Believe it or not, this is a type of loan product that actually exists. It’s called a reverse mortgage and it’s typically available to people over the age of 65 who want to borrow money using the equity in their home as security against the loan.

But (as always) there’s a catch.

Reverse mortgages in Australia

More popular overseas, it’s fair to say reverse mortgages get a bad rap in Australia. While reverse mortgages can help older Australians with their short-term or immediate financial needs, they can also come with significant long-term implications.

A 2018 review by the finance regulator ASIC found the common view among retirees - and even many finance brokers and lenders - was that so-called equity release products (ERPs) like reverse mortgages take advantage of vulnerable elderly people. The review also found that many borrowers who sign up to them don’t really understand how they work.

Yet, despite this, international research by big four consulting firm EY predicted the global equity release market could more than triple over the next ten years. But its report also found that one of the greatest barriers to growth in the lending market segment is the lack of understanding of how such loans work.

What is a reverse mortgage?

A reverse mortgage is a type of equity release product (ERP) that essentially allows older Australians to borrow money using the equity they have in their home as security for the loan. As such, it’s a way for homeowners to access the wealth that’s tied up in their most valuable asset when they may have limited cashflow to pay back alternative types of loans.

Borrowers can choose to receive the loan as either a lump sum, a regular income stream, a line of credit, or a combination of any of these options.

Unlike a regular mortgage, borrowers don’t have to make repayments on a reverse mortgage until all borrowers on the loan either sell the house, move into aged care, or die. However, many lenders will allow borrowers to make voluntary repayments if they want to.

As with any loan product, the loan must eventually be repaid in full, including interest and fees. This generally happens when the property the loan is secured against is sold and the lender takes what it is owed.

Reverse mortgage interest rates

As you might imagine, interest rates on reverse mortgages are often significantly higher than on regular home loans mainly because there is no immediate prospect of receiving repayments and it may be some time before the loan is repaid.

How does a reverse mortgage work?

In practical terms, a reverse mortgage allows borrowers over the age of 60 to convert the equity in their home (the value of the property they own minus any mortgage debt) into ready cash. Our Home Equity Calculator can give you some idea of the equity you hold in your property.

Borrowers can use this money as they wish including for day-to-day living expenses, paying bills, clearing debts, or on home improvements or modifications.

But as well as higher interest rates, there is another catch. While you’re not making repayments, a reverse mortgage also charges compound interest which means the loan balance has the capacity to grow significantly over time. In simple terms, interest is charged on the interest already owed plus on any fees or charges added into the loan amount. This can make for a sizeable sum when it is time for the loan to be paid back.

Reverse mortgages for seniors

To qualify for a reverse mortgage, many lenders require borrowers to be at least 65 years of age and have already paid off their home or, alternatively, repay any remaining home loan as part of taking out a reverse mortgage.

Generally, there are no income requirements for reverse mortgages, but Australia’s responsible lending requirements mean not everyone will be eligible for this type of loan.

The amount of equity that can be released will depend on the value of the property and the age of the borrower. Most lenders will allow homeowners to borrow anywhere between 15% and 45% of the property’s value.

The amount that can be borrowed under a reverse mortgage will be calculated as a percentage of the total value of the borrower’s home equity. In home loan jargon, this is what’s called the loan-to-value ratio (LVR).

Generally, the older you are, the more you can borrow although different lenders may have their own policies on LVR caps.

As a general rule, if you’re 60, the most you can borrow is likely to be between 15% and 20% of the value of your home. This is so there’s enough equity left to draw from later should you need it. Borrowers who are around 75 years of age may be able to borrow up to 35% LVR.

The amount you can borrow using the equity in your home is also limited by government regulations in two ways:

-

You can’t go into negative equity. This is known as the ‘no negative equity guarantee’ (NNEG). In simple terms, you can’t borrow more than the value of your home or be required to repay more than what your home is worth. Before the measure was introduced in 2012, borrowers faced the risk of eventually owing more on their reverse mortgage than what they could get from selling their property. In practical terms, it means when your home is eventually sold, the lender will receive its proceeds from the sale and the borrower can’t be held responsible for any debt that remains.

