Commonwealth Bank (CBA) reported a 12% increase to its full-year net profit to $9.6 billion, but underlying cash earnings were down 11% to $7.3 billion due to the effects of coronavirus.

The bank's results were bolstered by the operating strengths of both retail and business banking, as well as strong growth in both lending and deposits.

"The last financial year underlined the Bank’s core strengths particularly at a time of unprecedented constraints brought on by the pandemic, low interest rates, low credit growth, and the consequential impacts on the economy and the country as a whole," CBA CEO Matt Comyn said.

“The strength of our core banking businesses, combined with strong operational performance, has delivered good outcomes for our customers and shareholders –despite the challenges presented by lower interest rates and COVID-19."

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

How did Commbank respond to COVID-19?

COVID-19 featured heavily in Commbank's full-year results, with Mr Comyn saying Commbank took an additional credit provision of $1.5 billion for the potential impacts of COVID-19 on lending portfolios.

“This took into account the stress to the economy introduced by COVID-19 and the mitigating impacts of government and industry assistance packages and support, such as loan repayment deferral arrangements.”

According to CBA's results, it took one million calls and online requests for help during the financial year, as well as 250 million personalised support messages, which spiked once COVID-19 struck.

There were almost 700,000 Benefits Finder claims since launch, and Commbank's COVID-19 support page attracted a massive 5.5 million visits.

Large (but falling) numbers of repayment deferrals

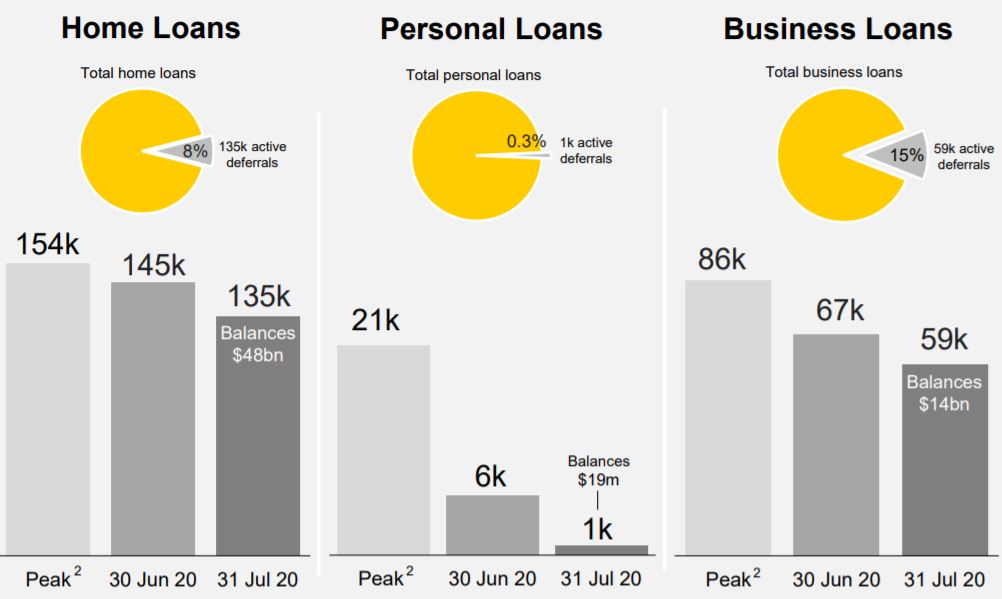

Commonwealth Bank granted over 250,000 loan deferrals to customers among its home, personal and business lending.

The majority of these were in home loans, with 135,000 home loans worth $48 billion deferred as of 31 July 2020.

However, this is a decline from 145,000 at 30 June and 154,000 at their peak when deferrals were first announced, and account for 8% of CBA's total mortgage book.

The decline in mortgage deferrals appears to be in line with the Australian Banking Association's (ABA) announcement that people should start resuming their mortgage repayments if they can afford to do so.

