The Australian Banking Association (ABA) has found the number of deferred loans has fallen below 300,000 nationwide, a reduction of almost 70% since the peak earlier this year.

Said peak saw more than 900,000 loans deferred overall, with the majority (803,000) by the seven largest banks.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

ABA chief executive Anna Bligh said the data revealed borrowers may be through the worst.

“Australian banks have played a major role in carrying the economic burden of the pandemic for their customers," Ms Bligh said.

"The good news is that the majority are now bouncing back as they restart their loan repayments."

Data up to November 4 revealed home loan deferrals by the seven largest banks, which includes the big four, Bank of Queensland, Suncorp, and Bendigo, are down to fewer than 145,000.

Total business loan deferrals have fallen to fewer than 73,000, and small and medium-size business loan deferrals are down to just over 65,000.

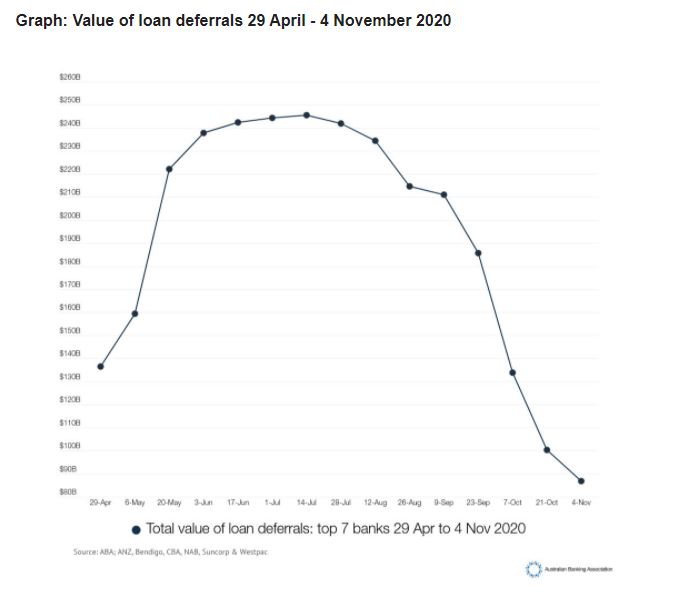

The value of deferred loans by the seven largest banks has now fallen below $100 billion – down to $86 billion.

This figure peaked at more than $250 billion in June.

The number of loans on hold is expected to fall further in coming weeks as more reach the end of their six-month deferrals.

Ms Bligh said the data was encouraging, but urged those still struggling to communicate with their lender.

“It’s great to see a lower than expected number of people needing to extend their deferral period," she said.

“Don’t wait till you are in over your head, talk to your bank, they’ll help you find a way through this. Don’t tough it out on your own."

Heritage Bank borrowers avoid loan deferral extension

Heritage Bank said borrowers have avoided the need to maintain COVID-related hardship measures, with just 5% of loan deferrals continuing past the initial assistance period,

Heritage CEO Peter Lock said the low rate of ongoing deferrals at Heritage was somewhat surprising, with a number of factors at play.

“We had a total of only 2,150 loans on COVID-related hardship provisions, which in itself is a very small percentage of our book," Mr Lock said.

“It does speak volumes about the quality of our loan book.

"We take our responsible lending obligations very seriously and our arrears rates traditionally sit at around one third of the industry average, so we know the credit quality of our customer base is very strong.”

Mr Lock said many customers who initially sought help when the pandemic hit found they were actually in a much better position than they realised.

“While interest rates dropped markedly in the last 12 months, many of our home loan customers did not reduce their repayments, so they actually got ahead of what was required.

“In fact, more than 70% of our home loan customers were at least one monthly repayment ahead, with many ahead by much more."

Arrears set to marginally rise

A report from ANZ found mortgage arrears were likely to see a small rise in the next 12 months.

However, this was likely to be offset by the bulk of mortgage deferrals already expiring, and lenders offering further support to those still deferring, making forced selling unlikely.

Mortgage arrears are currently at 1.2%, only 0.2% higher than September last year.

ANZ economists said better than expected outcomes for unemployment and lender support would mitigate the risk of a spike in arrears.

"ANZ 90+ day arrears data show that Victoria and NSW arrears rose modestly between March and September, but arrears rates in other states have declined through the same period," economists Felicity Emmett and Adelaide Timbrell said.

"RBA research suggests that housing arrears could rise to 2% as mortgage deferrals expire and unemployment continues to rise.

"Our view is that accommodative lender measures and a lower peak in the unemployment rate will mitigate this risk."

Reserve Bank modelling expects unemployment to peak at 8% around the end of the year, declining gradually to be just above 6% by the end of 2022.

The latest unemployment figures from the Australian Bureau of Statistics are released on Thursday.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Rachel Horan

Rachel Horan