Typically, spring selling season is the busiest time of year for the real estate market but new research suggests this year could be very different as a result of the COVID-19 pandemic.

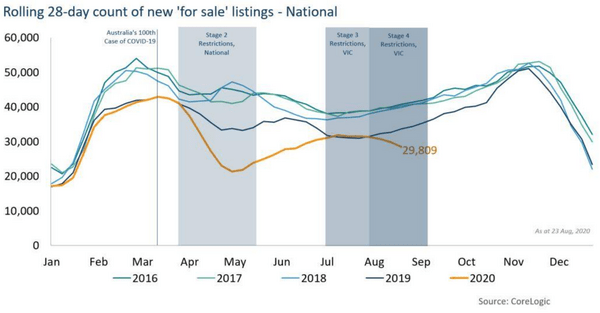

New CoreLogic data shows that in the four years before the pandemic, the number of new properties listed for sale nationally has, on average, increased by 6.3% between late July and August.

But this year, the same period has seen a 9.6% decrease in new listings nationally.

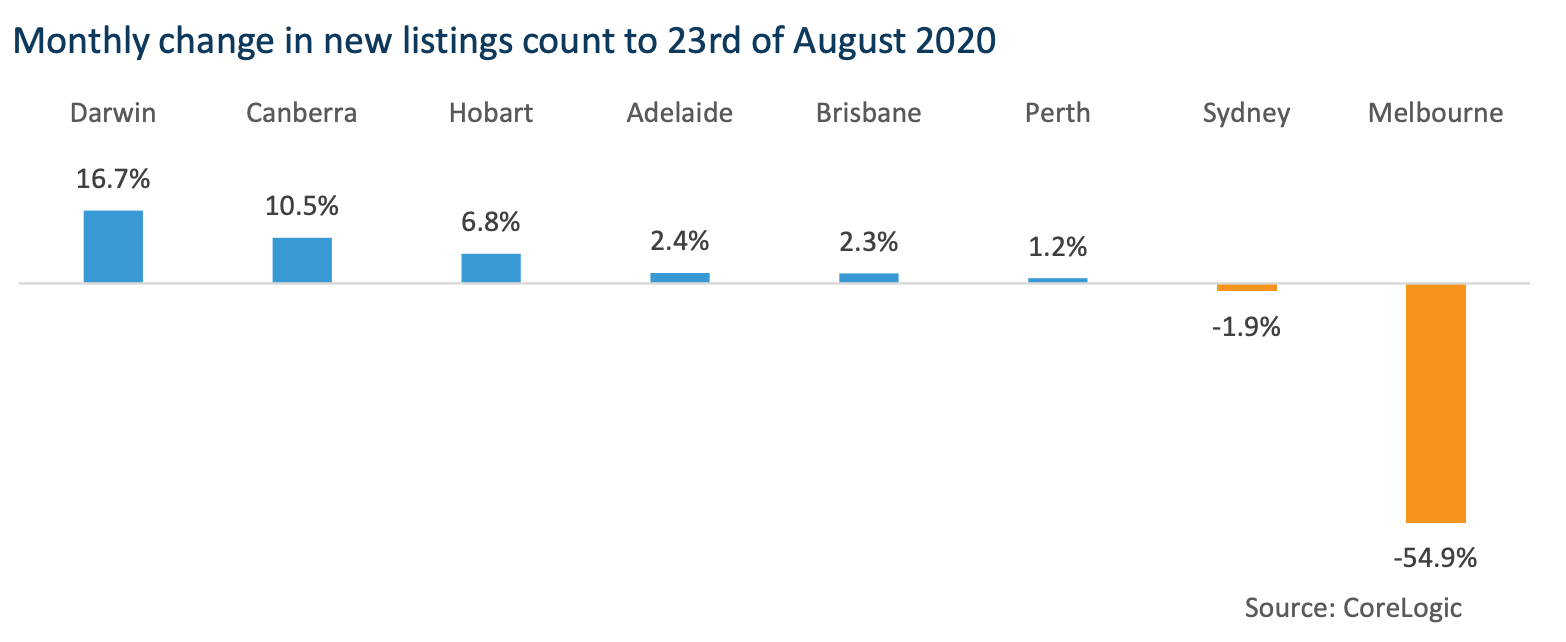

This was driven by Melbourne, where a 54.9% plunge in property listings in the month to August 23rd accounted for over 100% of the national decline.

"As Melbourne reached the halfway mark of its Stage 4 restrictions in late August, national listings activity has completely diverged from the usual listings patterns in the lead up to spring," CoreLogic Head of Research Australia Eliza Owen said.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Conversely, most other capital cities - with the exception of Sydney - saw an increase in new listings as lower levels of COVID-19 cases in other parts of the country saw greater levels of consumer confidence.

Ms Owen said the pandemic has had a greater effect on market activity than property prices.

"A key takeaway from CoreLogic data amid the pandemic, is that transaction activity slows significantly in response to COVID-19 restrictions," Ms Owen said.

"The resulting loss of employment, lower consumer sentiment and border closures have had a much larger impact on the number of properties marketed and sold, than property prices themselves."

This can be seen from the Stage 2 restrictions implemented in late March, when new property listings plunged 50.3% from mid-March to early May.

"This exacerbated the seasonal dip in for sale listings throughout March and April."

Ms Owen said there are two reasons why property transactions have slowed during COVID-19. The first is the obvious physical limitation of buying and selling property when strict social distancing measures are in place.

The second is the economic uncertainty generated by strict lockdown measures.

"The drop in sales volumes in times of high economic uncertainty, such as around the GFC and the national Stage 2 restrictions in March and April, indicates sellers and buyers are less likely to participate in property transactions during negative economic shocks or periods of heightened uncertainty," Ms Owen said.

Additionally, mortgage repayment deferral offerings from the banks have kept a tight lid on new listings.

"This has meant that people who cannot currently service their mortgage do not have to list as a distressed or motivated seller," Ms Owen said.

"This dynamic may change in the lead up to March, when banks may need to end repayment deferrals.

"Property owners who have deferred their mortgages, but are not in a position to reinstate their repayments by the end of March, may decide to offload their property in the lead up to this expiry date."

Ms Owen said we could expect to see a larger number of distressed listings come on the market.

Property industry should "brace for a subdued selling season"

Ms Owen said although the number of property listings on the market recovered quickly after the initial COVID restrictions in March and April, this time will be different.

"Once restrictions are repealed in Melbourne this time around, the recovery in transaction activity is likely to be weaker," Ms Owen said.

"That is because employment is taking another hit, consumer sentiment is dampened by the reality of a second outbreak of the virus, and a reduction in fiscal support is only a month away.

"Ultimately, the second round of restrictions across Victoria is likely to create a weaker ‘spring selling season’ than in previous years."

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury