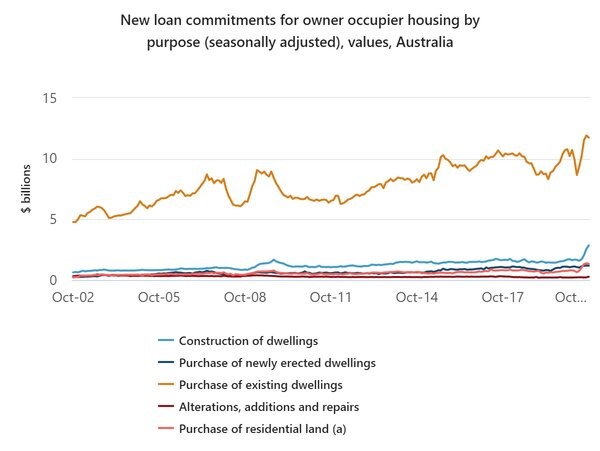

The figures from the Australian Bureau of Statistics (ABS) revealed the surge in construction loans drove the total value of new loan commitments for housing and the value of owner-occupied home loan commitments to record highs.

The total value of new loan commitments for housing rose 0.7% to $22.7 billion in October, seasonally adjusted.

The value of new owner-occupier home loan commitments rose 0.8% to $17.4 billion in October 2020, more than 30% higher than October 2019.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

ABS head of Finance and Wealth Amanda Seneviratne said the surge in construction loans could be partly attributed to first-home buyers taking advantage of the federal Government's HomeBuilder scheme.

“Commitments for the construction of new dwellings rose 10.9% and was the largest contributor to the rise in October’s owner-occupier housing loan commitments," Ms Seneviratne said.

"The value of construction loan commitments has risen by 65.6% since July, which coincides with the June 2020 implementation of the Government’s HomeBuilder grant in response to COVID-19."

Ms Seneviratne added “feedback from lenders was that there has been a large increase in first home buyers applying for these construction loans over the last few months.”

Source: ABS

Housing Industry Association (HIA) economist, Angela Lillicrap, said HomeBuilder was the catalyst for improving consumer confidence in the housing market.

“We do not expect this to be the peak of the cycle. HIA New Home Sales data suggests that detached housing finance approvals will continue to be strong over the coming months," Ms Lillicrap said.

"The extension of HomeBuilder will see strong results carry over into 2021.

“It is evident in today’s data that HomeBuilder has been successful in creating work on the ground in the December quarter and will protect jobs across the economy."

First home buyers out in force

The number of owner occupier first home buyer loan commitments increased by 3.4% in October, to reach 13,481, seasonally adjusted, well above the forecasted 2.8% rise.

This was more than 30% higher than in any pre-COVID month since 2009, when the first home owner grant was temporarily tripled as part of the Commonwealth Government’s economic stimulus package in response to the global financial crisis.

Buyers’ agent Grant Foley said it was clear first home buyers were making the most of the more subdued market conditions.

“The COVID-driven change in market conditions has presented first-time buyers with a genuine opportunity to make their move, especially in the inner urban apartment sector, which is typically popular with first-time buyers and has suffered bigger price falls than houses in similar areas,” Mr Foley said.

Victorian owner occupier home loan commitments fell 9.3% in seasonally adjusted terms, reflecting decreased housing market activity in August and September due to COVID-19 stage 4 restrictions in Melbourne and stage 3 in the rest of Victoria.

Victoria and the Australian Capital Territory were the only states and territories to record a fall in owner occupier home loan commitments.

The total value of loan commitments for investor housing was unchanged at $5.3 billion, while the value of new loan commitments for fixed-term personal finance rose 4.3%, as car sales rebounded in October.

Photo by Scott Blake on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Jacob Cocciolone

Jacob Cocciolone

Rachel Horan

Rachel Horan