That's according to the Australian Bureau of Statistics (ABS) Lending Indicators data for August, released today.

ABS Head of Finance and Wealth Amanda Seneviratne said the surge in new lending commitments left last month's figures in the dust.

“The value of owner occupier home loan commitments was $16.3 billion in August, the highest value in the history of the series," Ms Seneviratne said.

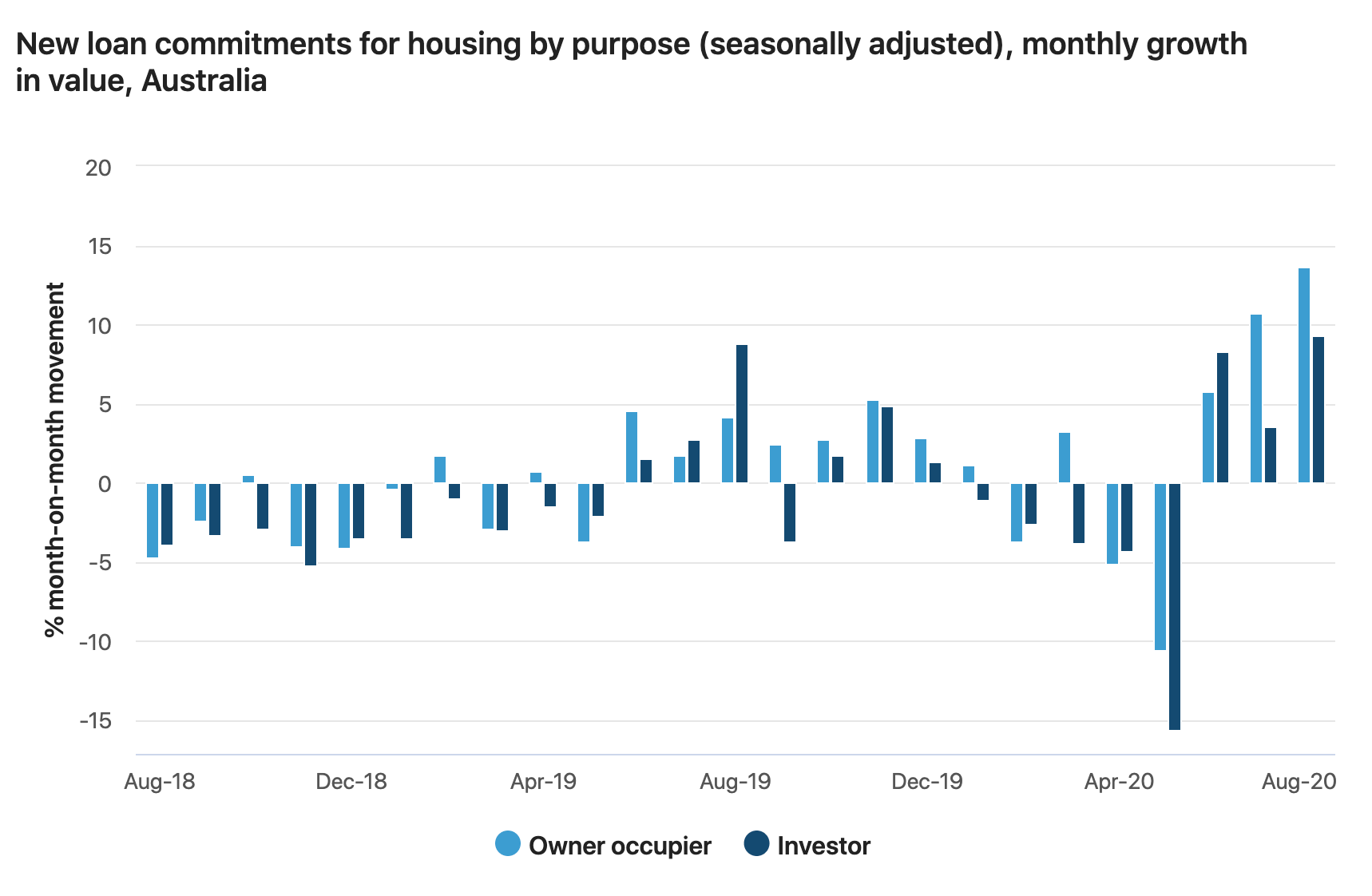

"August’s 13.6% increase in the value of owner occupier home loan commitments is the largest month-on-month rise in the history of the series, eclipsing the previous record of 10.7% set in July.”

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Ms Seneviratne said borrower behaviour and lender processing times have been strongly impacted by the COVID pandemic, and the pent-up demand is influencing the month-on-month figures.

“Lenders are reporting to us that current processing times mean that August commitments reflect customer demand in June and early July, prior to Victoria imposing stage 3 and stage 4 restrictions," she said.

Source: ABS

According to the ABS statistics, the number of owner occupier first home buyer loan commitments rose 17.7% to reach the highest level since October 2009.

The value of new loan commitments to owner occupiers for the construction of new dwellings rose 19.2% in August, while new loan commitments to owner occupiers for land were also strong and have seen a significant increase over the last three months.

“New loan commitments for owner occupier housing rose in all states and territories, except the Northern Territory. The largest increases in the value of new loan commitments were in Victoria, Queensland and New South Wales”, Ms Seneviratne said.

The value of loan commitments for investor housing rose 9.3% to $5 billion.

BOOM! AU housing finance smashes expectations, apparently a bit of pent up demand from June & July... the #RBA's cheap money at work, economic downturn or not #ausbiz pic.twitter.com/N7b5IBkwGG

— Alex Joiner (@IFM_Economist) October 9, 2020

It comes after Treasurer Josh Frydenberg announced the government will relax tough lending laws to make it easier for Australians to get a mortgage.

Under the changes, the onus will shift to borrowers to be honest about their ability to service a loan.

Speaking of the changes at the time, Frydenberg said they will remove a lot of red tape.

"As Australia continues to recover from the COVID-19 pandemic, it is more important than ever that there are no unnecessary barriers to the flow of credit to households and small businesses," Frydenberg said.

"Maintaining the free flow of credit through the economy is critical to Australia's economic recovery plan."

But consumer groups were quick to slam the announcement, arguing they could leave the economy with more household debt.

First home buyer lending surges as stimulus measures rolled out

The number of owner occupier first home buyer loan commitments increased 17.7% in seasonally adjusted terms - the biggest increase since October 2009.

It also marks the first time since May 2009 that the value of lending to first home buyers has been greater than the value of lending to investors.

The number of first home buyers taking out an investment loan accounted for 4.2% of all first home buyer commitments, while owner occupier first home buyer loan commitments accounted for 34.2% of all owner occupier commitments, excluding refinancing.

It comes off the back of the Federal Government announcing it would extend the First Home Loan Deposit Scheme by allowing an additional 10,000 first home buyers to enter the scheme from October 6 until June 30, 2021 on the condition they purchase a new build.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Aaron Bell

Aaron Bell

Harrison Astbury

Harrison Astbury