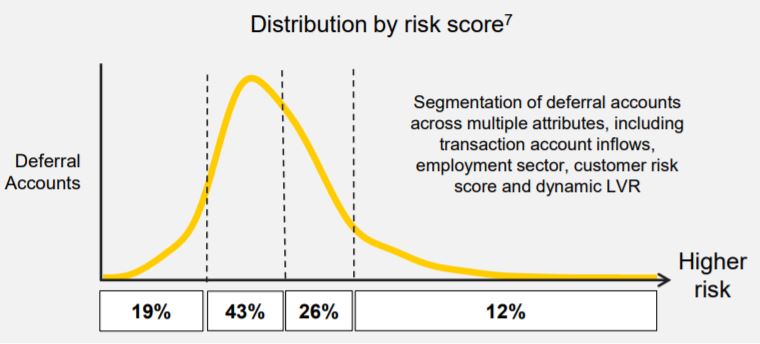

A deeper analysis of CBA's home loan deferrals shows that now, 25% of customers with deferrals are making some repayments, and just 12% of deferred loans are among those in "higher risk" occupations such as retail, food, hospitality and airlines, which should ease some concerns over any upcoming repayment cliff in the coming months.

Most of the deferred loans are among borrowers in medium-risk occupations, with 19% among those working low-risk jobs.

Source: CBA

Owner-occupied loans accounted for 72% of deferred home loans, with investment loans making up the remaining 28%.

Principal and interest (P&I) loans meanwhile were 84% of deferred loans while interest-only (IO) loans accounted for 16%.

Interestingly, transactional data revealed that 14% of deferred home loans had at least one borrower that was receiving JobSeeker payments. More than half of these (58%), or roughly 7% of all deferred loans, were joint accounts with only one borrower on JobSeeker.

CBA did not report on JobKeeper numbers relating to deferred home loans, although approximately 30% of business loan deferrals were made by those receiving JobKeeper.

"During COVID-19, we have been supporting our customers through the financial and business impacts of the health crisis," CBA said in its report.

"We are now contacting all customers with deferred loans to talk with them about their options, including returning to full or part payment or converting their loans to interest only.

"Our focus will continue to be on supporting our customers through difficult times."

Source: CBA

CBA customers flock to deposits during COVID-19

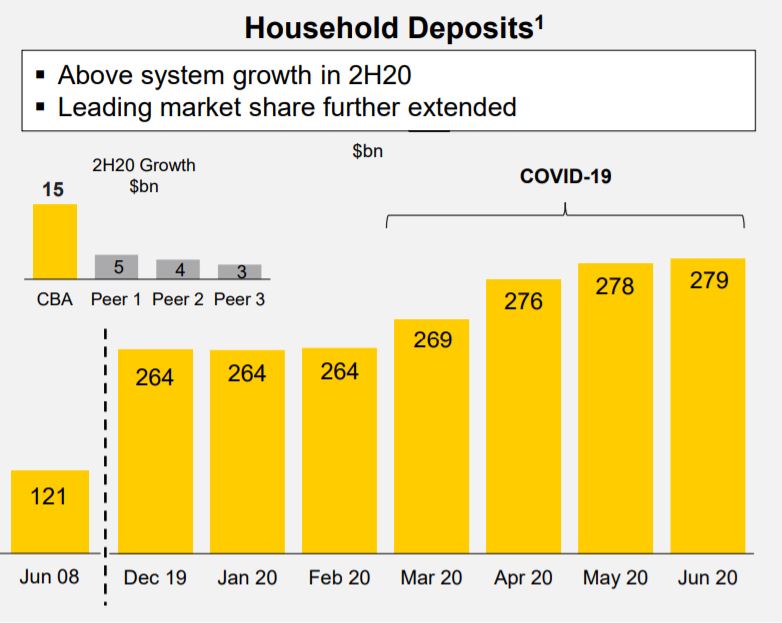

In what might be an indication of the wider market given Commbank's size, CBA reported a sizeable increase in household deposits and transactions during COVID-19.

Household deposit balances grew 9.8% year-on-year, and spot transaction account balances were up 25%, with this growth deemed to be "above-market growth".

On 30 June 2020 Commbank had $279 billion in household deposits, compared to $264 billion in February 2020, the month before COVID-19 arrived on our shores.

This is despite term deposit and savings account interest rates remaining extremely low.

Source: CBA

Economic outlook still uncertain

Matt Comyn said Commbank is "very well positioned" for a range of different economic scenarios going forward, but admitted things don't look too good.

"Overall, Australia and New Zealand though are very well positioned, particularly so on a global basis. That said, we have seen a sharp economic contraction during the course of the year as a result of the pandemic," he said.

"Not quite as bad as we’d first feared, but certainly the pace of recovery does look like it will be longer.

"Overall, we’re expecting GDP to fall by about 4% over this calendar year, but to bounce back by about 2% next year.

"Unemployment is likely to peak towards the end of this calendar year at close to 10%, which is clearly a significant economic impact overall."

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Denise Raward

Denise Raward