See also: What is negative home equity?

-

You can’t borrow more than a certain loan-to-value ratio (LVR). Under the National Credit Act, you can only borrow up to a prescribed percentage of the property’s value. These are set according to a borrower’s age and other variables. LVR limits effectively restrict the amount of interest that can accrue on new reverse mortgage loans and aim to prevent borrowers from depleting the amount of equity in their homes.

How much does a reverse mortgage cost?

The cost of a reverse mortgage will depend on the interest rate and fees. The biggest criticism of reverse mortgages is that as interest compounds, the debt grows. In simple terms, the longer you have the loan for, the more interest that compounds and the larger the sum of money you need to repay.

As an example, if you were to take out a reverse mortgage of $50,000 at a fixed interest rate of 8.5% p.a. compounding monthly, in 10 years’ time you would owe more than double that amount thanks to compound interest, as the table below demonstrates.

|

Loan term |

Interest |

Total amount owing |

|---|---|---|

|

1 year |

$4,420 |

$54,420 |

|

2 years |

$9,230 |

$59,230 |

|

10 years |

$66,632 |

$116,632 |

As well, application fees, transaction fees, and ongoing interest rates for reverse mortgages are typically much higher than for other forms of consumer credit such as standard home loans.

Advantages and drawbacks of reverse mortgages

The most obvious benefit of a reverse mortgage is that it allows borrowers to access the equity in their homes without having to sell them – and without having to make immediate repayments.

Given the right set of circumstances, a reverse mortgage could feasibly fund a homeowner’s retirement, boost their capacity to cover living expenses, pay off debts, or improve their quality of life in their later years.

ASIC’s review of reverse mortgages found that each of the 30 borrowers included in its report said a reverse mortgage allowed them to resolve their immediate financial needs (including paying debt, meeting essential living expenses, funding holidays).

However, all 30 also said they had been almost exclusively focused on fixing their immediate financial needs without considering the many long-term financial implications that can come with reverse mortgages.

The 2018 ASIC review of reverse mortgage lending in Australia concluded borrowers struggled to recognise the long-term implications of their loan.

According to ASIC: “Most of the borrowers we interviewed had either not considered or actively avoided estimating how much equity would still be available to them several years from now. This may have influenced some borrowers’ perceptions about the long-term risks of their loan”.

ASIC also questioned borrowers on how their decision to take out a reverse mortgage might affect their financial situation in the long-term. As you can see, many said they hadn’t really considered their future needs:

“The reverse mortgage means it diminishes in some way what we leave, but on the other side I just live for today and not worry about tomorrow.”

“I’m not quite sure how much I took out, or the rate of interest in the end. But I don’t have any goals really – I haven’t got much of a future.”

Risks and implications of reverse mortgages

There are five keys risks of reverse mortgages that borrowers should consider:

The interest rates and ongoing fees can be much higher than the average home loan

Reverse mortgages come with a number of fees, the common ones being ‘discharge fees’, ‘upfront establishment fees’ and ‘ongoing fees’. Given many reverse mortgage borrowers struggle with cash flow, these are often lumped into the loan amount rather than being paid for upfront.

Because borrowers aren’t required to make any regular loan repayments, interest on the loan and interest on fees are added to the loan amount every month for the duration of the loan.

This could mean that a $1,000 establishment fee could quickly turn into $3,000 or more after 20 years of compounding interest has accumulated.

The effect of compound interest means that your debt can quickly get out of control

The effects of compound interest can be underestimated by many consumers, particularly when it comes to reverse mortgages. While the principal amount owing on a regular home loan decreases over time as it’s paid off, the opposite is true for reverse mortgages.

Until any repayments are made, the debt continues to compound.

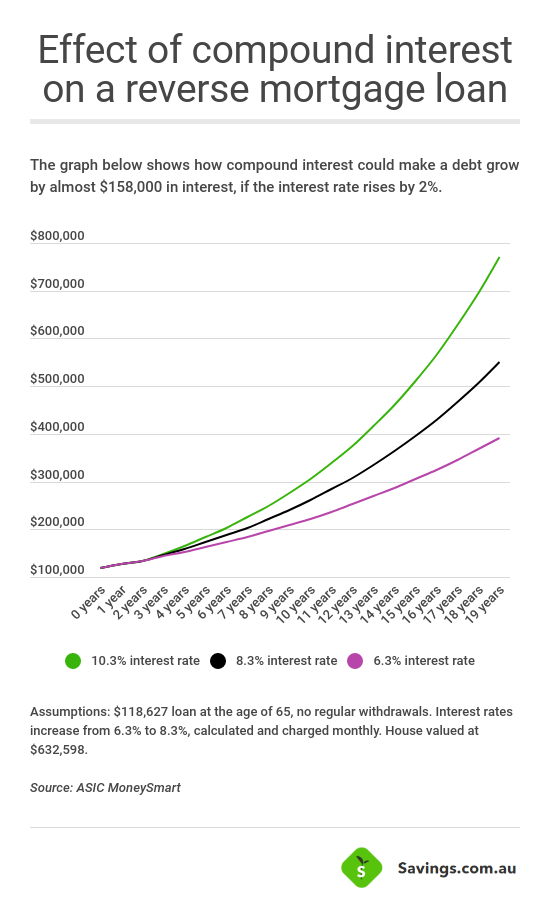

The graph below was used by ASIC to demonstrate how compound interest on a loan of $118,627 could grow by almost $158,000 in interest over a 20-year period if the interest rate were to rise by 2%.

Source: ASIC 2018

Due to the effect of compound interest over a longer loan term, borrowers who have the loan for a longer term face the erosion of their prime source of wealth, the equity in their homes. If too much equity is eroded, many borrowers may not be able to afford to meet their future needs when their homes are eventually sold and their loans repaid.

If the value of your home falls or doesn’t rise in value, you will have less money for future needs like aged care or medical treatment

Simply put, the more money you borrow now, the less equity you will have in your home in the future. As equity diminishes, borrowers face the risk of not being able to service their future needs, such as aged care or medical costs, after their homes are sold.

The risk of this happening increases as interest rates on their reverse mortgage rise or if property prices grow more slowly than expected (or a combination of the two).

Despite the introduction of the legislated No Negative Equity Guarantee, borrowers can still face the risk of being left with not enough funds for their futures. After all, no one can be sure of how long they are going to live.

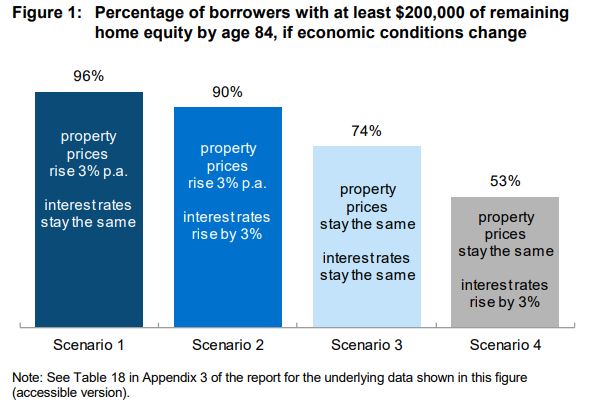

In its report, ASIC examined various scenarios to test whether standard reverse mortgage holders would still retain $200,000 in equity once they reached 84 years old, the average age people enter aged care.

Figure 1 demonstrates the proportion of borrowers drops considerably should property prices stagnate and interest rates rise by 3%.

Source: ASIC 2018

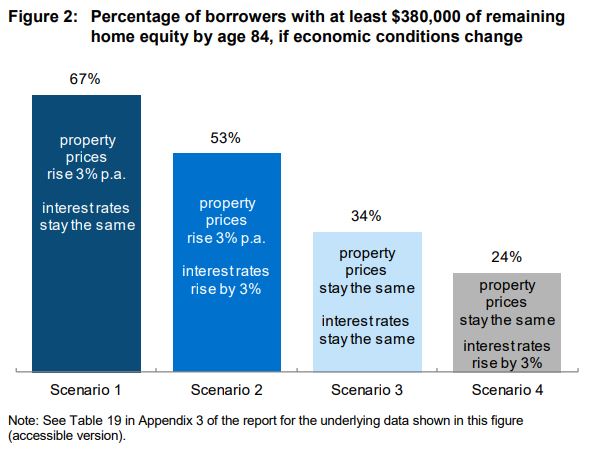

Figure 2 demonstrates that even fewer borrowers would be left with at least $380,000 which, at the time, was the average self-funded upfront cost of aged care for one person, according to ASIC’s modelling.

Source: ASIC 2018

ASIC expressed concern a lack of understanding of these outcomes can lead borrowers to take out larger reverse mortgages which, in turn, reduces their ability to afford critical future expenses such as aged care. ASIC’s data also revealed most reverse mortgage borrowers tended to apply for their maximum credit limit, leaving them in danger of cutting themselves short later on.

The loan can affect your eligibility to receive the pension

One of the big risks of a reverse mortgage is that it could also make you ineligible for the pension or other government benefits. This is because money received with a reverse mortgage may be subject to the income and assets test for Centrelink payments.

This applies if you choose to receive the reverse loan as an upfront lump sum and even if you gift the money released from a reverse mortgage to someone else. This is because monetary gifts can be counted towards the pension assets and income tests.

Effects on family

If the borrower dies or has to leave their home, other people living in the secured home can be forced to move out so the home can be sold to repay the loan. This can have serious implications for a surviving partner or others who may have been living in the home with the property owner. Some reverse mortgages may come with a tenancy protection warning to alert borrowers to this risk.

In some cases, reverse mortgages can also leave few proceeds once the home has been sold and the loan repaid. This can severely diminish the inheritances of any beneficiaries and may compromise the future care needs of any dependents.

Reverse mortgage alternatives

While reverse mortgages come with their pitfalls, the ASIC review found that many borrowers believe a reverse mortgage is the “only option” to address their immediate financial needs.

But there are a few alternatives which include:

Sell and downsize

The most obvious solution to access the equity in your home is to sell it. After all, if you’re at the age where you’re eligible for a reverse mortgage, it may be time to downsize from a large family home anyway. But this won’t appeal to everyone, particularly if your aim is to stay in the home.

Home Equity Access Scheme

Formerly known as the Pension Loans Scheme, the Home Equity Access Scheme is the main alternative to reverse mortgages for those who want to stay in their homes. Under the scheme, retirees can access a non-taxable fortnightly loan, borrowing up to a maximum value of 150% the rate of the age pension. This is a type of reverse mortgage loan that allows older Australians of pension age who own their home to receive a voluntary non-taxable fortnightly loan to supplement their retirement income.

Borrowers can choose the amount they want to receive fortnightly which can be up to 1.5 times the maximum rate of the qualifying pension. The loan can be repaid at any time, but it's usually repaid from the proceeds of any eventual sale of the secured property.

Homesafe Wealth Release

If neither of these options appeal, there are products that allow you to unlock the equity in your home by selling a share of it for an upfront price. One such product is Homesafe Wealth Release, marketed as an alternative to a reverse mortgage and offered by private company Homesafe Solutions.

Homesafe offers an upfront payment to the homeowner (usually a percentage of the equity available in the home) in return for an agreed percentage share of the proceeds of the sale of the home at a later date. Unlike a reverse mortgage, there is no compounding interest to be accounted for down the track. The company receives its share of the home sale proceeds when the home is eventually sold.

Rent out a spare room

You can always consider renting out a spare room on a flatmates' website or listing your property on Airbnb to bring in some more cash. Renting out a portion of your home on a monthly basis can bring in a side income to help fund essential living expenses, and it could also provide some companionship.

There are many things to be considered before going down this path, however, such as whether you will be comfortable having people in your home, how the income may affect your pension, and any tax implications.

Savings.com.au's two cents

As you can see, reverse mortgages are quite different to standard mortgages, largely because there is no imperative to make immediate repayments on your debt. But while accessing money through a reverse mortgage may be a viable solution for day-to-day cash flow issues, it pays to be aware of the longer-term implications.

A reverse mortgage certainly isn’t something that should be entered into lightly. It pays to do your research, consider alternatives, and balance the risks.

First published on January 2022

Image by zinkevych via Adobe Stock

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan