While some retailers such as furniture and appliance stores have offered interest-free or delayed payment options for decades, it wasn’t really until the launch of Afterpay in 2015 that BNPL as we know it really started to take off, with many other rival platforms popping up shortly after. As it now stands, the three biggest platforms - Afterpay, Zip, and Humm - claim to have as many as 8.5 million customers between them.

It seems almost every week a new brand sprouts up claiming to offer buy now pay later services, and quite frankly, it’s getting a little hard to keep track of them all. So Savings.com.au has prepared a list of every BNPL provider in Australia (that we know of) at the moment for every day consumers.

BNPL in Australia is generally split into three distinct categories:

- Specialist products offered by fintechs such as Zip and Afterpay

- Brands servicing a niche, such as for solar panels

- Those offered by big banks and platforms such as Paypal that have integrated instalments into their existing payments framework

By the time you’re reading this, there’s a good chance another one has come along - trendy name included, of course.

The buy now, pay later revolution might be changing how we shop, but just because it exists doesn’t mean you have to use it. If your BNPL spending is left unchecked, you can easily accrue debts and black marks on your credit history just as you can with a credit card or personal loan.

While many BNPL platforms don't technically charge interest, the late fees, when represented as a percentage of the purchase and annualised, can work out to be more in interest than a credit card or loan.

If you have the cash to pay for something from your bank account without going into a debt repayment plan, then it’s probably worth paying in-full. Or if you don't, or want to use BNPL for cash flow purposes on big purchases, it's worth sticking to the repayment schedule - like any debt.

Advertisement

The table below features personal loans with some of the lowest interest rates on the market.

Here is a list of every BNPL provider (that we know of) available in Australia at the time of writing for everyday consumers:

Afterpay

Afterpay is comfortably the biggest of the BNPL platforms in Australia, with 3.6 million ‘active’ customers in Australia and New Zealand according to its Financial Year 2021 report. 'Active' is a customer who has used it in the past 12 months.

Now owned by Jack Dorsey's Block, Afterpay is a no-credit-check service designed for users to be able to sign up while in line at the store. With Afterpay you have to pay for at least a quarter of the payment upfront while the rest can be repaid in fortnightly instalments. If you don’t, you can be charged late fees up to $10, capped at 25% of the order.

Other key Afterpay facts:

-

- A $1,500 transaction limit with a $2,000 outstanding balance limit

- $7 late fees after the initial $10

- Late fees capped at $68 or 25% of the purchase price (whichever is lower)

- Four fortnightly repayments

- No interest charged

- A digital card for purchases

- Qantas Frequent Flyer (QFF) point compatibility

- Can be used for flights with Webjet

Apple Pay BNPL

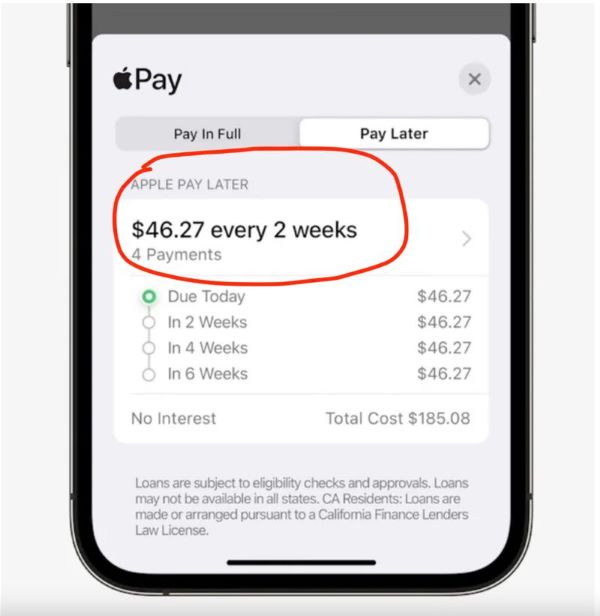

The launch of instalment plans offered via Apple Pay in mid-2022 was labelled a gamechanger.

