According to the Australian Bureau of Statistics (ABS), the number of loan commitments to owner occupier first home buyers rose 3.2% from December to January (seasonally adjusted).

Owner-occupied first home buyer loan commitments were up 25.6% on January 2019, while investor lending was up by 11.3%.

In a sign that the market may no longer be driven by investors, first home buyers accounted for 20.2% of all lending in January, up from 17.5% a year prior, while investors accounted for 27.6% of all lending, down from 29.6% in January 2019.

The number of owner occupier first home buyer loan commitments rose in all states and territories outside of Victoria and the Australian Capital Territory.

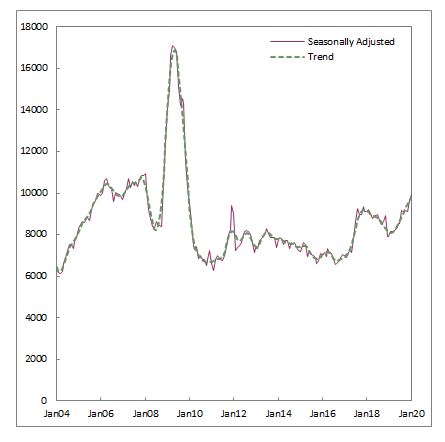

New loan commitments to owner occupier first home buyers, number, Australia

Source: ABS

Zippy Financial Director and Principal Broker Louisa Sanghera said it was clear eligible first-time buyers had been making the most of the Federal Government’s First Home Loan Deposit Scheme in January.

“The number of first home buyers has been growing for the past year, but the past month saw enquiries to our office strengthen considerably,” Ms Sanghera said.

“Prospective property owners were aware they needed to move quickly if they were going to have any chance of securing one of the deposit scheme’s limited allocations from the start of the year.”

Overall the value of new home loan commitments rose 4.6% for the month, seasonally adjusted.

ABS Chief Economist Bruce Hockman said the result followed a 4.4% rise in commitments in December.

“In January, the value of housing loan commitments grew at the fastest rate since the turning point in lending activity in mid-2019," Mr Hockman said.

"This growth continued to be driven by owner occupier housing, which rose 5.0% in January, the eighth consecutive month of uninterrupted growth.

“The value of new loan commitments for investor housing also strengthened in January, rising 3.6%.”

All states and territories outside of Queensland saw rises in owner occupier commitments.

The number of owner occupier first home buyer loan commitments were up 25.6% on January 2019.

New mortgages to owner-occupiers reached a record high in January. Investor lending growing but still 40% below its peak. This house price rebound is not investor driven right now #ausproperty pic.twitter.com/DGvHC6dlTc

— Callam Pickering (@CallamPickering) March 11, 2020

Fixed term home loan commitments rose 2.0% in January, following a 4.1% rise in January to be up 10.4% on the previous year.

In trend terms, the value of new loan commitments to businesses for construction fell 1.3% in January.

This was driven by weaker loan commitments for the construction of dwellings, with this series down 23.6% from the January 2018 peak.

Lower mortgage rates to provide boost to first home buyers

After the Reserve Bank's (RBA) decision to cut the cash rate to a new record low 0.5%, CEO of mortgage broker Aussie James Symond said first home buyers should be cautious about diving into the market.

“First home buyers now have even greater opportunity to break into the market," he said.

"While there are thousands of low rate home loan products available for first home buyers, ranging from basic loans to more sophisticated offerings, first home buyers need to be properly informed before committing themselves to a long term financial commitment.”

Mr Symond shared his top 7 tips for first home buyers with Savings.com.au:

- Work out how much you can afford to spend before you start, research price ranges in the suburbs where you want to purchase and ask an expert to help you

- Speak with an Aussie mortgage broker to help you decide what loan product suits your needs – especially your borrowing limit. When finding the best home loan for you, check out the ongoing payments, especially in the fine print for monthly service fees and other charges, and what they could become when rates inevitably rise

- If you are worried about potential rises in interest rate and repayments, you could split your loan between variable and fixed rates

- Remember a low start-up interest rate or honeymoon rate does not necessarily mean you will be paying less for your property in the long term

- Make sure you can still enjoy a great lifestyle after regular mortgage repayments.

- Get assistance and pre-approval for a loan, which Aussie can provide, so you know exactly what you can afford.

- Be aware you can get a loan under the Federal Government First Home Loan Deposit Scheme, allowing property purchases with a deposit of just 5 per cent. Another allocation of 10,000 loans in the scheme is expected to be made from 1 July 2020.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Aaron Bell

Aaron Bell

Datamentary

Datamentary