The financial services sector will be the first to utilise this new data-sharing regime, followed closely by the telco and energy sectors.

The Consumer Data Right, according to the ACCC, “will improve consumers’ ability to compare and switch between products and services”.

“It will also encourage competition between service providers, leading not only to better prices for customers but also more innovative products and services,” the ACCC said.

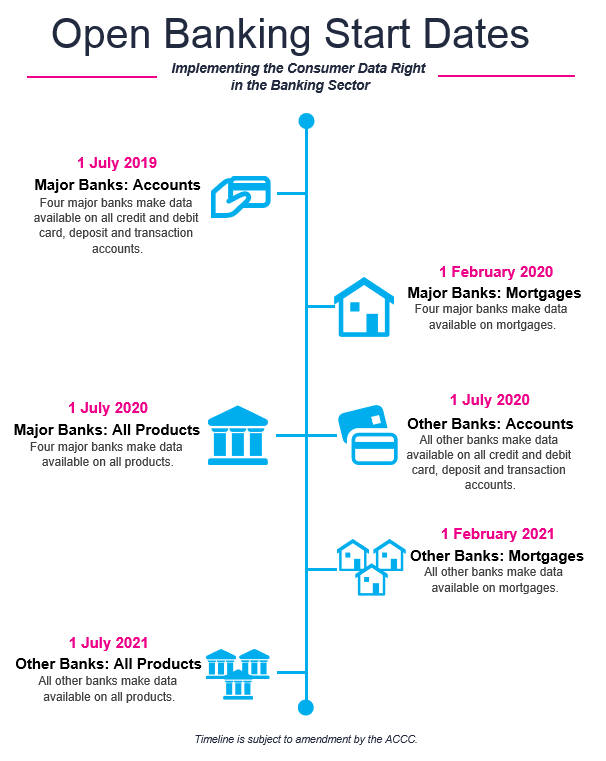

Implementation will begin in February 2020, with banks making credit and debit card data, mortgage account data and transaction account data freely available to consumers and small businesses who request it.

Australian Banking Association CEO Anna Bligh said the passage of CDR through Parliament would create the legal foundation for open banking, increasing competition across the industry.

“Empowering customers with the ability to use their data to drive a better deal on banking products has the potential to dramatically increase competition and foster innovation across the industry,” Ms Bligh said.

“Passing this legislation for the Consumer Data Right provides the foundation for these reforms to be delivered.”

Ms Bligh also said the system will undergo rigorous testing to ensure the safety of customers’ data.

“The industry will continue to work with the government in the final stage of the introduction of Open Banking to deliver a system which both increases competition and ensures data is kept secure,” she said.

The Treasury Laws Amendment (Consumer Data Right) Bill 2019 received bipartisan support.

Labor yesterday said it had secured a “breakthrough commitment” from the government to make changes to the CDR.

Treasurer Josh Frydenberg and Financial Services Minister Jane Hume meanwhile labelled the CDR legislation “a game-changer” that would “improve competition and efficiency through better access to data and lower prices”.

“The regime has strict privacy and security protections and allows consumers to control what data is shared, with whom and for what purposes,” they said in a joint statement.

Although a major step, the passing of this legislation is not the last one required for open banking to full start in Australia.

Rules on consumer data rights need to be finalised by the ACCC first, with data standards to be set by the Data Standards Body.

But the legislation’s passing means these final steps can now be completed.

With the CDR clearing the way for open banking, customers who allow their data to be shared with third-parties could soon reap the benefits in the form of:

- Easier switching between banks

- Increased competition and lower prices

- Highly personalised products to their financial situation

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Alex Brewster

Alex Brewster

Rachel Horan

Rachel Horan