When customers make an Apple Pay or Wallet purchase they will get the option to split the cost into four equal instalments over six weeks.

There's no interest, however information on any late fees is opaque.

Payments expert Grant Halverson said this is a fintech BNPL app's "worst nightmare".

"These start-ups face a powerful new competitor in Apple with over 500 million mobile wallets globally," Mr Halverson said.

Brighte

Brighte is a buy now, pay later solution aimed exclusively at solar and renewable energy home improvements. It is the leading 0% interest fintech for solar and home improvements with more than $500 million financed to date. Brighte claims one in 14 solar installations in residential homes are financed through its platform.

Brighte has one of the highest credit limits on this list with up to $30,000, though solar panels can cost thousands so this is to be expected.

Repayment terms are anywhere from six to 60 months.

In terms of costs, Brighte charges:

- A $1.50 weekly account keeping fee

- A $4.99 late payment fee (capped at $49.90 each year).

Pre-approval is available for purchases up to $15,000 with Brighte.

Compare Green Financing Options

Citi SpotPay

In 2021 Citi launched 'SpotPay' which is delivered via affiliate Diners Club.

It's accepted anywhere Mastercard is accepted via digital cards.

Purchases are split into four fortnightly payments. However for payments over $200 customers have the option to pay a $10 fee to split it further into eight instalments.

The maximum account limit is $1,000. There are no late fees for purchases under $100 however there is a $10 missed payment fee for purchases over the threshold.

This came as Citi's Australian retail business was in the midst of being acquired by NAB, which was completed in March 2022.

NAB is expected to bring SpotPay under its name through 2022 and 2023.

In the interim, and as of June 2022, NAB is using Citi's logo and designs under license from the global Citigroup.

CommBank StepPay & Klarna

CommBank was one of the first big players to launch a BNPL service launching in March 2021. Commonwealth Bank already part-owns Klarna (see below). Available only to eligible Commonwealth Bank (CBA) customers, StepPay is linked to CBA bank accounts and can be used anywhere its debit or credit cards are accepted, which is a big advantage over other competitors which charge extra merchant fees.

With CommBank BNPL:

- Purchases over $100 will be split into four equal fortnightly instalments

- For purchases under $100, the full amount will come out of the linked CommBank account in one go

- No interest charges, monthly or annual fees apply

- Late fees of $10 apply per missed instalment repayment

- A credit limit of $1,000 applies

- Credit checks apply to customers

Customers can access CommBank BNPL via the bank’s app or by adding it to their phone’s digital wallet.

Klarna

Swedish-based Klarna is one of the world’s largest BNPL platforms with tens of millions of customers, but it only arrived in Australia in early 2020 when Commonwealth Bank acquired 50:50 ownership here. Now, Klarna has already surpassed more than 550,000 customers in Australia across hundreds of different retailers.

Klarna functions in a very simple way, allowing customers to spread a purchase over four interest-free instalments much like Afterpay, although it also offers a 36-month financing plan for larger purchases. Klarna has a minimum spend of $35 and no maximum credit limit, with each limit “subject to an individual availability assessment”.

Klarna does charge late fees too, which amount to $3 per instalment for purchases over $50, capped at $9.

Customers can also be charged a varying amount to ‘snooze’ repayments if they think they’ll miss the deadline.

See also: Klarna the first BNPL platform to launch its own loyalty scheme

Gimmie

Gimmie says it can turn your "big buys into big brag-worthy buys".

The brand is distinct in the market in that customers can purchase products directly from the Gimmie site.

For example, a Samsung 55" TV starts at $27.64 per week at the time of writing, for a retail price of $2,395.

Customers have two options: Pay the retail price if paid within 90 days; or pay "a little more" than retail price in weekly, fortnightly, or monthly instalments over one or two years.

Missed payments on the second option incur a $10 late payment fee.

Customers are subject to a form of pre-approval and borrowing power assessment, must provide a drivers license and other ID, pay and bank account info, and not be bankrupt.

