A dedicated work or study area, a bigger property, and good local amenities are topping the wish-lists of buyers, while interest in high-density apartment living has fallen off a cliff, new NAB data shows.

According to NAB Executive, Home Ownership Andy Kerr, more flexible working arrangements are behind the change in preferences, with commute times becoming less of a factor.

"For many, the great Australian dream is a spacious home with a nice backyard for entertaining and it’s more affordable in outer suburbs and regional towns than the inner-city," he said.

“As a result, it’s been no surprise to see price growth in regional areas outpacing capital cities.”

Related: Regional house affordability falls as boom moves nationwide.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

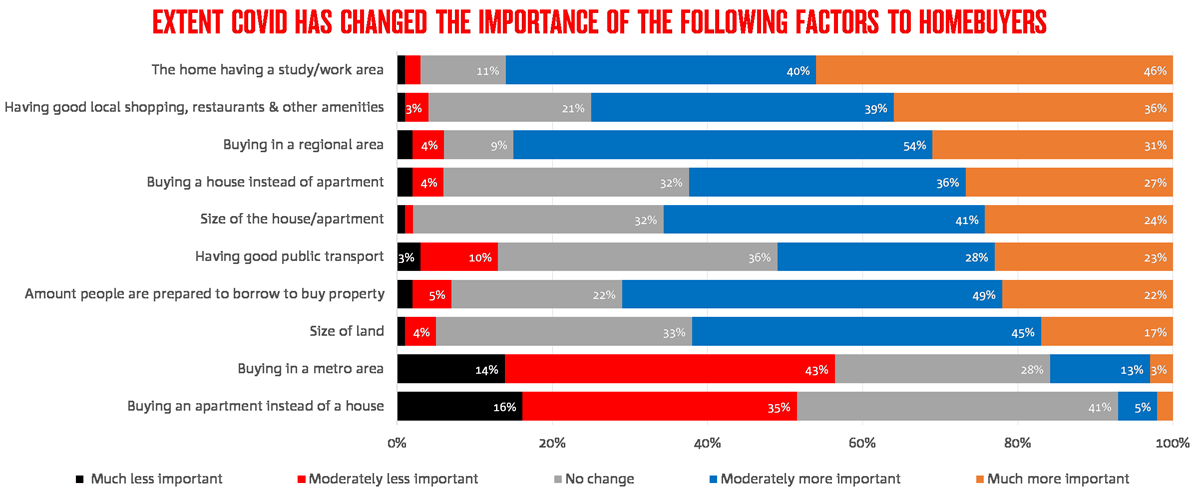

NAB's research, which surveyed 330 property professionals (including investors, real estate agents and developers) found nine in 10 (86%) believe having a dedicated study or home office is more important to homebuyers now than it was before COVID.

About 75% of those surveyed said having access to good local shopping, restaurants and amenities has become more important, as has the need for a bigger house (65%), buying a house over an apartment (63%), and access to good local public transport (51%).

See also: How COVID is changing Australian home ownership goals

“Lockdowns have reshaped how we live and with many at home for longer periods, the desire for a little more space has grown,” Mr Kerr said.

“This may mean a larger living room for the kids to play, a dedicated study to separate work from home life or a bigger backyard for the new puppy to run around.”

Source: NAB

Australians keen to get away from the inner cities

The factor that has shown the biggest decline in house hunting priorities is the need to be in a metro area, with over half (57%) of those surveyed saying this is now less important than it was pre-COVID.

Unsurprisingly, Victorians are the most keen to get away from the city after enduring the harshest lockdowns in the country that saw many Melburnians stuck inside shoebox apartments.

A massive 85% of respondents said moving to regional areas is becoming bigger priority for buyers, particularly for those in Sydney where house prices recently surged 3.7% in a single month.

“The regional push is more prevalent in NSW than any other state,” Mr Kerr said.

“Given Sydney prices remain the highest in the country, it’s probably little surprise moving further out to secure more space has proven popular.

"Proximity to the Blue Mountains and Central Coast beaches, in particular, has proven fashionable over the past year."

Interstate buyers are also flocking to parts of Queensland.

“Coastal areas are particularly popular, including the Sunshine Coast, Townsville and Cairns, while Ipswich has drawn strong demand for those wanting to stay closer to the state capital.”

In Western Australia, buyers are more concerned about finding a home office, and it's a similar story in South Australia.

"The regional push isn’t quite as strong in WA. We put this down to the comparative affordability of Perth as against the eastern capitals," Mr Kerr said.

"The regional push and move away from metro areas is least prominent in SA. This may be linked to affordability as Adelaide prices remain comfortably below the eastern state capitals.”

See also: The rise of regional property in COVID

Photo by Hossein Anv on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

William Jolly

William Jolly

Harrison Astbury

Harrison Astbury