, with results reflecting the outcomes of the day and published in Sunday newspapers and publications. A higher volume of auction numbers generally pushes the clearance rate down, and vice versa.

There are four key organisations that measure and publish auction clearance rates: CoreLogic, Domain, REA Group, and SQM Research. Occasionally the numbers might be different between the four, which can come down to when and how they calculate the data.

For example, SQM does not publish a preliminary clearance rate, and finds preliminary rates often exclude up to 20 to 40% of all properties that went to auction. Many of these properties are passed-in. By publishing the full results, the clearance rates are often lower.

What factors can impact auction clearance rate?

Auction clearance rate results can differ if data is delayed or properties are withdrawn from sale yet counted in original calculations. Auction clearance rates may include both the sold at auction results and those sold directly before or after. Properties withdrawn or passed-in are also collected and included. Both withdrawn properties and passed in auctions are classified as ‘no sale’.

External factors may also influence auction clearance rates including current interest rates, the availability of credit, price expectations of venders, number of competing auctions, number of actual bids placed and the suburb of the property. Further, sporting events, religious holidays and the weather may also influence the rate as lack of attendance may prevent a home from clearing at auction.

Read more: What are the benefits and drawbacks of buying a property at auction?

Why should you keep an eye on auction clearance rates?

Auction clearance rates provide an indication as to how the housing market is travelling, while also outlining economic performance. This is particularly relevant when it comes to managing investments and choosing the best time to buy or sell a home.

Low clearance rates point to low demand, which may be due to a weakening job market as fewer people can afford to buy and move. High clearance rates, on the other hand, can point to higher consumer confidence as individuals feel prepared to take on such large expenses as buying a home.

As you explore the housing market and learn more about auction clearance rates, keep in mind that these rates aren’t the sole factor to determine housing trends. It’s impossible to know exactly how a market may move, but you should consider it one of many data points to mind as you prepare to buy or sell. When considering purchasing a property, be sure to look at other factors outside of auction clearance rates such as pricing trends, interest rates, demographics and economic outlook.

Image by Rodnae Productions via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

William Jolly

William Jolly