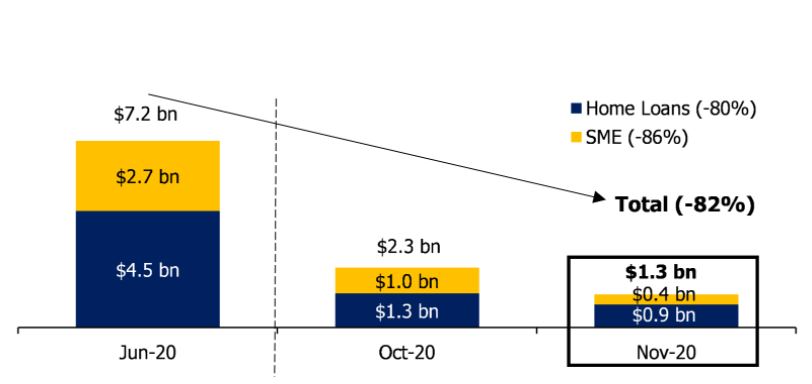

Ahead of its Annual General Meeting today, Bank of Queensland (BOQ) reported that as of 30 November 2020, it had just 2,500 housing loans remaining in deferral with balances of $889m.

Managing Director and CEO George Frazis said it was "pleasing" to see the majority of customers begin resuming repayments, as requested by the nation's banks if it was possible to do so.

"We will continue to work with the remaining 3% of customers still accessing our banking relief packages to support them in their recovery,” Mr Frazis said.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

Lender Home Loan Interest Rate Comparison Rate* Monthly Repayment Repayment type Rate Type Offset Redraw Ongoing Fees Upfront Fees Max LVR Lump Sum Repayment Extra Repayments Split Loan Option Tags Features Link Compare Promoted Product Disclosure

Promoted

Disclosure

Promoted

Disclosure

Promoted

Disclosure

Disclosure

That represents a total fall of 80% from the $4.5 billion recorded in June 2020, and is also under par compared to the industry average.

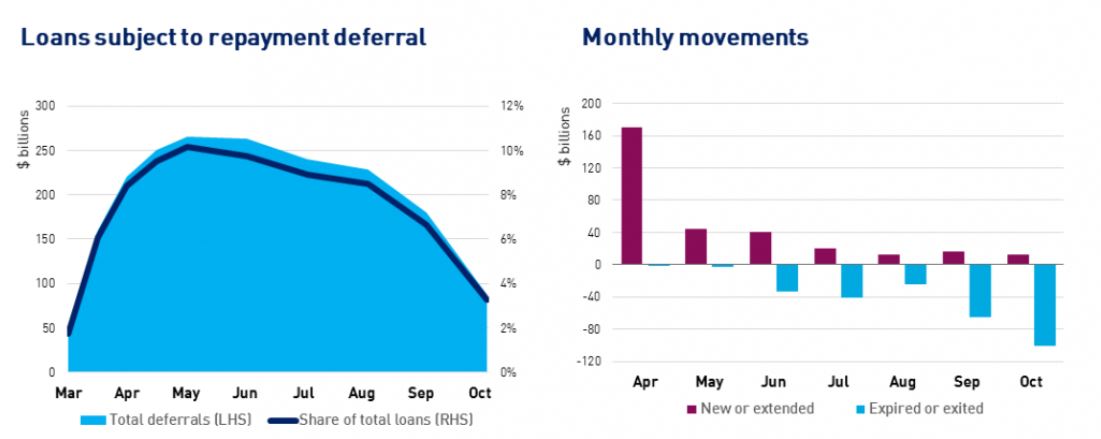

Data released last month from the prudential regulator APRA also revealed that all banks in Australia combined had $68.2 billion worth of housing loans in deferral, which is 3.9% of all mortgages.

This is a far cry from previous highs at the height of the pandemic: In late June, that same APRA data showed 11% of home loans were in deferral, to the value of $195 billion.

Source: APRA deferral data, October 2020

"Exits from deferral continued to outweigh new entries for the fourth straight month in October, with $100 billion in loans expiring or exiting deferral and $12 billion entering or being extended," APRA commented.

"The total value of loans subject to deferral more than halved over the month to October, with the pace of exits increasing significantly."

Borrowers with 90%-or-greater LVRs continue to be over-represented, however, making up 10% of deferrals despite being just 6% of the total loan book.

Borrowers on JobKeeper or JobSeeker also continue to be at-risk.

Data released via SQM Research's Housing Boom and Bust Report 2021 found these ongoing support measures are critical for the ongoing housing recovery.

BOQ's deferral numbers have plummeted since June. Source: BOQ.

New mortgage lending sees strong September quarter

APRA's latest quarterly ADI statistics for the September 2020 quarter revealed strong growth in mortgage lending compared to 2019.

The data shows that from the September 2019 quarter to the same quarter this year, new loans for owner-occupiers increased by 22.2%, while:

- Investment loans rose by 13.3%;

- Interest-only loans rose by 21%;

- LVR >95 loans rose by 35%

Over the 12 months though, only owner-occupied lending saw growth, rising by 6.4% to more than $1.15 trillion in total.

Otherwise:

- Investment lending fell by 1.3% to $608 billion;

- Interest-only loans fell by 22% to $275 billion;

- LVR >95 loans fell by 10% to $19 billion

Photo by Jakob Owens on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury

Aaron Bell

Aaron Bell