Humm and Bundll

Humm is a payments platform allowing shoppers to make “interest-free” purchases of up to $30,000 through the platform to be repaid in “slices”.

Humm, originally Flexigroup, launched in Australia in mid-2019 and has grown to be roughly the same size as Zip, with around 2.5-2.6 million active customers in 2021. Awareness of Humm has grown sharply, with 11.5% now are of it, up from 8.6% in September 2020.

When buying with Humm, there are two different payment plans with different repayment structures, which it classifies as ‘big things’ and ‘little things’.

- Big things: for big purchases (up to $30,000), you can make as many as 60 monthly payments

- Little things: for small purchases (<$2,000), you can make between five and 10 fortnightly payments

Humm is both fee-free and interest-free as long as you make your payments on time. Late fees are $6 for each missed payment, while monthly fees of $8 can be charged on ‘big things’ and ‘little things’ with 10 repayments. There is also a $30-$110 establishment fee for big things purchases.

Humm also has the 'humm90' platinum Mastercard with up to 110 days' interest free which is one of the longest interest-free periods in the market.

Humm also owns another smaller BNPL platform called Bundll.

What is Bundll?

Bundll, owned by Humm, was launched in 2019 and is described as being like a “debit card on steroids”. It allows customers to bundle all of their everyday purchases like groceries together into a single bill, which can then be paid off in regular BNPL instalments.

Bundll requires no credit check, charges no interest and no monthly fees. It does charge a $10 late fee, but it mainly aims to make money through merchant and interchange fees. Users can also get free 'Snooze' features if they refer friends to the program; snoozing allows customers to pause payments for two weeks. If they have no free Snoozes, Bundll charges $2.50 apiece.

The standard Bundll credit limit is $1,000, but a ‘superbundll’ (larger purchases combined with smaller purchases) can allow for purchases up to $4,000. This can be paid off over 12 weeks at a cost of 5% of the balance. However superbundll is no longer available to new customers - only existing ones.

Laybuy

Laybuy launched in Australia in September 2019 after becoming one of New Zealand’s biggest BNPL brands. Co-founded by NZ retail expert Gary Rohloff and his son Alex, Laybuy is partnered by more than 8,000 retailers in Australia but can be used anywhere that accepts Mastercard.

Laybuy, at last estimates, had more than 750,000 active customers globally including Australia, New Zealand and the UK.

Laybuy allows six weekly payments (interest-free), a frequency it says most people prefer, while it also has a feature called Laybuy Boost, which essentially allows customers to top up their account’s credit limit for more expensive items. Laybuy also:

- Charges a $10 late fee on each missed payment

- Has an initial $1,000 spending cap, expandable up to $1,400

- Conducts upfront credit checks to assign a spending limit

- Requires at least 1/6th of the purchase upfront

NAB Now Pay Later

NAB was the last of the major banks to dip its toe into the BNPL pond. In late May 2022 the bank launched "NAB now pay later".

The maximum limit is $1,000, and customers can split purchases into four fortnightly repayments.

The new service will have no late fees, no interest, and no account fees. Customers will also be provided a digital card with a revolving security number (CVV).

A repayment assessment will be completed upon application.

Late payments could mean the customer's BNPL account will be blocked.

They are also unable to go into negative balance on their account.

"Hundreds of thousands of NAB customers are using instalment payment services so we’ve created NAB Now Pay Later to make this option simple and digital for them," NAB executive Rachel Slade said.

Pay It Later

Pay It Later is one of the smallest BNPL platforms on here, both in terms of users and how much you can borrow. Pay It Later has a $1,000 credit limit, paid off over four weekly instalments at 0% interest.

Pay It Later charges $10 late fees up to a maximum of $60, and has no establishment or ongoing fees. For merchants, it charges a flat-rate transaction fee and a percentage-based transaction fee each time, and shoppers are often given discounts at these merchants for using it.

One difference Pay It Later has is a 60-day returns policy, managing all refunds for the customers if they want to return their purchase within that time.

Payo

Payo claims to be Australia's first 'eat now pay later' app. It is designed specifically for BNPL but at cafes, restaurants and other dining options.

Customers can eat now and pay later in four instalments, deducted on Wednesdays. The app charges no interest and no account fees. Participating restaurants can be found on the app.

There is a minimum payment of $10 per fortnight, and if the payment is late there's a $10 fee per instalment up to $40.

PayPal Pay in 4

Another entrant to the market for 2021, payments giant PayPal released its own platform called PayPal Pay in 4 in March 2021. Launching in June 2021, PayPal Pay in 4 works the same way other leading platforms do, allowing customers to split eligible purchases between $50-$2,000 over four equal, interest-free fortnightly instalments and charging no fees for on-time repayments.

There are no late fees, however Paypal could suspend the service until the balance is paid in full. For extended non-payment periods, other Paypal services could be suspended as well.

In late August 2022, Paypal boosted the maximum balance to $2,000 from $1,500.

PayRight

PayRight is a payment plan provider that's been around since 2016, and became ASX listed in December 2020. Based on 2021 data, it has around 42,000 active customers, and that number is growing by about 10% each quarter.

Payright works essentially the same way Afterpay and co. does, as it offers interest-free fortnightly or monthly instalments with terms of up to 36 months.

It claims to be different however by being geared towards larger purchases, and has a maximum credit limit of $20,000. According to internal data, the average transaction with PayRight is approximately $3,000. For purchases from $10,000 to $20,000, the terms allowable are 48-60 months.

In terms of costs PayRight has:

- An establishment fee of up to $59.95 for under 10k, or $89.95 for 20k

- A monthly account keeping fee of $3.50

- A payment processing fee of $2.95, added to each repayment

- And a late payment fee of up to $12.95, charged separately

There are also extra costs to take out additional repayment plans.

Suncorp PayLater

Another entrant in late 2021, Suncorp teamed up with Visa Instalments to offer 'PayLater'.

The product comes in the form of a debit card and is accepted anywhere Visa is accepted.

Customers can split purchases over $50 into four fortnightly instalments up to a maximum limit of $1,000.

A credit check will be completed.

For missed repayments, there is a two-day grace period before a capped $10 late fee per purchase is applied.

Zip Money & Zip Pay

Zip is the second biggest BNPL platform in Australia, and actually has two separate BNPL brands:

- Zip Money: for larger purchases, account limit over $1,000

- Zip Pay: for smaller purchases, account limit under $1,000

Zip in total has 5.7 million active members globally, up 217% year-on-year. It is also offered by more than 34,000 different stores and merchants. According to Roy Morgan, almost half of Australians know of Zip. Zip has also teamed up with Qantas to offer 'fly now pay later'.

What is Zip Money?

Zip Money is a line of credit with credit limits over $1,000, and is the less popular of Zip’s two brands. Regular accounts can access up to $5,000 and in special circumstances, credit limits can be up to $50,000. Zip Money does charge some interest, but it is interest-free for the first three months. Zip Money's late fee is $15.

What is Zip Pay?

Zip Pay (for smaller purchases) functions in a very similar manner to Afterpay in that it allows you to create an account in minutes (two minutes 18 seconds for us) and allows you to link a debit card for in-store and online purchases. Zip allows users to choose how often their repayments are made based on their preferences, be it monthly, fortnightly, weekly or instantly, and unlike Afterpay does require a credit check.

Other key Zip Pay facts:

- It charges a $5 late fee (capped)

- $7.95 monthly account fee which is waived if you carry no balance or pay the closing balance in full by the due date

- $40 per month minimum required payments

Defunct BNPL Platforms - Affirm, LatitudePay, OpenPay and FuPay

Affirm

In early March 2023 Affirm announced "it will begin an orderly wind-down of our operations in Australia", after operating in Australia for around 18 months.

In late 2021 US-based BNPL Affirm announced it would follow Peloton into Australia to offer instalment plans for the fitness equipment brand. In the US it's estimated Peloton accounts for nearly one third of Affirm's revenue.

So, if you want to buy a Peloton bike to get your sweat-on, you can use Affirm to break down the payment into monthly instalments.

This is done by choosing 'Affirm' as a payment option at the Peloton checkout. There are no fees - however missed payments could hurt your credit score. Customers are also usually required to pre-qualify for a loan amount.

LatitudePay

As of Friday 24 February 2023, Latitude Pay has closed its BNPL offering in Australia and New Zealand.

Latitude Pay, launched in late 2019, was a BNPL service created by Latitude Financial and partner Harvey Norman to initially be a payment option for purchases made solely at the retail giant. But since then it has partnered with Mastercard and a number of different eCommerce partners from the likes of The Good Guys, Forty Winks, catch.com.au and more.

Available online or in-store, Latitude Pay offers no-interest payments with no extra fees for purchases up to $1,000, split into 10 weekly instalments.

Latitude Pay requires a 10% payment upfront, with missed payments for the remaining nine portions incurring a $10 late fee.

In its first year of operation, Latitude Pay reportedly amassed more than half a million active customers.

OpenPay

As of 6 February 2023 Openpay has gone into receivership and its receivers McGrathNicol has closed the platform to new applications/purchases.

Openpay is one of the older BNPL platforms in Australia. It first launched in 2013 as a payments solution for a clothing line, before moving to the broader market in 2016. It finished the 2020-21 financial year with 541,000 active customers and several thousand merchants, specialising in retail, health and education stores.

Openpay has one of the largest credit limits among the BNPL platforms, allowing you to carry a balance of up to $20,000 (pending a possible credit check). It also offers flexible repayment plans, and depending on the size of the purchase it can be repaid over two to 24 months in weekly or fortnightly payments.

As with the majority of other options, Openpay is interest-free but can charge fees, like:

- A $9.50 default fee for missed payments

- Plan management fees up to $5 per fortnight

Openpay’s fees can vary based on the shop and the size of the plan, but the fees are capped at $200.

Related: Openpay CEO Michael Eidel on BNPL regulation.

Fupay

As of mid-May 2023, FuPay had reportedly shut down its apps on the Google and Apple App Stores, and closed its website.

Fupay (pronounced Foo-pay) is a BNPL platform that describes itself as an "unapologetically and authentically young millennial brand", if you're into that kind of thing. Fupay calls itself a "lifestyle management platform allowing young millennials to better understand and manage their cashflow needs."

Available with both Google Pay and Apple Pay compatibility, Fupay lets users instantly load between $20-$500 onto the card to be repaid over eight instalments. These repayments can be flexible based on personal preferences.

Fupay doesn't charge any interest, and does not perform a credit check, although it will still assess your income and financial behaviours.

Fupay has a 5% fee for each purchase, and has late fees but the exact breakdown is opaque.

Similar BNPL platforms

Not to be outdone by these heavy hitters above, there are other platforms that aren’t quite a traditional BNPL service but are worth mentioning nonetheless. These are:

Plan It (American Express)

American Express dipped its proverbial toes into the BNPL sector in mid-2020 when it released a new feature for customers called Plan It. Using the American Express App, Plan It lets customers move a portion of their credit card balance into a payment plan spread over three, six, nine or 12 months, with a fixed monthly fee and 0% interest.

Available for use on balances above $150, Amex Plan It charges a fixed monthly fee of 0.42%-1.04% of the starting plan balance, which differs depending on the type of card the customer has.

ANZ Visa Instalments

In late 2021 ANZ partnered with Quest Payments Solutions to offer BNPL delivered via Visa Instalments.

This means ANZ customers can use instalment options as part of the usual credit card checkout process.

This enables customers to set up a structured repayment schedule for all or part of their credit card balance or for specific purchases over a certain value.

Visa Instalments offers repayment plans from three months to 24 months with no interest.

ANZ may charge a fee - a fixed amount or a calculation based on a percentage of the balance being divided into instalments.

Flexibond

Backed by payments platform EML Payments and Ezidebit Australia, Flexibond is a specialist buy now, pay later platform that lets renters pay their bond in instalments. Customers receive a Flexibond digital Mastercard, and the platform pays the bond via that card, up to a maximum of $10,000, with a 5% activation fee based on the bond amount.

A YouGov survey in 2020 found 53% of renters struggle to pay their bond, which is usually four weeks' rent plus an extra two weeks' rent upfront. While Flexibond says it is helping struggling renters afford to move, consumer groups and tenants' unions say it could be an "unhealthy addition to an already unfair rental system".

Related: State-by-state rental bond loans.

Handypay

Handypay is a subsidiary of personal loan provider OurMoneyMarket and was launched in 2019.

Handypay is slightly different from other providers in that it targets less discretionary items. Instead, it targets home improvement purchases, eco-friendly additions to the home, health treatments, and education courses.

Customers can split between $500 and $5,000 into instalment options over 12 months. It works by having amounts deposited into customers' accounts, with 0% interest for a set period.

There is a one-off upfront fee of $250, and a $35 late fee. Once the 0% period end, the advertised interest rate reverts to 9.99% p.a.

Think of it more like a BNPL and personal loan hybrid.

Limepay

Limepay is one of the smaller BNPL platforms in Australia but is still worth a shout. Launching in mid-2020, Limepay is a bit different as it is a retailer-focused BNPL, allowing merchants to effectively launch their own BNPL platform through its website.

Limepay offers flexible payment instalments in the standard four blocks. It is designed to streamline the process for the consumer, who can link a credit or debit card or use a digital wallet to access the service.

Limepay charges no interest and charges $5 but late fees that are capped at $10 for future missed payments. Its late fees are capped at $68 for any purchase price or no more than 25% of the purchase price.

Splitit

Splitit lets customers make purchases using an existing debit or credit card but in deferred instalments, letting them continue to enjoy the benefits of their current payment methods such as rewards points. Splitit doesn’t charge any fees beyond your usual debit and credit card fees and interest charges.

Westpac PartPay

After dipping its toe in the BNPL world through investments in Zip and a partnership with Afterpay, Westpac has launched its own version of BNPL, called PartPay.

PartPay allows Westpac credit card customers to split payments into four instalments.

The purchase must be on a linked digital PartPay card and be valued at $100 or more.

The digital card can be added to smartphone wallets via the Westpac app.

The account is linked to a bank account and fortnightly payments will be automatically deducted.

There are no late payment fees and zero interest, however if a customer misses a payment, the instalment is transferred to the main credit card purchase balance, which accrues interest.

PartPay customers can still accrue rewards and points, and access complimentary insurance associated with their Westpac credit card.

Anti-BNPL platforms

While the BNPL craze might have taken off here, that doesn’t mean everyone is a fan of it. There are a couple of platforms and startups that have appeared with the intention of combatting the potentially dangerous practices of buying now and paying later. Arguably the three most prominent are:

Sipora

Sipora, available on iOS, is a budgeting and saving app, but is one that could be useful for those who struggle with debt. It’s essentially a round-up shopping app designed to combine your favourite retailers with round-up technology, allowing you to save quickly instead of buying through debt. It connects to your bank account similar to how Raiz does and rounds up each transaction you make in your everyday life to the nearest $1, $2 or $5 to be put into a Sipora account.

“Sipora offers consumers a way to save for something they want in a relatively short period of time, without relying on credit or buy now, pay later debt,” co-founder Jonathon Despinidic told Savings.com.au shortly after it launched.

YouPay

The recently launched YouPay describes itself as an alternative to BNPL, having begun in response to the “staggering number” of people signing onto consumer debt products. YouPay lets shoppers send private payment links to friends and family, instead of encouraging people to pay for one-quarter of a purchase upfront, potentially accruing late fees. This way, people can tap into support networks or shared expense groups instead of relying on debt plans.

