Before we launch into what compound interest is, maybe we should start with a brief explanation of what interest means in the world of finance.

If we're talking about savings, interest is money paid to you by the bank as a reward for depositing your cash with them. It's also an incentive for you to continue to entrust them with your hard-earned cash.

The interest the bank pays you depends on the interest rate and is directly proportional to the amount of money you have deposited.

There are two main types of interest: simple interest and compound interest. Simple interest is paid on the amount you have deposited - the principal - after an agreed period of time. This is how the vast majority of term deposits work.

So, now we've got that out of the way, let's move on to what compound interest is and how it works.

What is compound interest?

In basic terms, compounding is the process of something growing or building upon itself - the snowball effect if you like.

Compound interest is interest paid on the initial principal, the original sum of money you invested (or the amount borrowed or still owing on a loan), as well as the accumulated interest on that money. So, for your savings, you earn interest on the money you deposit and on the interest you've already earned - in other words, you earn interest on your interest.

So, while you might have to hustle to earn the money you initially invest, from there, the money itself does the hustling for you. Compounding is a good way to supercharge your savings.

To get the most out of compounding interest, there are three golden rules:

-

Reinvest the interest (or simply keep it in your savings account)

-

Think long term

-

Keep adding money

One of the key ingredients in compounding interest is time. Throw time into the mix and compounding becomes a serious money-making weapon. The longer you leave your nest egg to grow, the more your money grows.

A case study

If a 20-year-old invested $1,000 of their salary each fortnight, they'd be a millionaire by the age of 43 (this is based on an average return of 5% p.a.). That represents a $486,971 in interest earned on top of the $552,000, they would have deposited over a 20-year period - minus any taxes of course. Not bad.

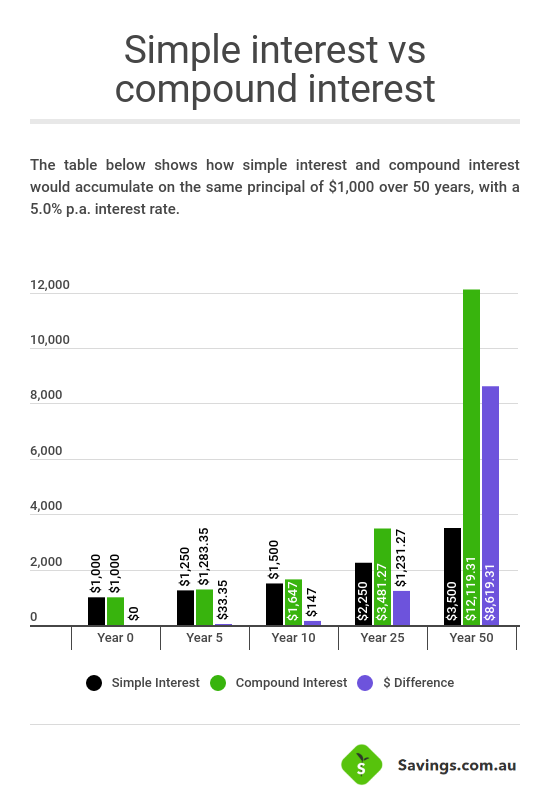

Here's a graph that demonstrates how compound interest far outstrips the earning power of simple interest.

As you can see, the longer you leave your money to sit and grow, the more money you accumulate. Such is the magic of compound interest.

How to calculate compound interest

Online calculators are probably the easiest way to calculate compound interest but if you're partial to a bit of maths, here's the equation:

A = P x (1 + r)n

Formula explanation

A = the end amount of your investment

P = the principal (the starting amount)

r = the percentage interest rate converted to a decimal rate (e.g. 2% is 0.02)

n = the number of time periods interest will compound

In most cases, the interest will be compounded monthly (12 times a year) for a standard savings account, but sometimes annually if you're trying to calculate the interest earnings on a long-term deposit.

How do the banks calculate compound interest on my savings account?

Banks and other Authorised Deposit-taking Institutions (ADIs) typically calculate interest on the daily closing balance. This is the equation for savings accounts:

Daily closing balance x interest rate (as a percentage) / 365

Interest begins to accumulate on the day the opening deposit is made into your savings account. Then, it's credited to your account on the last day of the month. Generally, any interest that's awarded to your savings account is available for use on the same day it's been credited.

How do I know if my savings account is paying compound interest?

Nearly all savings accounts pay compound interest. A few select term deposit products do too, but you would have to seek them out.

To find out if your savings account is paying compound interest, simply take a look at when and where the interest is paid. Any interest paid monthly into your savings account will be compounded.

But bear in mind, if your savings account requires a minimum monthly deposit to earn a higher interest rate, any interest you earn generally won't count towards the deposit requirement for the next month. That will have to be met through other funds.

How to find a compound interest savings account in Australia

There are literally hundreds of savings accounts on the market to choose from. However, many high interest savings accounts can come with various terms and conditions attached so make sure you do your homework to ensure you are able to meet them to achieve the highest possible interest rate.

Alternatively, you can opt for a no, or low, condition savings account that pays a competitive interest rate - more of a set and forget account where you can still make regular deposits.

How can you make compound interest work for you?

Like most good things, when it comes to compound interest, it takes time. Compound interest is a highly effective way to build wealth, but it's definitely not a get-rich-quick scheme.

In other words, the sooner you understand the power of compound interest, the sooner you can put it to work for you.

Save early and often

If you haven't already figured out the blindingly obvious by now, time is money when it comes to compound interest. Get into the mentality that the longer your money earns compound interest, the better it is for you. And we're talking decades, not just a few years.

In some cases, starting your saving earlier can mean you don't need to save as much money as somebody who waits until later. And even if you quit saving at some stage, your head start will continue to pay dividends down the track.

Look at the interest rate

Many savings accounts offer a standard rate paid on the entire balance, no strings attached, plus a bonus interest rate you'll only get if you meet certain criteria.

See also: The different types of savings account interest rates

It's an incentive designed to stop you from touching your savings and to encourage you to contribute funds to further boost your balance. Both will see your compound interest grow, which is why you should:

Keep your savings separate from your spending money

One pitfall of using your savings account to grow your compound interest is how easy it is to access your money.

To stop yourself from dipping into your hard-earned savings, pop them away into a separate high-interest savings account and try not to touch them at all.

The ugly side of compound interest

Compound interest is all peachy - until you're the one paying it if you have loans or any other outstanding debt.

The majority of loans and line of credit products offered by lenders and other financial institutions (think home loans, credit cards, car loans) charge compound interest.

When you're borrowing money, compounding interest works against you because you're continuing to pay interest on the loan amount still outstanding.

Unless you diligently pay off your credit card in full at the end of each month, compounding interest can make the outstanding balance grow as time goes on.

As an example, if you have $5,000 owing on a credit card with an interest rate of 20% and make only the minimum repayments (usually around 2-3% of the total balance and/or a minimum dollar value of between $20-$30), you'd end up paying more than $26,000 in interest over 49 years to clear your debt.

That's why it's important to understand how much you can realistically afford to borrow on any credit product. Compound interest is great when it's working for you but can whack you when it isn't.

Savings.com.au's two cents

Compound interest is one of the key financial concepts to understand if you want to watch your money grow. Having a good grasp on what compound interest is and how it can supercharge your savings is something we think everyone needs to know. If you can appreciate the benefits of compound interest earlier in life, you're a lot more likely to reap the rewards of it later on.

If you don't already have a savings account, consider opening one right now - it can take as little as 10 minutes online. Pick a savings account with a high interest rate and make sure you can meet the conditions to achieve it. If you're unsure, look for an account with no or few conditions and start depositing money.

It doesn't matter if your initial deposit is modest. It's all about having time on your side and using that time, as well as making regular deposits, to harness the power of compound interest.

First published on July 2019

Image by Pixabay via Pexels

William Jolly

William Jolly

Emma Duffy

Emma Duffy