"BNPL is an amazing piece of technology and a huge convenience when managed appropriately. When it isn’t though there can be problems for customers," CEO and Founder Matt Holme told Savings.com.au.

"Before going into debt with an institution - be it BNPL or a credit card - we want you to turn to your support network of family and friends for assistance."

Up Bank Maybuy

As a tongue-in-cheek marketing stunt, neobank Up launched Maybuy, which is marketed as a delayed-gratification savings feature in its app.

Customers can create automated savings plans for items in their online cart, called a Maybuy.

Once the savings goal is reached, customers can either purchase the item or opt to keep the money and put it towards something else.

What are the pros and cons of using buy now, pay later?

There are a lot of different BNPL providers out there and more popping up by the minute, while similar products are being launched by banks and credit card companies like American Express too.

Advantages of using buy now, pay later

With millions of Australians potentially using these products, they must be doing something right, and there definitely can be benefits to using them. For one, even the most expensive ones give you less runway than a credit card.

While most BNPL platforms cap their late fees (which are only a few dollars each time), the average credit card interest rate is around 17% per annum. When you combine that with higher credit limits on credit cards they have the potential to accrue thousands of dollars in interest debt, not to mention annual fees of hundreds of dollars on some cards.

Most BNPL platforms don’t charge ongoing fees, and will often have a debt ceiling of several dozen to a couple of hundred dollars before you get cut off. All in all, BNPL is generally cheaper than credit cards.

Other perceived benefits of BNPL include:

- They’re easy to apply for quickly

- You can easily sign up to multiple, as they have less extensive credit requirements

- Four in five consumers (81%) find BNPL convenient and easy to use (ASIC)

- They can have flexible repayments as well as simple ones

- Many stores offer them now

But of course, there are risks to using them too.

Disadvantages of using buy now, pay later

Although it can be cheaper than using a credit card, that isn’t always the case, especially if you don’t meet your repayments on time. While some BNPLs limit how much they charge in late fees (e.g. Afterpay never charges any higher than $68 in late fees before you get cut off) these can still add up if you’re missing repayments on other platforms as well, potentially accruing hundreds of dollars in late fees.

Some other potential cons of BNPL:

- There are less stringent credit checks on some, making them easier to apply for (see more about how BNPL can affect your credit score here)

- It can encourage impulse spending, particularly if you're already bad with credit, while you can also get into the habit of paying with debt, instead of with money you already have.

Another potential problem of using BNPL too much is that it could harm your ability to get a loan in the future, such as a home loan or car loan. Lots of lenders still regard them as a line of credit because you’re borrowing money you don’t have, which can look bad on an application and lead to you getting rejected.

So with buy now, pay later, the disadvantages might not always be visible to you.

Which BNPL platform is the best?

As with any financial product, no buy now, pay later service is ‘best’ for everyone. Afterpay might be the biggest and most well-known, but what makes a product right for you is how well it suits your financial personality.

If for example you only occasionally use BNPL, larger players like Zip or Afterpay might be a better shout as they’re more widely available and have simple repayments. Other options like Humm, Bundll or Klarna might be more suited to those who want to make more regular purchases or perhaps want to buy more expensive items.

Further, some might be offered by your bank or payments platform, and can be convenient to use as you are already used to the brand, and the instalment option might be integrated into the app.

There are lots of points of difference between each of the different BNPL platforms:

- Some conduct credit checks, some don’t

- Some charge higher fees, some don’t charge fees at all

- Some offer higher credit limits, while others offer longer or shorter repayment plans

- Some are available at a broader range of shops, while others are better suited for more niche purchases (such as Brighte for solar panels)

When deciding which one to use, consider each of these and compare each platform on them. But most importantly, you should think about whether you really need to use one at all.

First published on April 2021

Photo by Denisse Leon on Unsplash

.jpg)

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly